Trade Policy Shifts and Their Potential Implications for U.S. Agricultural Exports

Protectionist policies are once again threatening to reshape agricultural trade, as the U.S. administration escalated tariffs on Chinese electric vehicles (EV) in May 2024, echoing the actions of its predecessor. Presidential hopefuls have taken this a step further, advocating for increased tariffs on Chinese products and those from other countries. Meanwhile, U.S. lawmakers are also considering revoking China’s Permanent Normal Trade Relations (PNTR) status—a move that has already been applied to countries like Cuba and North Korea. This action would trigger even higher tariffs on Chinese imports, escalating tensions further. These policy shifts are reminiscent of past actions that led to significant retaliatory measures from China and other countries, severely impacting U.S. agricultural exports. The agricultural sector, particularly commodities such as soybeans, corn, beef, and wheat, bore the brunt of this trade retaliation. Considering these developments, we examine the potential economic effects of three U.S. trade policy scenarios on these critical commodities for the American Heartland.

Background and Scenarios

Over the past eight years, concerns about unfair competition and national security related to imports from China have increasingly shaped U.S. trade policy. Lawmakers have expressed growing alarm over China’s trade practices, which they argue undermine American industries and pose substantial threats to national security. These concerns have led to renewed calls to revoke China’s PNTR status, which would significantly increase tariffs on all Chinese imports. Such a shift would dramatically escalate the ongoing trade tensions between the two nations, potentially leading to widespread economic repercussions. In May 2024, the White House took a decisive step by imposing new tariffs on a range of Chinese products, including critical sectors such as electric vehicles and semiconductors (The White House, 2024). This action, reminiscent of previous administration policies, reflects a broader trend toward protectionism in U.S. trade policy. Presidential candidates have echoed this sentiment, proposing even more aggressive measures, including broad-based tariff increases on all U.S. imports (The Republican National Committee, 2024). These developments signal a potential return to the intense trade conflicts of recent years, with far-reaching implications for U.S. agriculture.

Historically, U.S. trade policies that target China have triggered swift and severe retaliatory measures from Beijing. The 2018-2019 trade conflict is a prime example, where China responded to U.S. tariffs with significant retaliatory tariffs on American agricultural products (Carter & Steinbach, 2020). This response had a major impact on U.S. agriculture, particularly in the Midwest, where the economy heavily depends on agricultural exports. The soybean industry sets a noteworthy example, as it relies heavily on the Chinese market. Reduced demand from China led to lower export prices and increased competition from other countries, most notably Brazil. The consequences were severe, with many U.S. farmers facing significant financial losses. The potential for a repeat of these events is now a primary concern for the U.S. agricultural sector. As new trade policies are proposed, the risk of further retaliatory tariffs looms large, threatening to disrupt markets again and cause substantial economic harm to U.S. agriculture.

