FOMC Policy: Potential Linkages to Farm Interest Rates

The Federal Open Market Committee (FOMC) met this past Tuesday and Wednesday. The statutory dual mandate of the Committee is to foster maximum employment and price stability. From the FOMC statement: “The slower pace of the recovery reflects in part factors that are likely to be temporary, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan.” The Committee decided to keep the target range for the federal funds rate at 0 to ¼ percent and conditions likely warrant low levels for the federal funds rate for an extended period.

Continuing macroeconomic problems in Greece, a depressed U.S. housing market and disappointing May unemployment data raise concerns that economic growth may slow and be weaker than expected. A key question is whether this is a soft patch and just a temporary issue or is the economy actually at a tipping point with a substantial prospect for a double-dip recession as suggested by Yale economist Robert Shiller.

One implication of recent FOMC policy is the increased probability that interest rates on farm loans will remain low for the next few months. Figure 1 shows that interest rates to farmers are at historically low levels. The average interest rate on loans to farmers from banks with agricultural portfolios greater than $25 million was 3.89 percent in the first quarter of 2011. Almost 50 percent of the loans made to farmers were less than 5 percent while over 75 percent were less than 6 percent.

A potential risk for borrowers is that they became more indebted than they otherwise would have under normal interest rate environments. A general rule of thumb is that interest costs on farms should not exceed 20 to 25 percent of gross farm income. Figure 2 shows that interest expense as a proportion of value of farm production (VFP) has decreased in this decade. The median level for Illinois FBFM is less than 3 percent while 75 percent of Illinois FBFM farms are less than 5.1 percent.

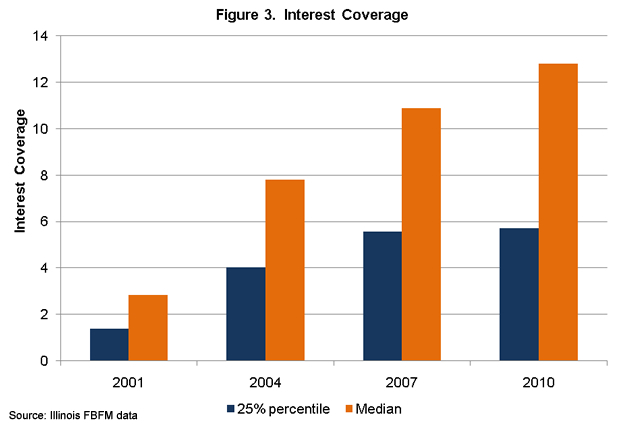

Interest coverage is another measure used to assess the ability of a business to meet debt obligations. The measure is the number of times a farm can make interest payments on its debt with its earnings before interest and taxes. Again, in Figure 3 this measure shows Illinois farms, on average, have exhibited an increased ability to meet debt payments over the past decade. The median measure exceeds 12 in 2010 while only 25 percent of FBFM farms have interest coverage levels below 5.7.

In general, Illinois farm operations remain financially healthy as a result of historically low interest rates, low to moderate debt usage, and strong farm profitability. As stated in an earlier farmdocdaily column, farmers should evaluate their exposure to interest rate changes. Although interest rate increases do not appear to be in the immediate future, prudent risk management suggests farmers should evaluate the impact interest rate changes have on their operation.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.