A 2022 Review of the Farm Bill: Economic Perspectives on Title I Commodities

Note: This article is based on testimony given before the House Agricultural Committee Subcommittee on General Farm Commodities and Risk Management on June 9, 2022. Full video of the committee hearing can be found here.

Changes in commodity prices related to the ongoing war in Ukraine have implications for current and future US farm policy. Title I commodity programs in the 2018 Farm Bill are an important component of the farm safety net generally used to address the economic consequences of low commodity prices for US farmers over periods longer than the single production cycle covered by crop insurance.

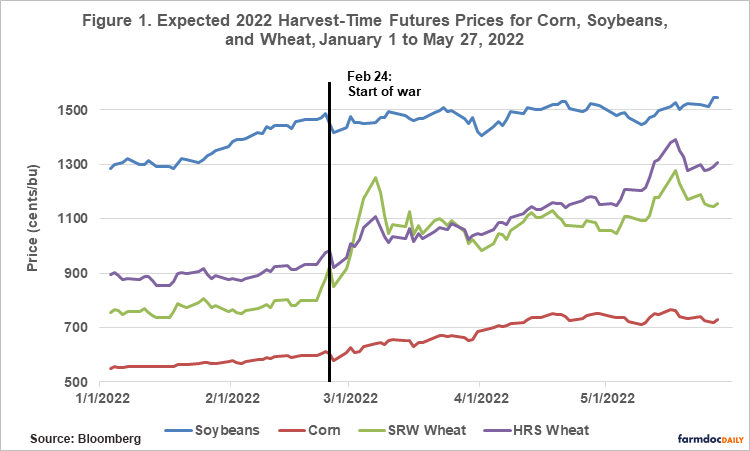

Expectations for commodity prices are an important determinant of the policymaking process. We are currently in a period of high agricultural commodity prices. Since the beginning of 2022, corn, wheat, and soybean prices have increased 20 to 50% from already elevated levels. Supply disruptions due to the Russian invasion of Ukraine are a major cause of this price change, but inventory reductions over the past four years, poor growing season weather in major production regions in the US, South America, and elsewhere, and strong demand from China and other importers are also important contributing factors.

The current market price structure suggests elevated corn, wheat, and soybean prices for the duration of the marketing period for the 2022 crop and lower but still historically elevated prices for the 2023 crop.

US farmers face challenges related to adverse weather and rising costs. However higher prices for corn, soybeans, and wheat are expected to improve profitability for US farmers relative to 2021. For example, University of Illinois crop budgets show expected revenue increases larger than concurrent growth in farm input costs for fertilizer and energy that are also high, in part, as a consequence of the Russian invasion of Ukraine.

Recent policy proposals have included the use of Title I commodity programs to incentivize US farmers to fill the gap in global supply. This is a difficult challenge because Ukraine and Russia are low cost producers of corn, wheat, and other commodities. Commodity supply from Ukraine and Russia can only be replaced with higher cost production from elsewhere.

Experiences under the 2018 Farm Bill offer some lessons for policy responses to the current situation. Since 2018, Title I commodity programs have played a diminished role in the farm safety net relative to ad hoc programs intended to compensate farmers for specific price declines related to the US-China trade war and the coronavirus pandemic that did not trigger payments under existing programs.

This experience suggests there are trade-offs among objectives for US farm policy including decoupling program payments from production to avoid distorting market price incentives, targeting of program payments to specific realized losses, and delivering timely program payments. For example, a rapid, timely policy response to an observed price change is likely to impair targeting of payments to realized losses. For example, the second round of the Coronavirus Food Assistance Program in 2020 compensated farmers for price declines between January and June of that year that only temporarily lowered the expected value of the 2020 crop.

Targeting programs encourage US production when prices are historically high runs counter to the principle that US farm programs should avoid market price distortions by decoupling program payments from production, a principle that was maintained in the ad hoc farm programs developed by USDA. Using Title I or similar programs to increase supply response would also create long-term budget liabilities and the actual impact on production may be small.

In summary, there is a limited role for farm policy, especially Title I commodity programs, to address the consequences of the war in Ukraine for global commodity markets. Current and expected future prices are providing farmers in the US and elsewhere a strong incentive to meet this challenge by increasing production.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.