Dispatches from the Trade Wars

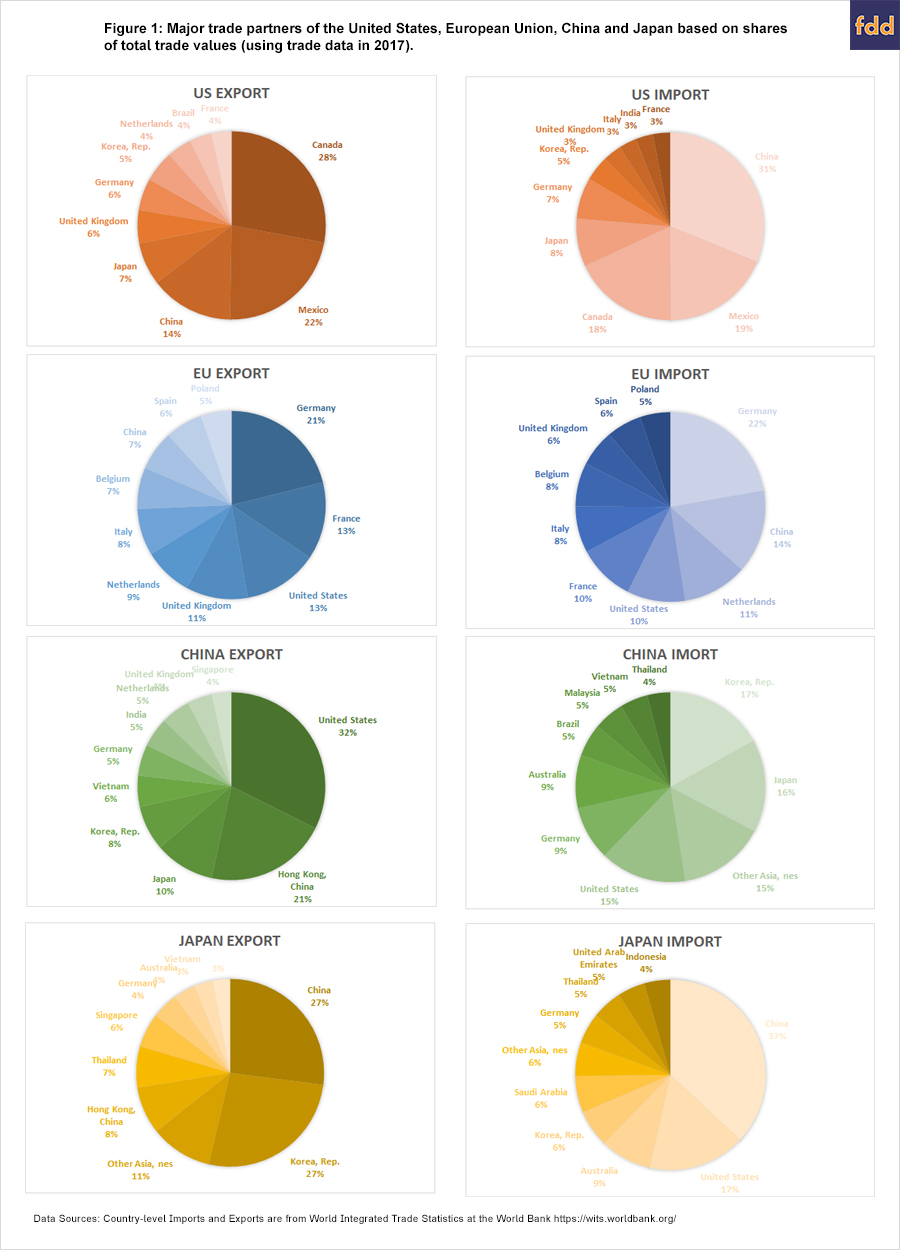

The last month has produced a lot of news on the trade front, much of which has implications for US farmers and their markets. All of the largest and most important trade relationships for the US are in flux. This article provides a brief summary of where things stand.

