Current Corn, Soybean, and Wheat Prices in Long Term Perspective

As U.S. farms and agribusinesses confront the difficult task of understanding current prices, it is useful to start with longer term perspectives. Such is the objective of this farmdoc daily article.

Data and Procedures

Corn, soybean, and wheat prices for the 1913-2014 crop years are examined. The initial year reflects the first availability of crop year prices for soybeans. Source is the U.S. Department of Agriculture, National Agricultural Statistics Service QuickStats website, here. Crop prices are divided, i.e. deflated, by the Consumer Price Index (CPI). Source for CPI is the U.S. Department of Labor, Bureau of Labor Statistics, here. The specific CPI is for all urban consumers and is chosen because it is available for a longer time than other measures of economy-wide price inflation.

Long Term Trend

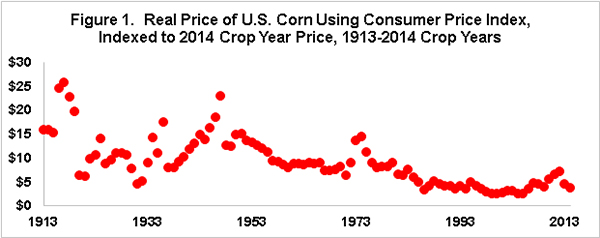

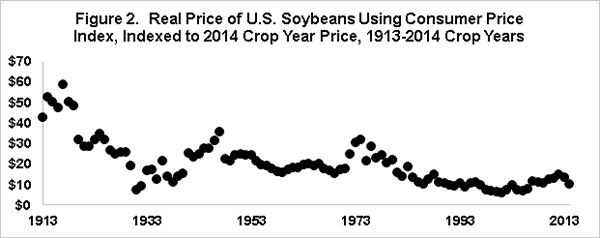

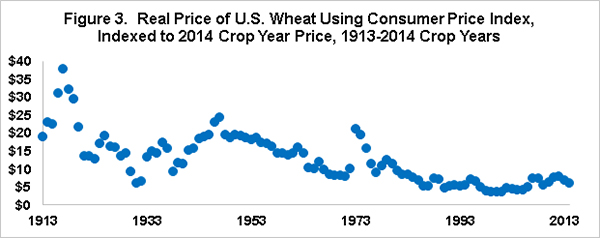

Real prices are indexed to the 2014 crop year prices of $3.65 for corn, $10.05 for soybeans, and $6.00 for wheat. In contrast, 1913 real prices are $15.76 for corn, $42.80 for soybeans, and $18.87 for wheat. As Figures 1, 2, and 3 reveal, real prices of corn, soybeans, and wheat trend steadily lower over the last 100 years despite farm policy intervention and intermittent multiple-year increases. The later occurred in the early-to-mid-1930s due to drought and a rebound from the Great Depression, during and after World War II due to demand and U.S. policy, the 1970s due to exports and global production problems, and more recently due to food and biofuel demand, and global production problems. The long term decline reflects a simple story: supply expands faster than demand. Thus, prices work lower to stimulate demand and dampen the increase in supply.

1970 vs. 2000 Prosperity

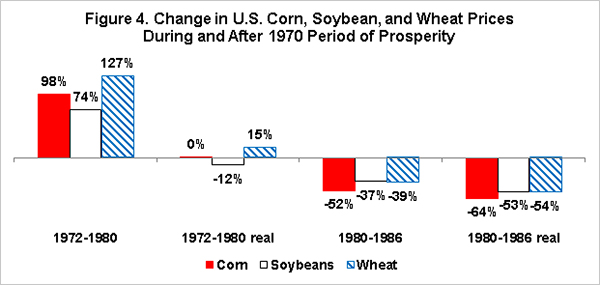

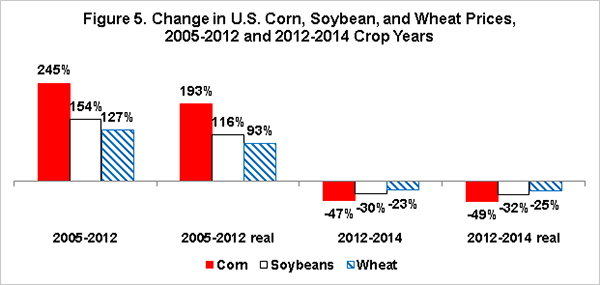

While too early to be certain, let’s assume the recent prosperity period ends in 2012. If so, notable differences exist in price changes during the 1970 and 2000 prosperity. Most strikingly, real prices changed little between 1972 and 1980 (see Figure 4) as general price inflation offset higher nominal, or observed, crop prices. In contrast, between 2005 and 2012, real corn, soybean, and wheat price increased 193%, 113%, and 93% (see Figure 5). These price increases underscore the importance of corn in the 2000 prosperity, likely due to biofuels, but also the low level of general price inflation. CPI increased 93% from 1972 to 1980 but only 18% from 2005 to 2012. After 1980, nominal prices bottomed in 1986, with a total decline of 37% to 52%. Real price decline is larger, 53% to 64%, reflecting general price inflation. In comparison, 2014 crop year prices of corn, soybeans, and wheat are 47%, 30%, and 23%, lower than in 2012. While the decline since 2012 is sizable, it is nowhere near the increase in nominal observed or real prices since 2005.

Summary Observations

- Two important historical perspectives on corn, soybean, and wheat prices emerge: (1) a long term real price decline and (2) a more powerful increase during the 2000 than 1970 prosperity.

- The much greater price increase of the 2000 vs. 1970 prosperity reflect the existence of dual (food, biofuels) vs. single (food) demand factors. The muting of one recent growth engine, biofuels, is a key factor in the recent decline in prices, notably for corn. Biofuel growth in the future is more likely to reflect growth from the market, not government policy, and thus will depend on lower crop prices. By extension, it will be difficult to recover the crop price declines since 2012 without a notable slowing in the growth in crop supply.

- The key question is: Can food demand growth drive crop, more broadly, farm real prices higher? History is not kind. For as long as price records exist, including this 100 year record, food demand growth has not been enough to offset the increase in supply of farm products, resulting in downward pressure on prices.

- While historical trends do not always hold, absent strong arguments to the contrary, the default position is that real U.S. crop prices are likely to trend lower. More succinctly, unless general price inflation increases, supply growth declines, or multiple year global supply disruptions occur; the question is not if but when will corn crop year average price average below $3 and push toward $2. In such an environment, traditional managerial concerns of production efficiency, conservation of cash, and maximizing tomorrow’s chance to farm dominate.

- CAVEAT: This is not a price forecast for 2015 or, more broadly, near term crop year prices. It does not assess supply and demand timing elements. Short term factors can and do override long term factors. This is a forecast of the longer term currents buffeting price determination.

This publication is also available at http://ohioagmanager.osu.edu.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.