Prevent Plant Policy Options

As discussed in the May 4, 2022 farmdoc daily, crop insurance’s prevent plant provision has the potential to notably reduce planted acres if planting is delayed by weather until prevent plant’s first decision date. This potential is important in years with a tight supply-demand balance, such as 2022. And particularly relevant at a time when the US is exploring methods to increase production of food crops experiencing a global shortage due to the Ukrainian-Russian war (farmdoc daily May 10, 2022). Options for balancing the incentives to plant and take prevent plant are examined. They are divided into options for 2022 and longer-term options.

Prevent Plant Overview

Prevent plant is a provision in publicly subsidized individual farm yield and revenue insurance. Specifically, if an insured cause of loss, such as excessive moisture, delays planting to or after a date set by USDA, RMA (US Department of Agriculture, Risk Management Agency), a farmer has a decision to plant a crop or not plant and take a prevent plant insurance payment. The initial prevent plant date varies by US region and crop, but for many spring planted crops occurs from May 20 through late June. For a farmer, prevent plant is, in effect, a conditional land set aside decision that becomes available when an insured cause of loss delays planting until a date set by RMA. Prevent plant potentially reduces planted acres and thus supply resulting in higher prices. For a more in-depth discussion of prevent plant, see the May 3, 2022 and May 4, 2022 farmdoc daily articles.

Prevent Plant Policy Options for 2022

Because insurance contracts are already signed for most crops to be harvested in 2022, it is unlikely that changes which reduce coverage will be adopted. Such changes would likely be challenged in court and incur political displeasure in a Congressional election year. This situation means Federal outlays are likely to increase if the political desire is to reduce prevent plant’s potential impact on planted acres. Payments are likely to be made via the Commodity Credit Corporation (CCC) and not crop insurance. This approach avoids issues that might arise with insurance’s actuarial ratings. Given this situation, 2022 prevent plant policy options are:

- maintain yield guarantee at the elected coverage level for crops planted after prevent plant’s first decision date — this proposal increases risk protection for crops planted after prevent plant’s first decision date — currently, the insured guarantee is reduced at a rate set by RMA until the final date RMA allows a crop to be planted and be eligible for insurance — payments would occur only if a yield loss is realized relative to the elected coverage level

- treat yield the same for prevent plant and acres planted after prevent plant’s first decision date — currently, prevent plant acres are assigned no yield while planted acres incur the risk of a yield below the APH insurance yield, which potentially lowers future APH during RMA’s 10 year calculation window — an option for 2022 is to assign no insurance yield to crops planted after prevent plant’s first decision date and yield at harvest is less than the current APH — this impacts future premiums and government spending