Discussion

On Monday, August 27, 2018, the U.S. government announced that trade talks had moved forward with our third largest trading partner, Mexico. President Trump announced that the United States and Mexico had reached a bilateral trade agreement that revises key portions of the North American Free Trade Agreement (NAFTA) (Swanson, Rogers and Rappeport, Aug. 27, 2018). Robert Lighthizer, the United States Trade Representative, expected the deal would conclude on August 31st. Key changes involved increasing the North American content required for automobiles to be sold tariff-free, with a clause that 40-45% of the value of a car be built be labor earning at least $16 per hour. Another substantial change is that the new agreement is only in place for 16 years, with a decision to extend it required every six years (Reuters, Aug. 27, 2018). Notably, any changes to NAFTA will require congressional approval on a short timeline with a busy legislative calendar.

Canada, our second largest trading partner and the third member of NAFTA, resumed talks with the US today. The US states that Canada has until Friday to sign on, or be excluded from the revised NAFTA. One area of specific concern to Canada is the removal of Chapter 19, which allowed NAFTA countries to settle antidumping disputes (Reuters, Aug. 27, 2018), while the US is arguing for increased access to the Canadian dairy market. It is currently unclear is whether an agreement will be reached or how failure to include Canada would affect trade and the changes for a revised NAFTA to be approved in Congress (Swanson and Rappeport, Aug 29, 2018).

Meanwhile, the trade conflict with our largest trade partner ramped up last week. With trade talks ongoing, on Thursday, August 23rd, the U.S. increased tariffs by 25 percent on $16 billion worth of Chinese imports (BBC News, Aug. 23, 2018). China immediately matched with a 25 percent charge on $16 billion worth of U.S. goods including vehicles, fuels, coals, and recyclables.

The Trump administration has proposed a further round of 25% tariff on $200 billion in products from China (Borak, Aug. 2, 2018). If this goes through, more than half of the total $500 billion Chinese imports will be subject to tariffs. In response, China threatened retaliatory duties on $60 billion worth of goods including coffee, honey, and industrial chemicals (Bradsher and Li, Aug. 3, 2018). Liu Kun, China’s Finance Minister, said China would continue to respond “resolutely” at the trade measures in an interview with Reuters (Woo, Shen and Chen, Aug. 24 2018 ).

Escalation of the trade conflict between the world’s two largest economies is cause for concern and there appears to be no foreseeable end in sight (farmdoc daily, August 16, 2018). For example, we can observe a close relationship between the tariff conflict and rapid drops in corn and soybean prices this year (farmdoc daily, July 31, 2018). Research and experience suggest that the longer tariffs remain in place, the more likely our trading partners will find other suppliers for their agricultural imports (farmdoc daily, January 18, 2018).

As these US trade uncertainties continue, important US trading partners are not standing still. Last month (July 17th), the European Union signed the world’s largest trade agreement with the US’ fourth largest trading partner, Japan (Gale and Peker, July 17, 2018). The deal is expected to reduce around $1 billion in tariffs for European companies every year. For Japanese exporters, around $2 billion of reduction in tariffs annually. The Japan-EU deal eliminates most bilateral tariffs, creating more favorable terms for Japanese cars sold in the EU, and European wine and dairy products sold in Japan. This deal sends a strong signal in support of global free-trade amongst the heated trade wars between China and the U.S.

The EU-Japan trade deal follows EU’s trade agreement ratified with Canada (CETA) in 2017, and with Mexico in April of this year (Blenkinsop, April 21, 2018). The EU-Canada trade agreement is meant to eliminate 98% of existing tariff lines, while the EU-Mexico deal aims to make all trade in goods duty-free, including in the agricultural sector. EU also restarted long-stalled talks with Latin America’s biggest trading bloc—Mercosur, including Argentina, Brazil, Paraguay, and Uruguay (Blenkinsop, July 19, 2018). In May, the EU initiated official talks with Australia and New Zealand in its latest push to expand global trade links (Brunsden, May 22, 2018). On June 25th, the EU and China held the 7th annual EU-China High-level Economic and Trade Dialogue in Beijing seeking progress in the economic and trade field (European Commission Press release, June 25, 2018).

