2014 Crop Program Decision: March WASDE Price Uncertainty

Farm Service Agency (FSA) farm operators have to elect their Title 1 crop program for the 2014-2018 crop years by March 31, 2015. At this deadline, good information will exist on 2014 crop yields for individual farms and counties for which the National Agricultural Statistics Service (NASS) reports yields. ARC-CO (Agriculture Risk Coverage – county) uses the latter yields while ARC-IC (ARC – individual) uses the former yields. By February 27, 2015, operators also will know their FSA farm program yield, which is used by PLC (Price Loss Coverage). All 3 options use crop year average price to calculate their payment, if any. Thus, a key question is, “How much uncertainty about 2014 U.S. crop year price remains on March 31, 2015?” This article examines this question. A related farmdoc daily article is “Resolution of U.S. Crop Year Price Uncertainly and Its Implications for the 2014 Farm Program Decision,” published August 28, 2014. Today’s article uses a somewhat different analytical approach and focuses on crop year price uncertainty as of March.

Data

The U.S. Department of Agriculture (USDA) releases a monthly forecast for certain crops of crop year price. The forecasts are reported in WASDE (World Agricultural Supply and Demand Estimates). For a given crop year, forecasts begin with the May WASDE. For example, the May 2014 WASDE contained price forecasts for the now current 2014/2015 crop year. The forecast consists of a low – high price range, which is often averaged to create a mid-price forecast.

Crops examined in this analysis, along with their crop year, are barley, oats, wheat (June 1 through May 31); rice (August 1 through July 31); and corn, sorghum, soybeans (September 1 through August 31). The analysis period is the 1980 through the recently-completed 2013 crop years. Price estimates were not consistently reported by WASDE for the upcoming crop year in May until 1980.

Accuracy of the WASDE price forecast is evaluated by subtracting the mid-price estimate from the final crop year price. The closer are these two prices, the more accurate is the forecast. The difference is expressed as a percent of the mid-price forecast. Final crop year price is from the USDA, NASS Quick Stats website.

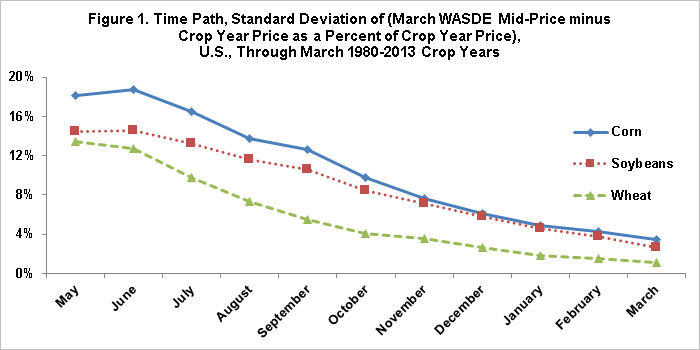

Perspective on March WASDE Price Uncertainty – resolution of crop year price uncertainty for corn, soybeans, and wheat: As Figure 1 shows, a large share of crop year price uncertainty is resolved on average by the time of the March WASDE. Crop year price uncertainty, as measured by the standard deviation of price forecast accuracy is over 80% lower in the March WASDE than in the preceding May WASDE for corn, soybeans, and wheat.

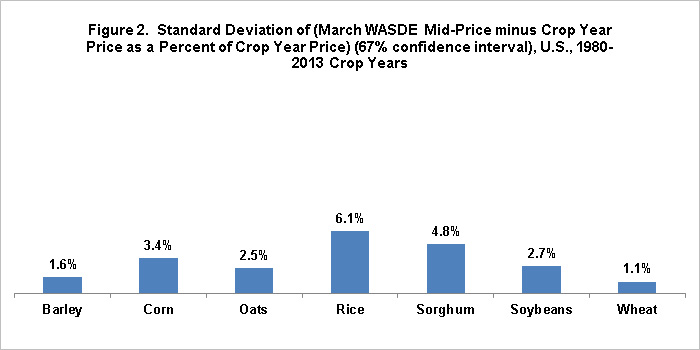

Crop Year Price Uncertainty as of March WASDE: Crop year price uncertainty as of the March WASDE varies across the program crops depicted in Figure 2. The range is from 1.15% for wheat to 5.47% for rice. As expected, the most accurate forecasts are for the 3 crops closet to the end of their crop year (wheat, barley, and oats). The price uncertainty for rice is affected by an unusually high forecast miss for the 1985 crop year of +20.8%. Next highest miss is -12.3% for the 2002 crop year. If the 1985 crop year is removed, rice price uncertainty as of the March WASDE is 4.0%.

Assessing Crop Year Price Uncertainty as of March WASDE: Standard deviation has a useful attribute in assessing uncertainty. Specifically in this analysis, two-thirds of the final crop year prices will be within plus or minus one standard deviation if we assume the distribution of misses is a normal distribution. Thus, for example, 67% of the final crop year prices are within plus or minus 1.15% of the March WASDE price forecast for wheat. For corn and soybeans, the range is plus or minus 3.48% and 2.78%, respectively. However, 67% may be too small of a statistical confidence interval given the potential importance of the March 2015 WASDE for the crop program decision. A producer may want to know the 99% (instead of 67%) statistical confidence range. This range is plus and minus 3 times the standard deviation. For corn, soybeans, and wheat; the 99% confidence range is plus or minus 10.45%, 8.34%, and 3.45%, respectively (see Figure 3). Thus, the greater the desired forecast confidence, the greater the advantage of wheat in terms of crop year price certainty as of the March WASDE. As an aside, 2 times the standard deviation is used to generate the price range associated with 95% confidence.

Summary Observations

- While considerable price uncertainty for the 2014 crop year will have been resolved by the time the March 2015 WASDE is released, the remaining price uncertainty is not trivial, especially if the crop year ends later than May 31.

- Crops, in particular wheat, with a likely low remaining price uncertainty for the 2014 crop year will have a non-trivial advantage in estimating 2014 crop year payments at the deadline for making the crop program choice.

- The crop year price uncertainty that will likely remain in March 2015 covers a wide range of potential payments. To illustrate this range, the methodology used in the December 18 farmdoc article, “ARC-CO and PLC Payment Indicator for 2014 Crop Year: December 2014 WASDE U.S. Yield and Price,” is used along with the prices that result from assuming the December mid-price estimate for corn of $3.50 and the standard deviations of price uncertainty at the 99% confidence interval in Figure 3 for corn. Given this situation, the 99% confidence interval for corn crop year price is $3.13 to $3.87 [$3.50 +/- ($3.50 times 3 times 3.48%)]. Using the December U.S. yield estimate for corn (170 bushels per planted acre), the range of indicated payments at the 99% confidence interval is $20 to $67 per acre for ARC-CO and $0 to $63 per acre for PLC.

- The clear implication is that farmers and landowner need to accept that a lot of uncertainly will remain for 2014 crop year price as of the March 31 farm program choice deadline, especially for crops whose crop year ends after May 31. More importantly, this price uncertainty will result in considerable uncertainty about the size of payments by ARC and PLC for the 2014 crop year.

This publication is also available at http://ohioagmanager.osu.edu.

References

Zulauf, C. "Resolution of U.S. Crop Year Price Uncertainly and Its Implications for the 2014 Farm Program Decision." farmdoc daily (4):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 28, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.