The Value of Soybean Oil in the Soybean Crush: Further Evidence on the Impact of the U.S. Biodiesel Boom

Biodiesel production and consumption in the U.S. boomed in recent years due to rising RFS mandate requirements. However, no evidence was found in a farmdoc daily article last week (September 7, 2017) that the boom in biodiesel led to a boom in soybean oil prices, the main biodiesel feedstock. China’s soybean import boom, which paralleled the U.S. biodiesel boom, was suggested as the explanation. Since soybean oil is a joint product that is produced in fixed proportions when soybeans are crushed, China’s soybean import boom necessarily also produced a huge quantity of soybean oil. This large increase in global soybean oil supplies, also boosted by good growing season weather, allowed the U.S. boom in biodiesel production to take place without causing a corresponding boom in soybean oil prices. This highlights the important role that the soybean crush plays in understanding the relationship between biodiesel and soybean oil prices. The purpose of this article is to analyze the soybean crush in order to provide additional evidence regarding the soybean oil price impact of the U.S. biodiesel boom. This continues the recent series of farmdoc daily articles that examine the role that biodiesel plays with respect to compliance with RFS mandates. (July 12, 2017; July 19, 2017; July 26,2017; August 9, 2017; August 16, 2017; August 23, 2017; August 30, 2017; September 7, 2017)

Analysis

We begin with an example of the most common way of computing the components of the soybean crush and the crush margin. On September 8, 2017, the price of soybeans at Iowa soybean processing plants was $9.36 per bushel, the price of soybean meal was $288.90 per ton, and the price of soybean oil was $0.34 per pound. The typical assumption is that a 60 pound bushel of soybeans yields 48 pounds of high protein soybean meal (46.5 percent), 11 pounds of soybean oil, and 1 pound of processing waste. Then, one bushel of soybeans on September 8 produced the following crush revenue,

- Soybean meal: $288.90/2000 x 48 = $6.93 per bushel, and

- Soybean oil: $0.34 x 11 = $4.43 per bushel.

The crush margin is simply the difference between revenue and cost (soybeans),

- Margin = ($6.93 + $4.43) – $9.36 = $1.32 per bushel

Note that the crush margin computed in this manner is the gross margin of the soybean processor. All other variable and fixed costs have to be subtracted to obtain the net margin.

With this background on the basics of soybean crush computations, we can analyze the patterns in the data for additional clues on the behavior of soybean oil prices during the biodiesel boom years. Figure 1 plots the weekly (Friday) soybean meal and oil price at Iowa plants from April 13, 2007 through September 8, 2017. Both meal and oil prices move in a very wide range, with high and low prices for meal of $177 and $609 per ton and high and low prices for oil of $0.26 and $0.66 per pound, respectively. For much of this sample period the two prices track one another in broad terms. But in some periods, like 2011 and 2012, prices divergence sharply. The dominant trend in both meal oil prices after 2012 is sharply downward. Prices in recent months are among the lowest since 2007. One issue with Figure 1 is the large difference in scales, with soybean meal quoted in $ per ton and soybean oil traded in $ per pound, which can distort comparisons. Figure 2 converts the soybean meal price to $ per pound so the prices of the two co-products can be compared on the same per unit basis. This conversion makes it obvious that soybean oil is the much more highly valued product on a per pound basis. Over this sample, the average soybean meal price was $0.17 per pound and the average soybean oil price was $0.40 per pound.

While soybean oil is more highly priced than soybean meal per pound, one bushel of soybeans yields over four times as much meal as oil. Figure 3 accounts for this difference in yield and multiplies the per pound price by the pounds of each co-product produced when crushing a bushel of soybeans (48 pounds soybean meal and 11 pounds soybean oil). Expressed this way, it is clear that soybean meal actually contributes the bulk of the crushing value of soybeans on a per bushel basis. The average soybean meal contribution during the sample was $8.33 per bushel and the average soybean oil price contribution was $4.43 per bushel. Figure 4 provides further perspective by presenting the percentage of total crush value represented by soybean oil. Of course, 100 minus this percentage is the value proportion represented by soybean meal. Given the volatility of the prices noted above, it is not surprising that there is a wide range for the percentage oil value, from roughly 25 to 45 percent of the total. A key observation from Figure 4 is that there is no obvious trend in the oil value percentage over the sample that parallels the biodiesel boom of 2011-2017. If anything, there has been a downward trend in the soybean oil percentage, just the opposite of what one would expect if the biodiesel boom exerted unusual upward pressure on the price of soybean oil relative to soybean meal.

