Parameters for a 2016 Cash Rent with Bonus

Cash rents need to be lowered to avoid farmer losses in 2016 (farmdoc daily, September 1, 2015). For obvious reasons, landowners are reluctant to lower cash rents, particularly given uncertainty about 2016 revenue. Switching from a fixed cash rent lease to a variable cash lease allows a lower base rent to be established while simultaneously allowing landowners to share in higher crop revenues if they occur. Suggestions for 2016 parameters of a variable cash rent lease are given in this article for high-productivity central Illinois farmland. Adjustments for lower productivity farmland are suggested.

Why Have a Variable Cash Rent Lease?

Expected prices and costs associated with 2016 corn and soybean production suggest that most cash rents need to be reduced. If cash rents are not reduced, farmers could face large loses (farmdoc daily, September 1, 2015). Of course, prices and yields will play a large role in determining 2016 returns. Moreover, actual yields and prices can vary tremendously from current expectations. A variable cash lease allows cash rent to increase if actual prices and yields result in higher than expected revenue.

The particular form of a variable cash rent discussed in this article is a “cash rent with bonus” arrangement (see farmdoc daily, September 27, 2011). This lease has a base rent that will be paid by the farmer to the landowner regardless of crop revenue. A bonus occurs when crop revenue exceeds a revenue trigger. To implement a cash rent with bonus, a farmer and landowner have to agree on:

- A base cash rent,

- Crop revenue triggers, and

- Landowner shares of revenue above the revenue trigger.

Items (2) and (3) above typically vary by crop.

Cash Rent with Bonus Parameters for 2016

Panel A of Table 1 show cash rent with bonus parameters that are appropriate for high-productivity farmland in central Illinois. This table is from a FAST spreadsheet called “Cash Rent with Bonus” available for download from the FAST section of farmdoc. Suggested parameters are:

- Base rent of $200 per acre – This is the amount paid by the farmer and landowner regardless of crop revenue.

- Crop revenue triggers of $750 per acre for corn and $550 per acre for soybeans. The trigger revenues are set based on conservative estimates of non-land costs ($550 per acre for corn and $350 for soybeans), plus the base rent. When calculated this way, revenue covers the farmer’s costs before revenue sharing occurs between the farmer and landowner.

- Landowner share above revenue trigger of 50%.

At the current time, reasonable expectations of 2016 prices are $3.65 per bushel for corn and $9.15 per bushel for soybeans. No bonus will result if yields are near average (see Panel B of Table 1). At the yields shown in Panel B, bonuses would begin at a $3.85 per bushel for corn and $10.00 per bushel for soybeans.

The $200 per acre base rent is set assuming that 2016 ARC payments will be near $35 per base acre when averaged across corn and soybean base acres (farmdoc daily, August 18, 2015). If ARC payments occur, the farmer would have losses at the prices and yields shown in panel B of Table 1. ARC payments are not included in the calculation of bonus because they will not be known for certain until the second half of 2017.

Many fixed cash rents for this productivity currently are in the high $200 per acre range. Hence, a $200 base rent results in a substantial reduction in landowner returns. Setting the “landowner share of above revenue trigger” at 50% provides landowners with upside potential if revenues are above expectations. Often the share percentage is set in the 40 to 45% range.

Changes in these parameters likely will be needed in 2017. ARC payments likely will be lower in 2017 than in 2016. Lower ARC payments suggest that base rents and trigger revenues should be lowered as well. Changes in non-land costs between 2017 also could cause the need to changes rental parameters.

Landowners and farmers could use different parameters than those suggested in this article. Increases in “landowner share above revenue trigger” should be associated with lower “base rents” and lower “crop revenue triggers”.

Historic Performance of these Parameters

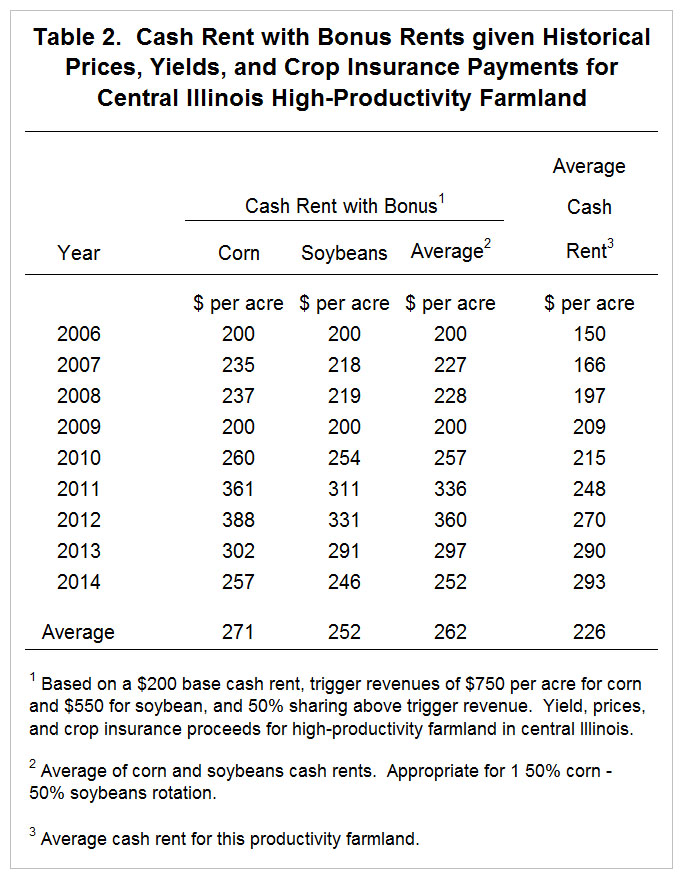

Table 2 shows the cash rents that would have resulted had the above lease been in place from 2006 through 2014. Prices, yields, and crop insurance payments used to generate these cash rents come from averages for central Illinois with high-productivity for farmland (see here). The average cash rent would be appropriate for 50% corn – 50% soybeans rotations. Cash rent with bonus levels would have been $200 per acre in 2006, $227 in 2007, $228 in 2008, $200 in 2009, $257 in 2010, $336 in 2011, $360 in 2012, $297 in 2013, and $252 in 2014. These yearly cash rents average $262 per acre, which is higher than the $226 per acre average for cash rents in central Illinois for high-productivity farmland.

Lower Productivity Level

The above example presumes farmland is expected to yield 195 bushels per acre. Lowering the base rent and trigger revenues would be appropriate for lower farmland productivities. At 180 bushels per acre, a $150 base rent would be roughly equivalent to the above $200 base rent for 195 bushels per acre. Revenue triggers for 180 bushels per acre farmland than are $700 per acre for corn ($550 non-land costs + $150 cash rent) and $500 for soybeans ($350 non-land costs + $150 cash rent).

Summary

This article suggests 2016 cash rent with bonus parameters. A FAST spreadsheet called “Cash Rent with Bonus” is available here for download for examining the impacts of alternative lease parameters.

References

farmdoc. Fast Tools: Cash Rent with Bonus Worksheet. Released September 9, 2015. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 18, 2015.

Schnitkey, G. "Cutting $100 per Acre in Costs for Corn and Soybeans." farmdoc daily (5):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 1, 2015.

Schnitkey, G. "Cash Rent with Bonus Leasing Arrangement: Description and Example." farmdoc daily (1):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 27, 2011.

Schnitkey, G. "2016 ARC-CO Payment Estimates for 2016 Cash Rent Bids." farmdoc daily (5):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 18, 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.