Finally, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is scheduled to go into effect in early 2019. The CPTPP is one of the largest multilateral FTAs, dominating 13.5 percent of global GDP (Capri, Nov. 15, 2017). The CPTPP is estimated to bring approximately $150 billion for the member countries. When President Trump pulled the U.S. out of the 12-nation Trans-Pacific Partnership trade deal in January 2017 (Mui, Jan. 23, 2017), Japan took on a leadership role to complete an 11-nation deal earlier this year without the U.S. (Stevenson and Rich, Nov. 11, 2018). The CPTPP helps Japan fortify and demonstrate its leading role in the Asia-Pacific and establish new trade rules for trade deals in the Asia-Pacific.

Concluding Thoughts

Trade wars in the form of tariffs and tariff retaliation can escalate quickly with widespread, long-term damage, particularly for firms with increasingly complex international supply chains. Unpredictable trade policies increase the risk facing firms doing business with the United States, and creates an incentive for importers to look to other markets where trade liberalization is becoming further entrenched. For example, a firm operating in Japan may look more favorably on sourcing inputs from Germany rather than the U.S. given a firm trade agreement. This switch from importing good from one country to another due to trade barriers is known as ‘trade diversion’. While updating and improving trade agreements is an important goal, the choice of strategies countries use to get other nations to the table is important; the long-term benefits we seek may be harder to achieve with a trade war. We do not want our efforts to backfire, with the benefits of trade for American farmers and businesses ending up diverted to our trade partners who choose a more open stance on trade.

References

BBC News, “US-China trade war: New tariffs come into force”, Aug. 23,2018

Blenkinsop, P. “EU and Mexico agree new free trade pact,” Reuters, April 21, 2018

Blenkinsop, P. “EU-Mercosur trade talks targeting September finale: Argentina”, Reuters, July 19, 2018

Bradsher, K., C. Li, “China Threatens New Tariffs on $60 Billion of U.S. Goods”, The New York Times, Aug. 3, 2018

Brunsden, J. “EU ministers greenlight Australia-New Zealand trade talks”, Financial Times, May 22, 2018

Burak, S., K. Baylis, J. Coppess and Q. Xie. "The Japanese Beef Market’s Lessons for Trade Policy." farmdoc daily (8):9, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 18, 2018.

Capri, A. “The Reborn TPP Proves That Multilateral Agreements Trump Bilateral Trade Deals Every Time,” Forbes, Nov. 15, 2017

European Commission Press release, “EU and China discuss economic and trade relations at the 7th High-level Economic and Trade Dialogue”, June 25, 2018

Gale, A., Peker E., “Japan, EU Sign Trade Deal: ‘We Stand Together Against Protectionism,” The Wall Street Journal, July 17, 2018

Mui, Y. “President Trump signs order to withdraw from Trans-Pacific Partnership,” The Washington Post, Jan. 23, 2017

Stevenson, A., M. Rich, “Trans-Pacific Trade Partners Are Moving On, Without the U.S.” The New York Times, Nov. 11, 2017

Swanson, A., K. Rogers and A. Rappeport “Trump Reaches Revised Trade Deal With Mexico, Threatening to Leave Out Canada,” The New York Times, Aug. 27th, 2018

Swanson, K., J. Coppess and G. Schnitkey. "Trade Timeline and Corn and Soybean Prices." farmdoc daily (8):141, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 31, 2018.

Timmons, S. “Canada wins in Trump’s NAFTA “deal” with Mexico,” Quartz, Aug. 27, 2018

“UNITED STATES–MEXICO TRADE FACT SHEET: Modernizing NAFTA to be a 21st Century Trade Agreement”, Office of the United States Trade Representative, Aug. 27, 2018

Woo, R., Y. Shen, Y.Chen, “China to keep hitting back at the U.S. over trade, to boost government spending - finance minister,” Reuters, Aug. 24 2018

Zulauf, C., J. Coppess, N. Paulson and G. Schnitkey. "The Tariff Conflict and Change in Value of Production of U.S. Field Crops." farmdoc daily(8):153, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 16, 2018.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.