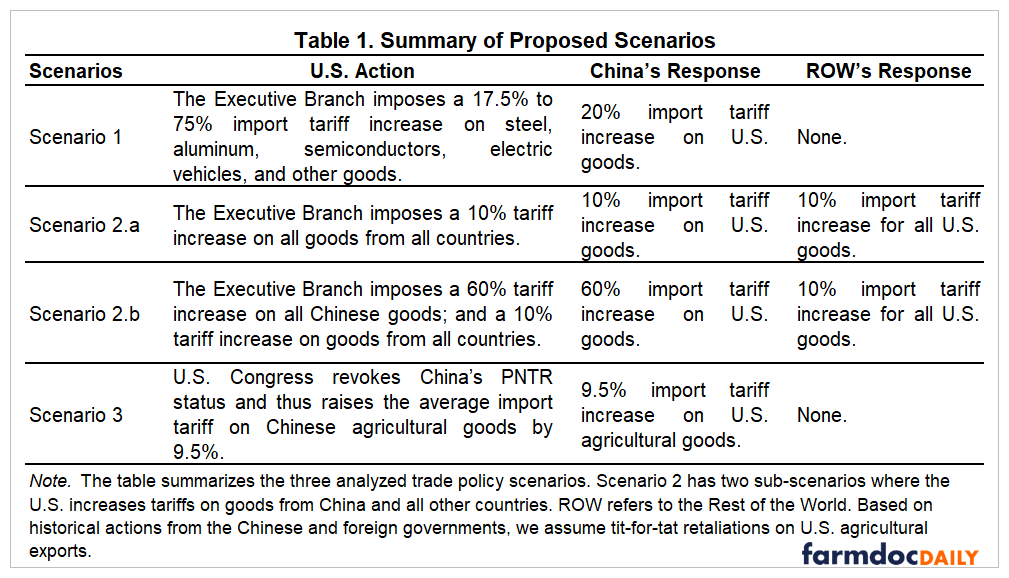

The proposed U.S. trade policies under consideration could have profound implications for the agricultural sector, particularly if they provoke retaliatory tariffs from China. To understand the potential impacts, we consider three primary scenarios that reflect varying levels of tariff increases and corresponding retaliatory measures, as summarized in Table 1. In the first scenario, the U.S. Executive Branch imposed a 17.5% to 75% increase in import tariffs on select Chinese goods, including steel, aluminum, semiconductors, and EVs. In retaliation, China responds with a 20% tariff increase on U.S. agricultural products. This scenario assumes that no other countries will engage in retaliatory actions, making it a bilateral conflict between the U.S. and China. The second scenario advocated by the Republican presidential candidate is more complex and is divided into two sub-scenarios. Scenario 2.a involves the U.S. imposing a 10% tariff increase on all goods from all countries, prompting a global retaliatory response with similar tariff increases on U.S. agricultural exports. Scenario 2.b escalates the situation further, with a 60% tariff increase on Chinese goods and a 10% increase on goods from other countries, leading to severe global trade disruptions.

The third scenario presents a slightly different approach, focusing on the potential revocation of China’s PNTR status by the U.S. Congress. This action would result in a 9.5% increase in U.S. tariffs on Chinese agricultural goods, with China likely responding with an equivalent 9.5% tariff increase on U.S. agricultural exports in a tit-for-tat scenario. Unlike the previous scenarios, this one does not involve broader global retaliation, instead concentrating on the bilateral trade relationship between the U.S. and China. Each scenario in our analysis provides a detailed framework for estimating the potential export losses U.S. agriculture might face, particularly focusing on key commodities such as soybeans, corn, beef, and wheat. Understanding the scale and distribution of these potential impacts can help inform strategies to mitigate the adverse effects of these brewing trade disputes.

