Lower Fuel Prices Unlikely to have Large Impact on Non-Land Corn and Soybean Costs

Crude oil prices have decreased in recent weeks, leading to decreases in gasoline and diesel fuel prices. Lower fuel for producing corn and soybeans in 2015 will occur if fuel prices remain lower through the 2015 growing season. However, fuel costs are a low proportion of total costs of producing corn and soybeans. As a result, oil and fuel price declines will have a small impact on 2015 production costs.

Crude Oil and Fuel Prices

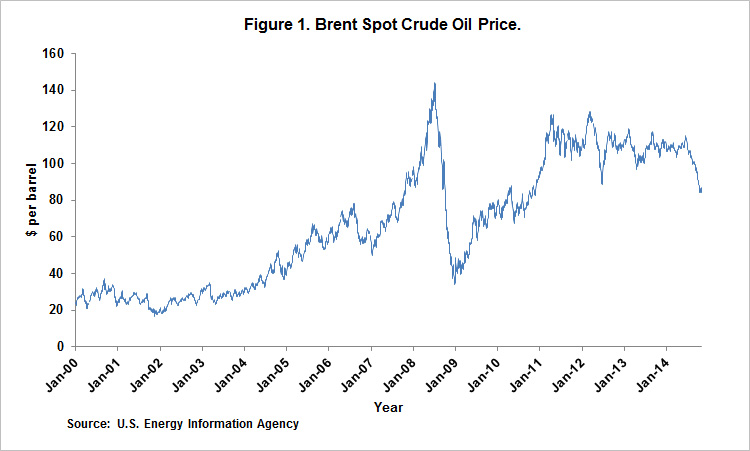

The price of Brent crude oil rose from a low of around $60 per barrel in June 2009 to over $100 per barrel in February 2011 (see Figure 1). Between February 2011 and August 2014, crude oil prices almost always were over $100 per barrel. The spot price on Brent crude oil averaged $109 per barrel during the first six months of 2014.

The spot price of Brent crude oil fell below $100 per barrel on September 5, 2014, the first time Brent Crude has been below since June 2013. On November 3rd, the spot price of Brent Crude was $84.90. A number of factors have contributed to this decline including increases in North American oil production, hesitancy by Saudi Arabia to cut its own oil production, drops in Asian demand for oil due to slower growing economies, and concerns about demand for oil in Europe due to the potential of economic recessions.

Currently, the outlook for oil prices continues to be below $100 per barrel for 2015. Prices on Intercontinental Exchange (ICE) future contracts for Brent crude oil are in the low $80 per barrel for all contracts with expirations in 2015. Of course, any number of events could change that outlook. Crude oil prices can exhibit sharp swings, as is illustrated by the prices shown in Figure 1.

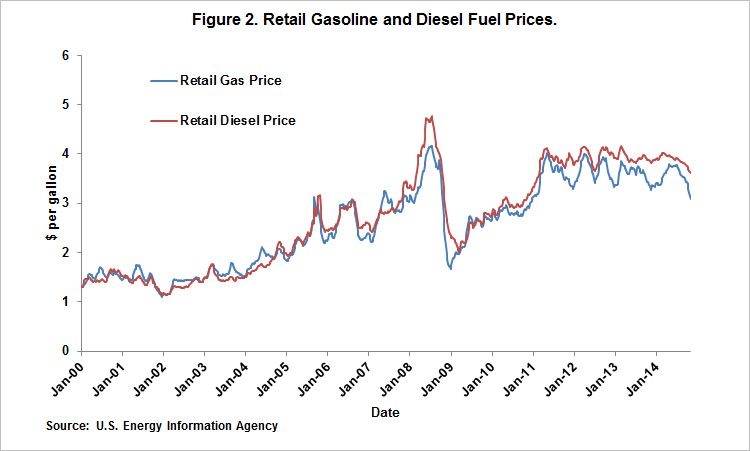

Decreases in crude oil prices have led to lower retail gasoline and diesel fuel prices. On November 3rd, retail gasoline price was $3.08 per gallon in the United States, and diesel fuel prices were $3.62 per gallon. These current prices are lower than earlier prices. During the first half of 2015, retail gasoline prices averaged $3.67 per gallon and diesel fuel averaged $3.96 per gallon.

Impact on Corn and Soybean Production Costs

Fuel and lube costs in 2013 were $24 per acre for growing corn on high-productivity farmland in central Illinois. Fuel and lube accounted for 4% of the $615 of non-land costs associated with corn production. Current crude oil prices are roughly at the same level as occurred in 2010. In 2010, fuel costs for corn equaled $17 per acre. If 2015 fuel costs equal 2010 costs, an $8 per acre reduction will occur in fuel and lube costs. Overall an $8 reduction in fuel costs would reduce non-land costs by 1.3%.

Fuel and lube costs for soybean in 2013 averaged $21 on high-productivity farmland in central Illinois. In 2010, fuel and lube costs equaled $15 per acre. Using 2010 as a benchmark, fuel price decreases of current magnitudes could equal a $6 per acre decrease or 1.6% of the $368 non-land costs of producing soybeans in 2013.

Impact on Other Costs

Declines in fuel costs could lower other production costs, such as fertilizer and seed. If there is an impact, these costs likely have a lagged relationship to fuel costs. As a result, crude oil price decreases likely will be felt not in 2015, but in 2016 and years thereafter if prices decreases persist.

Drying costs also could decrease. However, drying costs are more related to natural gas prices than to crude oil prices. Natural gas prices do not always follow crude oil prices.

Summary

From the standpoint of costs, fuel price reductions will reduce non-land costs of producing corn and soybeans. Cost decreases, however, will be modest compared to total production costs.

A countervailing impact of lower costs may be the impact that lower crude oil prices have on ethanol prices. Lowering crude oil prices could reduce the price of ethanol, which could lower commodity prices. Whether these impacts happen will be traced out over time.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.