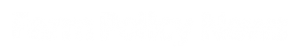

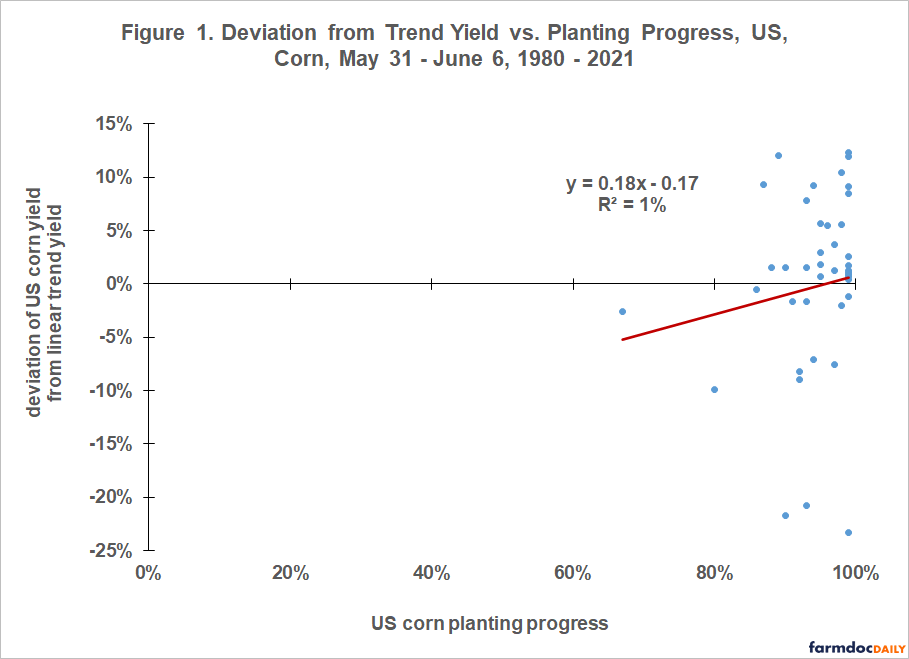

In assessing these options, it is worth noting that, since 1980, no statistically significant relationship exists between (a) US planting progress in early June and (b) the deviation of harvested US corn and soybean yield from trendline (see Figures 1 and 2 and Data Note 1). June planting progress explains 1% of trendline yield deviation. These relationships do not mean that late planting cannot lead to lower yields but they do underscore that planting progress is only one of many factors that impact harvested yield. Since insurance pays on realized yield, not date of planting; these relationships call into question the commonly accepted strong relationship between later planting and lower yields, at least from the perspective of the US in aggregate. These relationships also suggest that Option 1 may have a lower budget cost than might be expected. These analytical results are consistent with the results presented in the April 28 and May 9 farmdoc daily articles and the questions posed in these articles.

Longer-Term Option – Address the Circularity Between Prevent Plant and HPO (Harvest Price Option)

Prevent plant substitutes a known insurance payment if the crop is not planted for an unknown, potentially larger payment if the crop is planted. The potentially larger payment is related to insurance’s HPO feature. HPO values the insurance guarantee and thus indemnity payments at the higher of the projected or harvest insurance price, provided yield declines more than the insurance deductible. In 2012, HPO resulted in corn receiving large indemnities. HPO could again result in large indemnities in 2022. For many crops, prices already exceed their projected insurance price. For example, recent corn harvest bids have exceeded $7.00. Corn’s projected insurance price is $5.90.

A circularity exists between prevent plant and HPO. Prevent plant removes land from production, resulting in no production even though expected production exceeds zero. Prevent plant thus increases price, in turn potentially increasing HPO indemnities. Circularities increase program cost, i.e. government outlays, and, in the context of crop insurance, farmer-paid insurance premiums.

It is generally considered appropriate policy to avoid policy-induced circularities because of the impacts noted at the end of the preceding paragraph. The circularity can be broken by offering revenue products that have either prevent plant or HPO, but not both. Currently, the insurance contract, revenue protection with Harvest Price Exclusion, has prevent plant but not HPO. A revenue insurance contract with HPO but without prevent plant would have to be created. In essence, farmers would have to choose between HPO and prevent plant.

An alternative approach that would limit but not eliminate the circularity is to reduce the current cap on the HPO payment. Currently, the HPO price cannot exceed two times the projected insurance price.

A policy option what would create symmetry between prevent plant and planted acres is to add HPO to the prevent plant payment. This approach would increase HPO payments, Federal outlays, farm-paid premiums, and the risk for crop insurance companies.

Longer-Term Option — Prevent Plant and APH Yield

As discussed under options for 2022, yield is currently treated differently for prevent plant vs. planted acres. Prevent plant acres do not contribute to insurance’s approved APH yield, while yields on acres planted after prevent plant’s first decision date do contribute to the approved yield. Farmers have an incentive to keep APH as high as possible to maximize crop insurance’s risk management value. The different treatment provides more of an incentive to take prevent plant. Two ways of eliminating this incentive are to calculate the approved APH insurance yield either by (a) including prevent plant acres at zero yield or (b) excluding yields for acres planted after prevent plant’s first decision day.

Longer-Term Option — Prevent Plant and Marginal Decision Making

A seminal contribution of economics is the importance of marginal decision making. Conceptually, RMA establishes the prevent plant coverage factor for a crop as the share of a crop’s expenses incurred prior to planting (USDA, RMA, November 2018). The prevent plant coverage factor is the same for all acres of a crop. However, strong reasons exist for believing this share varies by geographical area and by farmers within an area. For example, RMA treats 100% of land costs as incurred prior to planting and uses the cash rental rate as its measure (RMA, November 2018). Land owned with no debt has no cash cost except real estate taxes and insurance. Farmers may assign a residual value to this land after the crop is marketed, thus treating land as an expense occurred after planting. Farmers with a lower share of costs incurred before planting would be expected to more likely choose prevent plant. The policy implication is that the prevent plant coverage factor should be set using marginal, not average, share of expenses incurred prior to planting. Determining the marginal prevent plant coverage factor is difficult, but reducing current prevent payments would be a step toward reflecting that prevent plant is a marginal managerial decision by farmers. One approach that would also solve the marginal incentive created by cross-crop prevent plant (farmdoc daily May 4, 2022) is to constrain the prevent plant payment to the lowest prevent plant payment for any crop planted on the insured unit over the last 4 years. Currently, the prevent plant payment is likely to be the highest prevent plant payment for any crop planted on the insured unit over the last 4 years.