Potential Impact on U.S. Agriculture

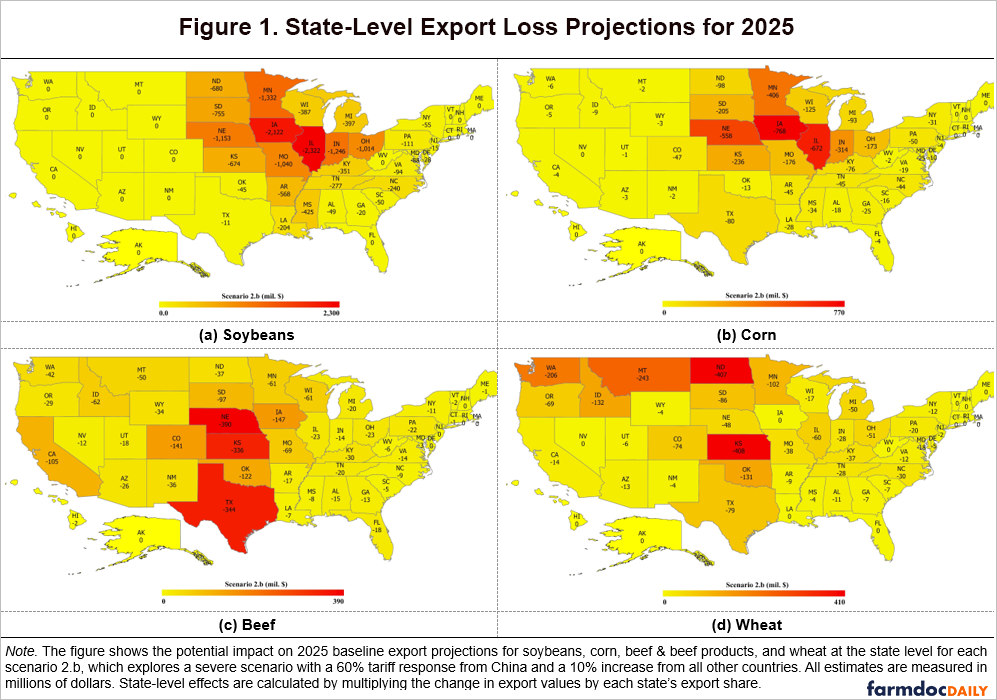

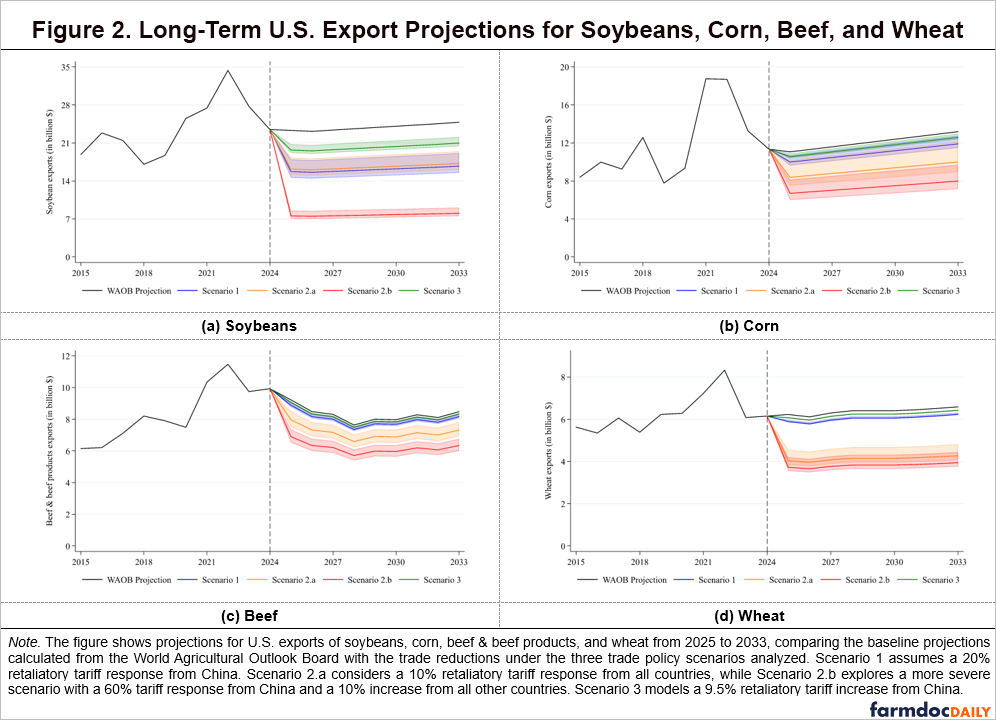

To estimate potential U.S. export losses for each scenario, we first calculate projected exports for each commodity in 2025 using the World Agricultural Outlook Board’s report (2024). We adjust the projected farm prices from this report to obtain export prices and multiply them by the projected quantities to determine export values. We estimate the U.S. export losses due to China’s retaliatory tariffs using the product line elasticity estimates from Grant et al. (2021). A detailed explanation of our projection procedure is found in Kim et al. (2024). Table 2 presents the projected 2025 export values and the estimated export losses for soybean, corn, beef, and wheat. The table shows point estimate reductions from these baseline projections together with lower and upper bounds for each scenario, considering a 90% confidence interval. Figure 1 maps the state-level export losses under the worst-case scenario for soybeans (Panel a), corn (Panel b), beef (Panel c), and wheat (Panel d). We also present the projected long-term export trends for these commodities under all scenarios in Figure 2.

Due to China’s position as the largest buyer of U.S. soybeans, it would be the most vulnerable commodity to retaliatory tariff hikes. Under Scenario 1, where China imposes a 20% import tariff on U.S. commodities, we estimate a 32.6% reduction in U.S. soybean exports, amounting to a loss of $7.6 billion. The impact is most dramatic under Scenario 2.b, where U.S. soybean exports could plummet by 67.6%, or $15.8 billion. In Scenario 3, with a 9.5% increase in Chinese import tariffs, soybean exports are projected to decrease by 15.5%, or $3.6 billion. The states most affected by these losses would be Illinois, Iowa, Minnesota, and Indiana. Illinois faces a potential $2.3 billion decline, followed by Iowa, with a potential export loss of $2.1 billion. In the long term, the gap between the baseline and scenario projections could widen, with Scenario 2.b indicating a decrease of $16.8 billion by 2033.

Corn exports are also significantly impacted, though less than soybeans. Under Scenario 1, we project a 9.7% decrease in corn exports, translating to a loss of $1.1 billion. In the worst-case scenario (2.b), corn exports could drop by 39.5%, or $4.4 billion. In Scenario 3, a 9.5% increase in Chinese tariffs would lead to a 4.6% decrease in corn exports, equivalent to a $0.5 billion loss. Iowa, Illinois, Nebraska, and Minnesota would be the most affected, with Iowa and Illinois each facing losses between $0.8 billion and $0.7 billion. Long-term projections indicate that under Scenario 2.b, export losses could grow to $5.2 billion by 2033.

The U.S. beef industry would also face significant challenges under the proposed tariffs. In Scenario 1, beef exports are estimated to decline by 3.7%, or $0.3 billion. Under Scenario 2.b, the reduction could reach 25.2%, resulting in a $2.3 billion loss. Scenario 3 would see a 1.7% decrease in beef exports, amounting to a $0.2 billion loss. The states most impacted potentially include Nebraska, Texas, and Kansas, with Nebraska facing a $0.4 billion decline. In the long term, the beef export loss under Scenario 2.b is projected to remain relatively unchanged, with losses staying around the same level by 2033.

