What are the Chance of PLC Payments for the 2019 and 2020 Pro-gram Year

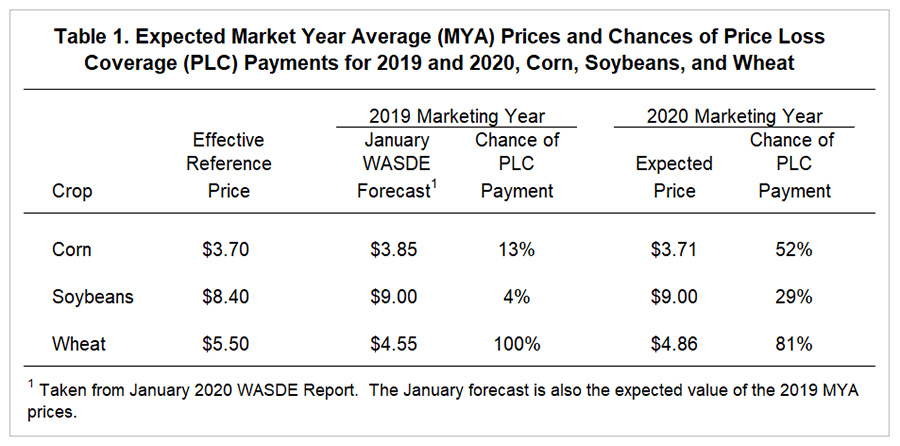

Price estimates in the January report of the World Agricultural Supply and Demand Estimate (WASDE) add more clarity to the chance of Price Loss Coverage (PLC) payments for the 2019 marketing year. For 2019, January estimates of the 2019 Market Year Average (MYA) prices are $3.85 per bushel for corn, $9.00 per bushel for soybeans, and $4.55 per bushel for wheat. Based on these price estimates and historical deviations between WASDE and ending MYA prices, our estimates suggest that the likelihood of PLC paying for the 2019 year is 13% for corn, 4% for soybeans, and 100% for wheat. These probabilities soon will be updated in the Gardner ARC/PLC Payment Calculator, an online tool for assessing payments from PLC and Agricultural Risk Coverage at the County Level (ARC-CO) by county. Placing these likelihoods in context of the program choice decision is discussed further in this article.

Background

Price Loss Coverage (PLC) will make payments when the market year average (MYA) price falls below the effective reference price. The 2019 and 2020 effective reference prices are $3.70 per bushel for corn, $8.40 per bushel for soybeans, and $5.50 per bushel for wheat (See Table 1).

MYA prices are national prices averaged during the commodity’s marketing year. The 2019 market year for corn and soybeans began on September 2019 and ends in August 2020. The market year for wheat runs from June to May. The 2019 market year for wheat began in June 2019 and will end in May 2020. For all three crops, the marketing years are well underway.

Estimates for the 2019 MYA prices are provided monthly in the World Agricultural Supply and Demand Estimates (WASDE), a report published by the Office of the Chief Economist, United States Department of Agriculture. The January report estimated the 2019 MYA prices at:

- $3.85 for corn, above the $3.70 effective reference price by $.15,

- $9.00 for soybeans, above the $8.40 effective reference price by $.60, and

- $4.55 for wheat, below the $5.50 effective reference price by $.95 (see Table 1).

Note that actual 2019 MYA prices could vary from the January WASDE estimates. As described in the next section, we estimate the probability of the MYA price being below the effective reference price based on historical differences between January estimates reported in WASDE and ending MYA prices. There is a 13% chance of the 2019 MYA price for corn being below $3.70 in 2019 (see Table 1). In other words, 87% of the time the 2019 MYA price for corn will be above the $3.70 and a PLC payment will not occur, while 13% of the time the 2019 MYA price will be below the $3.70 effective reference price and a PLC payment will occur.

Based on historical price changes, the 2019 MYA price for soybeans has a much lower chance of generating a PLC payment in 2019 than corn. The chance that the 2019 MYA price will be below the $8.40 reference price is 4% (see Table 1).

Based on historical price changes, wheat has a 100% chance of generating a PLC payment in 2019.

Table 1 also includes estimates of the likelihood of PLC payments in 2020, a year from now. Farmers will choose between PLC and ARC for both the 2019 and 2020 marketing years. Therefore some estimate of 2020 payments are useful. For all crops, the range of possible prices increases because of the increased uncertainty associated with price expectations more than 1 year in the future. As a result, the chance of PLC payments increases for corn and soybeans. Corn’s probability increases from 13% in 2019 to 52% in 2020. For soybeans, the likelihood increases from 4% to 29%. Given current expectations for increased wheat prices in 2020, the likelihood of PLC payments for wheat decline from 100% in 2019 to 81% in 2020.

Price Changes between January WASDE and MYA price

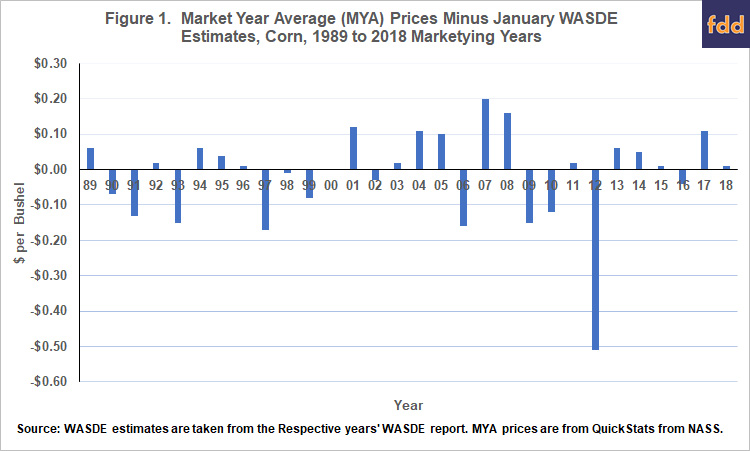

The 2019 probabilities shown in Table 1 are based on historical differences between the final MYA price and the January WASDE estimates for corn. Figure 1 shows those differences for each year from 1990 to 2018. The 2018 bar is $.01 per bushel, equaling the difference between the $3.61 final 2018 MYA price and the $3.60 WASDE estimate made in January 2019. The largest difference occurred in 2013, when the January 2014 WASDE report had a $7.40 estimate and the 2013 MYA price turned out to be $6.89.