Summary Observations

Crop insurance’s prevent plant provision has the potential to notably reduce planted acres if planting is delayed by weather until prevent plant’s first decision date. This potential is especially important in years such as 2022 with a tight supply-demand balance and food supply concerns.

Prevent plant policy options for 2022 are unlikely to reduce coverage since insurance contracts are already signed. Given this situation, 2022 prevent plant policy options are:

- maintain yield guarantee at the elected coverage level for crops planted after prevent plant’s first decision date

- treat yield the same for prevent plant and acres planted after prevent plant’s first decision date by assigning no insurance yield for acres planted after prevent plant’s first decision date.

Underlying issues also exist that transcend 2022 and need to be addressed.

- A circular feedback loop exists between prevent plant and HPO. Prevent plant increases HPO payments. This issue can be addressed by offering insurance contracts that have either prevent plant or HPO, but not both. A partial approach is to limit the circularity by reducing the current cap on HPO payout.

- Prevent plant acre are treated more favorably than planted acres in terms of the approved AHP insurance yield. Options are to calculate APH either by (a) including prevent plant acres at zero yield or (b) excluding yields for acres planted after prevent plant’s first decision day.

- Acknowledge the role marginal decision making plays in farmers’ prevent plant decisions. Using the lowest prevent plant payment among eligible crops on an insured unit would partially implement this proposal.

Data Note

- Planting progress is the percent of a US crop planted as of a date based on responses from local observers. It is available beginning with the 1980 crop from Quick Stats (USDA, NASS (National Agricultural Statistical Service), May 2022). Deviation from trendline yield is calculated using a linear regression and data from Quick Stats. The deviation equals ((harvested yield – trend yield) / trend yield). Corn’s trendline equation for 1980-2021 has an intercept of 93.0 bushels / planted acre with a +1.91 bushel / planted acre annual increase in yield. R2 explanatory power is 80%. Soybean’s trendline equation for 1980-2021 has an intercept of 26.7 bushels / planted acre with a +0.54 bushel / planted acre annual increase in yield. R2 is 87%. Yield is total production divided by acres planted to the crop for a given year. Corn acres planted for grain equals total planted corn acres minus acres harvested for silage. Trend yield is calculated within sample and is not an out-of-sample forecast.

References and Data Sources

Irwin, S. “What Do We Know About the Impact of Late Planting on the U.S. Average Corn Yield?.” farmdoc daily (12):59, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 28, 2022.

Irwin, S. “The Impact of Late Planting on the State Average Yield of Corn in Illinois.” farmdoc daily (12):66, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 9, 2022.

Schnitkey, G., K. Swanson, C. Zulauf, N. Paulson and J. Baltz. “Review of Prevented Plant Decisions for 2022.” farmdoc daily (12):62, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 3, 2022.

Swanson, K., G. Schnitkey, C. Zulauf, J. Coppess and N. Paulson. “Administration Efforts to Incentivize Production due to Ukraine-Russia Conflict.” farmdoc daily (12):67, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 10, 2022.

US Department of Agriculture, National Agricultural Statistical Service. May 2022. QuickStats. http://quickstats.nass.U.S.da.gov/

US Department of Agriculture, Risk Management Agency. November 2018. Establishment of Prevented Planting Coverage Factors for the Federal Crop Insurance Program. https://www.rma.usda.gov/-/media/RMAweb/Publications/Establishment-of-Prevented-Planting-Coverage-Factors-Nov-2018.ashx?la=en

Zulauf, C., G. Schnitkey, K. Swanson, and N. Paulson. May 4, 2022. Prevent Plant and 2022 Acres: A Looming Issue. farmdoc daily (12):63. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. http://www.farmdoc.illinois.edu/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.