Implement Dealer Financing and Farm Financial Stress

In a series of recent articles, we show that farmers’ use of implement dealer financing has increased substantially since 2003 (farmdoc daily May 9, 2018). Implement dealers currently provide nearly one-third of the agricultural sector’s long-term non-real estate debt. We also found that implement dealer financing is more common for smaller farms (farmdoc daily May 16, 2018). Some industry observers have expressed concern that implement dealer financing may lead to increases in financial risk for participating farms (Wall Street Journal, July 18, 2017). This post compares the financial risks between farmers with and without implement dealer financing for long-term non-real estate debt (i.e., machinery and equipment loans). We find that farms that use implement dealer financing have similar indicators of potential financial stress than those that do not.

Sources for Detailed Farm Loan Data

While many lenders, such as commercial banks or the Farm Credit System, report aggregate lending to farmers, it is difficult to measure other lending relationships, such as borrowing from individuals. For these types of lending relationships, economists typically rely on surveys of farm operators. The best source for national-level aggregate farm debt is the Agricultural Resource Management Survey (ARMS) jointly produced by USDA Economic Research Service and National Agricultural Statistics Service. The annual ARMS survey asks farmers detailed information on the terms, age, interest rate, and lender type for (up to five) outstanding loans (see May 9, 2018).

It is important to note that the lender type is reported by ARMS’ farmer-respondents. Thus, we define implement dealer financing as loans for which respondents report the lender as “implement dealers and financing corporations.” As a result, we are unable to identify the financial institution providing the line of credit, which takes a variety of forms, but instead are only able to identify farmers’ definition of the credit supplier.

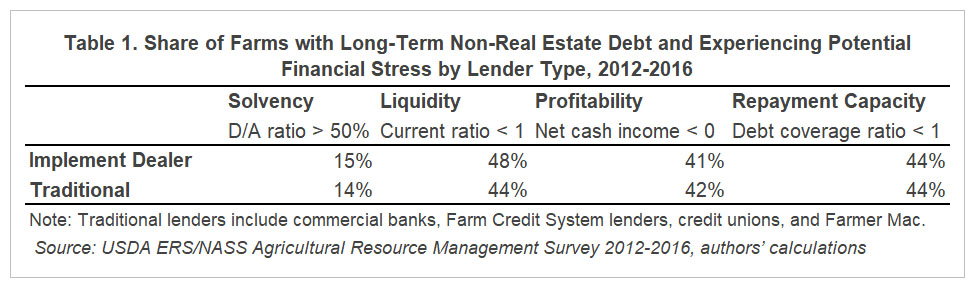

Table 1 compares a number of financial measures for farms with long-term non-real estate loans from implement dealers to farms with similar loans from traditional lenders. Overall, the measures suggest that farms that used implement dealer financing were very similar to farms that do not. The two groups were very similar in terms of solvency, liquidity, profitability, and repayment capacity.

In addition, we used multiple regression analysis to examine which farm characteristics are best at predicting the use of implement dealer financing (results are available here). Multiple regression analysis allows us to test for the relationships between implement dealer financing and various farm characteristics, holding all other factors constant. Under a variety of modeling specifications, we were unable to identify a statistically significant relationship between farm financial conditions and the use of implement dealer financing. However, we found that farm size, farmer age, education, and production specialty were good predictors of implement dealer financing. Specifically, larger farms and younger and less educated farmers were less likely to use implement dealer financing. In addition, implement dealer financing was used more frequently by cotton producers (all else being equal).

Conclusion

Many observers of the agricultural sector have noted farmers’ increasing use of implement dealer financing, and other “nontraditional” suppliers of credit. Using ARMS data, we found that implement dealer financing increased from about 11% of long-term non real estate lending in 2003 to 27% in 2016. The growth of implement dealer financing has raised concerns about the risk associated with higher debt levels during a downturn. ARMS data also suggest that farms using implement dealer financing have similar levels of financial stress as farms who do not use implement dealer financing.

Disclaimer

The views expressed herein are those of the authors and are not attributable to the USDA, the Economic Research Service, or the National Agricultural Statistics Service. This research was conducted while Kevin Patrick was employed at the Economic Research Service.

References

“America’s Farmers Turn to Bank of John Deere.” Wall Street Journal, July 18, 2017. https://www.wsj.com/articles/americas-farmers-turn-to-bank-of-john-deere-1500398960

Farm Credit Administration. FCS Major Financial Indicators. https://www.fca.gov/rpts/fcsindicators.html

Ifft, J., K. Patrick, and T. Kuethe “Farmers’ Use of Implement Dealer Financing” farmdoc daily (8): 89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2018.

Ifft, J., T. Kuethe, and K. Patrick. “Nontraditional Lenders in the U.S. Farm Economy.” Presentation at the 2017 Agricultural and Rural Finance Markets in Transition, October 2-3, 2017, Minneapolis, Minnesota.

Kauffman, N., and M. Clark. “Farm Lending Stabilizes, but Bank Liquidity Tightening.” Federal Reserve Bank of Kansas City, Main Street Views. October 19, 2017. https://www.kansascityfed.org/research/indicatorsdata/agfinancedatabook/articles/2017/10-18-2017/ag-finance-dbk-10-18-2017

Kuethe, T., J. Ifft, and K. Patrick “The Rise in Implement Dealer Financing” farmdoc daily (8): 84, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 9, 2018.

USDA, Economic Research Service. ARMS Farm Financial and Crop Production Practices. https://www.ers.usda.gov/data-products/arms-farm-financial-and-crop-production-practices/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.