RIN Stock Update: Implications of the 2012 Drought

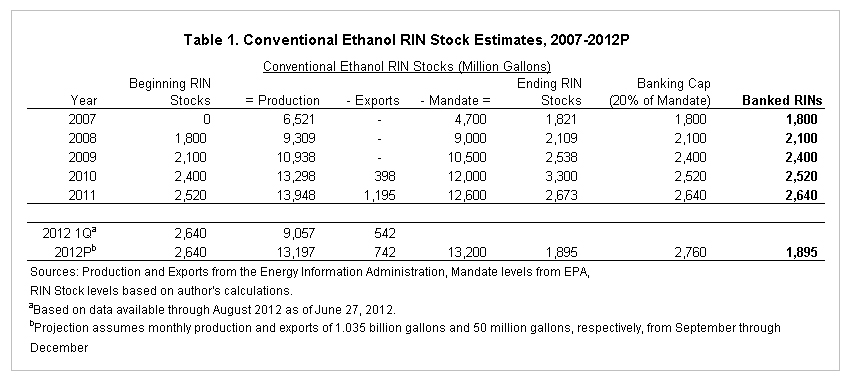

Today’s post provides an update on U.S. ethanol production and imports through August, and projections for 2012 ending Renewable Identification Number (RIN) stocks. Prior analyses of the available stock of RINs accumulated over the past three years through the RFS2’s banking provision are available here and here. These previous estimates indicated an ending stock level for 2011 of approximately 2.64 billion gallon RINs which could be used for mandate compliance in 2012 as an alternative to physical blending, providing up to 960 million bushels of flexibility in revealed demand for corn-for-ethanol if ethanol blending margins declined. Ethanol production and exports through the first quarter of 2012, and the expectation for a slowing in ethanol production due to the drought’s impact on corn prices, suggested the likely use of a portion of available RIN stocks for mandate compliance in 2012 and a lower carry in to 2013.

Table 1 below provides an update of current RIN stock estimates using ethanol production and export data available from the Energy Information Administration (EIA). The data indicates that 9,057 million gallons of ethanol were produced through August with ethanol exports totaling 542 million gallons. Weekly ethanol production estimates from EIA suggest that domestic ethanol production has averaged 1.035 billion gallons per month since August. Ethanol exports in August and September declined to 50 million gallons per month.

Assuming monthly production of 1.035 billion gallons and monthly exports of 50 million gallons from September through the end of the year implies a domestic production level of just under 13.2 billion gallons and exports of 742 million gallons for 2012. This results in net ethanol RIN generation for the year of just under 12.5 billion gallons. Given the 13.2 billion gallon renewable ethanol mandate in 2012, this will require RIN stocks to be drawn down somewhere below the 2 billion gallon level. The implication for 2013 is continued flexibility in the demand for corn-for-ethanol of approximately 700 million bushels relative to total demand implied by the 2013 non-advanced mandate of 13.8 billion gallons (more than 5 billion bushels of corn).

Furthermore, the small 2012 corn crop and resulting potential for binding mandate conditions continue to be reflected in the ethanol RINs market. Daily settlement prices for the December 2012 corn futures contract are provided in Figure 1 (red series, values on the right axis). The harvest futures declined steadily throughout the spring as good weather and an early planting season resulted in expectations for a record corn crop. Ethanol RIN values also steadily declined through the first six months of the year, reaching a low of $0.01/gallon in mid-June. With drought conditions taking hold in mid-June, there was a significant increase in corn prices as production expectations declined. December corn prices peaked at over $8.00/bushel in August, and have traded in the $7 to $7.70 range over the past two months. Similarly, 2012 RIN prices increased significantly throughout July, reaching a high price of $0.0465/gallon, and have continued to trade above early season levels through October.

Summary

The 2012 drought led to significant increases in corn prices and a slowing in domestic ethanol production and exports. For the first time since the RIN system was established, it is estimated that 2012 net RIN generation will not exceed the non-advanced ethanol mandate, and RIN stocks carried over from previous years will be used for mandate compliance. This was reflected in 2012 ethanol RIN prices, and illustrates how the design of the system can be used by obligated parties to respond to variability in the economics of ethanol blending. Current estimates indicate continued flexibility for corn-for-ethanol demand to meet the 2013 non-advanced mandate, but at lower levels than in previous years due to estimated stock use in meeting the 2012 mandate.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.