In 2019, the MYA price must decline by $.15 from the $3.85 WASDE estimate before PLC will make a payment. From 1990 to 2019, the MYA price was $.15 lower than the January estimated in 3 years: 1998, 2008, and 2013. There are 30 years between 1990 and 2019 so those 3 years represent 10% of the years in that period. There is a 10%, likelihood that price would decline enough to result in a PLC payment. Our 2019 estimate shown in Table 1 is slightly higher at 13% because of smoothing in our probability estimates.

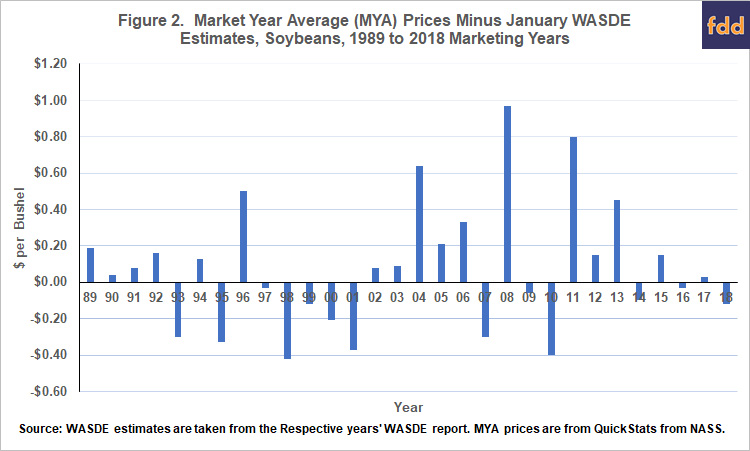

Figure 2 shows differences for soybeans. In 2019, the MYA price would have to be $.55 lower than the $9.00 January estimate for a PLC payment to be triggered. There are no cases between 1990 and 2019 when the MYA price was $.55 lower than the 2019 MYA price. Our estimate in Table 1 shows a 4% chance because of modeling techniques that reflect conservatism in evaluating price distributions.

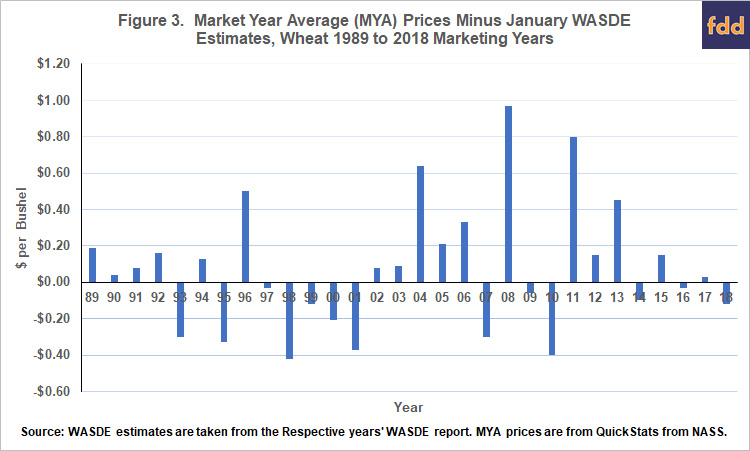

Figure 3 shows differences in MYA and January WASDE estimates for wheat. Because the wheat market year ends with May, the estimates are in a fairly tight range. None of the differences exceed $.20 per bushel. Currently, the January WASDE estimate of $4.55 per bushel is $.95 per bushel lower than the $5.50 effective reference price. History would suggest that the 2019 MYA price for wheat will almost certainly be below the effective reference price.

Making the ARC/PLC Decision

These likelihoods enter into the decision between PLC or ARC-CO. The Gardner Program Payment Calculator will soon the above probabilities incorporates these estimates into its calculations. In all cases, the likelihood of PLC payments will equal those shown in Table 1 until price estimates are updated. For example, the likelihood of a corn payment is 13% for 2019 and 52% for 2020.

- Corn: We would not expect PLC to not make payments in 2019. ARC-CO could make payments in a limited number of counties in 2019, but those counties likely will be limited to areas with very late planting. In contrast, given current price levels, PLC likely has a higher chance of payment and higher expected payment for 2020.

- Soybeans: PLC is not expected to make payments in 2019. There is a chance that ARC-CO will make payments in 2019 for more counties. For 2020, the likelihood of payments and level of payments are about the same between ARC-CO and PLC.

- Wheat: There is a near certainty of PLC payments in 2019, and a very high chance of payments in 2020. ARC-CO will make payments in many counties in 2019, but those payments likely will be lower than PLC payments. The level of a PLC yield on a farm will matter in this determination. We suggest running the Gardener ARC/PLC payment calculator in these cases.

Summary

Estimates of ARC/PLC payments can be obtained from the Gardner Payment Calculator. Scenario analysis also can be conducted using the 2019 Farm Bill What-if Tool, a Microsoft Excel tool available for download for the 2018 Farm Bill Toolbox. This tool also includes a calculator for ARC-IC. We suggest farmers evaluate ARC-IC payments for their farms, and then make comparisons to payments for ARC-CO and PLC.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.