Wheat exports would face the steepest percentage losses under a tariff increase from all countries. Scenario 2.a projects a 36.2% decline in wheat exports, equating to a $2.2 billion loss. In Scenario 2.b, wheat exports could fall by 40.2%, or $2.5 billion. The other two scenarios, where retaliatory tariffs come only from China, project comparatively moderate estimates for wheat. Under Scenario 1, wheat exports are expected to decrease by 5.4%, or $0.3 billion, while Scenario 3 would result in a 2.6% reduction, or $0.2 billion. Kansas, North Dakota, Montana, and Washington would be identified as the states most affected, with Kansas and North Dakota each experiencing reductions of around $0.4 billion. Long-term trends suggest that under Scenario 2.b, wheat export losses would increase from $2.5 billion in 2025 to $2.7 billion by 2033.

Conclusion

Under three proposed trade policy scenarios, we estimate substantial export losses for U.S. soybeans, corn, beef, and wheat. Each scenario assumes that the U.S. government imposes increased import tariffs on goods from China and other countries through either executive or legislative action. Unsurprisingly, these actions would provoke retaliatory measures from U.S. trade partners, leading to higher import tariffs on U.S. agricultural goods. In the worst-case scenario—where Chinese tariffs on U.S. goods rise by 60%, and tariffs from all other countries increase by 10%—we project that U.S. exports could decrease by $15.8 billion for soybeans, $4.4 billion for corn, $2.3 billion for beef, and $2.5 billion for wheat.

These projected trade losses pose significant challenges for Midwest agriculture, which relies heavily on exporting these critical commodities to foreign markets. The Midwest’s agricultural economy is deeply integrated into global markets, particularly for soybeans and corn, where Illinois and Iowa are among the largest producers and exporters. A substantial decline in exports, as projected under these scenarios, would lead to an oversupply in domestic markets, driving down farm prices and squeezing profit margins for farmers. This price pressure could have cascading effects, reducing farm income, increasing financial stress, and potentially leading to farm closures, particularly among smaller operations. The beef industry in states like Kansas, Texas, and Nebraska would also be hard-hit by declining exports. Reduced demand from international markets leads to lower cattle prices, further straining an industry already facing constant margins. Similarly, the wheat-producing states of North Dakota and Kansas would suffer significant export losses, hurting individual farmers and impacting the broader rural economies that depend on agriculture.

Collapsing exports in these commodities would exacerbate existing challenges in the Midwest. The region’s heavy reliance on agricultural exports makes it particularly susceptible to the adverse effects of protectionist trade policies and retaliatory tariffs. In the face of these potential losses, government intervention, such as a buyout program similar to the Market Facilitation Program (MFP) implemented during the 2018-2019 trade conflict, might become necessary to support affected farmers. However, the scale of the export losses projected in our analysis suggests that any such buyout program would need to be much larger than previous efforts. To cushion the blow to Midwest agriculture effectively, a new support program would require massive funding to cover the lost export revenue, potentially amounting to tens of billions of dollars annually. This support would be crucial in helping farmers manage the immediate financial impacts, maintain operations, and prevent further economic decline in rural communities.

References

Carter, C. A., & Steinbach, S. (2020). The Impact of Retaliatory Tariffs on Agricultural and Food Trade (No. w27147). National Bureau of Economic Research. https://doi.org/10.3386/w27147.

Kim, D., Steinbach, S., Yildirim, Y., & Zurita, C. (2024). Understanding Trade Strategy Impacts on Soybean Exports and Farm Income in North Dakota. CAPTS White Paper 2024-01. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4920301.

Grant, J. H., Arita, S., Emlinger, C., Johansson, R., & Xie, C. (2021). Agricultural Exports and Retaliatory Trade Actions: An Empirical Assessment of the 2018/2019 Trade Conflict. Applied Economic Perspectives and Policy, 43(2), 619-640. https://doi.org/10.1002/aepp.13138.

The Republican National Committee. (2024). 43rd Republican National Convention: The 2024 Republican Platform - Make America Great Again! Retrieved from https://gop.com/about-our-party/.

The White House. (2024). Fact sheet: President Biden takes action to protect American workers and businesses from China’s unfair trade practices. https://www.whitehouse.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/.

World Agricultural Outlook Board [WAOB]. (2024). World agricultural supply and demand estimates (WASDE) report. WASDE – 641. Office of the USDA Chief Economist. https://www.usda.gov/oce/commodity-markets/baseline.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.