Figure 5 shows the movement in the crush margin itself (soybean meal value + soybean oil value – soybean price). Again, there is nothing out of the ordinary in recent years. Finally, Figure 6 adds the per pound price of soybeans to the plot of meal and oil prices shown in Figure 2. While there is a clear pull on soybean prices from soybean oil during some time periods (e.g., 2010-2011), this plot makes it abundantly clear that soybean and soybean meal prices track one another very closely pound-for-pound.

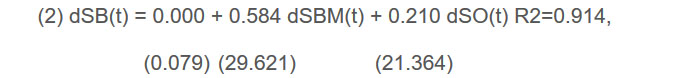

We now test the soybean oil price pressure hypothesis more rigorously with regression analysis. Specifically, we estimate a simple regression model of soybean pricing and examine whether the coefficients on soybean oil change during the biodiesel boom. The regression is estimated in first differences (changes) in order to remove the strong level effects in the data. The estimation results for the full sample of April 13, 2007 through September 8, 2017 are as follows,

where dSB(t) is the change in per pound soybean prices at Iowa plants for the current week, dSBM (t) is the change in per pound soybean meal prices at Iowa plants for the current week, and dSO(t) is the change in the per pound soybean oil prices at Iowa plants for the current week. Since the t-statistics (in parentheses) substantially exceed two, the slope coefficients are highly statistically significant. The overall explanatory power of the model is reasonable with an R2 of 0.805. Given that all of the variables are specified on a per pound basis, the results clearly highlight the dominant role that soybean meal plays in determining the value of soybeans. Roughly speaking, a one cent per pound change in soybean meal prices has about 2.5 times the impact on soybean prices of a one cent change in soybean oil prices.

We now split the sample to see if there is evidence of a larger impact of soybean oil prices as the biodiesel boom took place. The estimation results for April 13, 2007 through December 30, 2011 are,

and for January 6, 2012 through September 8, 2017,

There is, of course, some variation in the size of the estimated slope coefficients for soybean meal and oil across the two sample splits. But the important result is that the coefficient on soybean oil barely changes. This provides definitive evidence that the relative impact of soybean oil prices on soybean prices was unaffected by the biodiesel boom.

Implications

Soybean meal and oil are joint products produced in fixed proportions when crushing soybeans. Conventional wisdom is that soybeans are crushed for their soybean meal value rather than soybean oil. The biodiesel boom in the U.S. during recent years has required very large volumes of feedstock, primarily soybean oil. This has raised the possibility of conventional wisdom regarding the source of value for soybeans being upending. We analyzed weekly soybean meal, soybean oil, and soybean prices from April 13, 2007 through September 8, 2017 and found no evidence that the relative impact of soybean oil prices on soybean prices was affected by the biodiesel boom. If anything, there has been a downward trend in the value of soybean oil in recent years, just the opposite of what one would expect if the biodiesel boom exerted unusual upward pressure on the price of soybean oil relative to soybean meal. This supports our previous conclusion that the large increase in global soybean oil supplies associated with China’s soybean import boom, in combination with good growing season weather, allowed the U.S. boom in biodiesel production to take place without causing a corresponding boom in soybean oil prices.

References

Irwin, S. and D. Good. "The Relationship between Biodiesel and Soybean Oil Prices." farmdoc daily (7):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 7, 2017.

Irwin, S. and D. Good. "Projecting Biodiesel RINs Prices under Different Policies." farmdoc daily (7):159, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 30, 2017.

Irwin, S. and D. Good. "How to Think About Biodiesel RINs Prices under Different Policies." farmdoc daily (7):154, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 23, 2017.

Irwin, S and D. Good. "Biomass-Based Biodiesel Prices--How Much Does Policy Matter?" farmdoc daily (7):149, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 16, 2017.

Irwin, S. and D. Good. "EPA Interpretation of the "Inadequate Domestic Supply" Waiver for Renewable Fuels Ruled Invalid: Where to from Here?" farmdoc daily (7):144, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 9, 2017.

Irwin, S and D. Good. "Revisiting the Estimation of Biomass-Based Diesel Supply Curves." farmdoc daily (7):135, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 26, 2017.

Irwin, S and D. Good. "Filling the Gaps in the Renewable Fuels Standard with Biodiesel." farmdoc daily (7):130, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2017.

Irwin, S and D. Good. "The EPA's Renewable Fuel Standard Rulemaking for 2018--Still a Push." farmdoc daily (7):125, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 12, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.