2023 Crop Budgets: Higher Costs and Lower Returns

The first release of the 2023 Illinois Crop Budgets is available on farmdoc. Costs are projected to increase in 2023 from 2022 levels. At projected cost levels, per bushel prices of $5.30 for corn and $12.75 for soybeans result in marginal profitability, similar to levels experienced from 2014 to 2019. While 2023 is projected to be profitable, risks exist. A decline in commodity price likely would not be associated with similar decreases in cost levels, reducing already narrow margins. Profitability risks will be mitigated over time as input prices are locked in and as projected prices for crop insurance are set in February 2023.

2023 Crop Budgets

Table 1 provides corn and soybean budgets for four regions of Illinois:

- Northern Illinois,

- Central Illinois with high-productivity farmland,

- Central Illinois with low-productivity farmland, and

- Southern Illinois.

More detailed budgets are available here in the management section of farmdoc. Several notes concerning the budgets shown in Table 1 are:

- Yields are set at trend levels for 2023, with trends established through historical yields. Over time, corn yields have increased an average of 2.0 bushels per acre, while soybean yields have increased by .5 bushels per acre.

- Projected prices are $5.30 per bushel for corn and $12.70 for soybeans, near current 2023 fall bids.

- Non-land costs are based on historical expenses on Illinois farms, updated based on current and expected input price levels.

- Land costs are based on projected cash rents.

Farmer returns represent the amount remaining for the farmer after paying all financial costs, with a land charge at the average projected cash rent. The lowest returns are projected for southern Illinois, with farmer returns of -$63 per acre for corn and -$61 per acre for soybean. The highest returns are in central Illinois with high-productivity farmland, with farmer returns of $8 for corn and $43 per acre for soybeans. For all regions of Illinois, the relatively high returns experienced in recent years are projected to end in 2023.

Soybeans are projected to be more profitable in all regions of Illinois (see Table 1). However, the differences in crop returns are relatively small. In northern Illinois, for example, corn is projected to have a -$11 per acre return, while soybeans are projected to have an $11 return, a difference of $22 per acre. Those differences are not likely to change normal rotational decisions.

Cost Increases

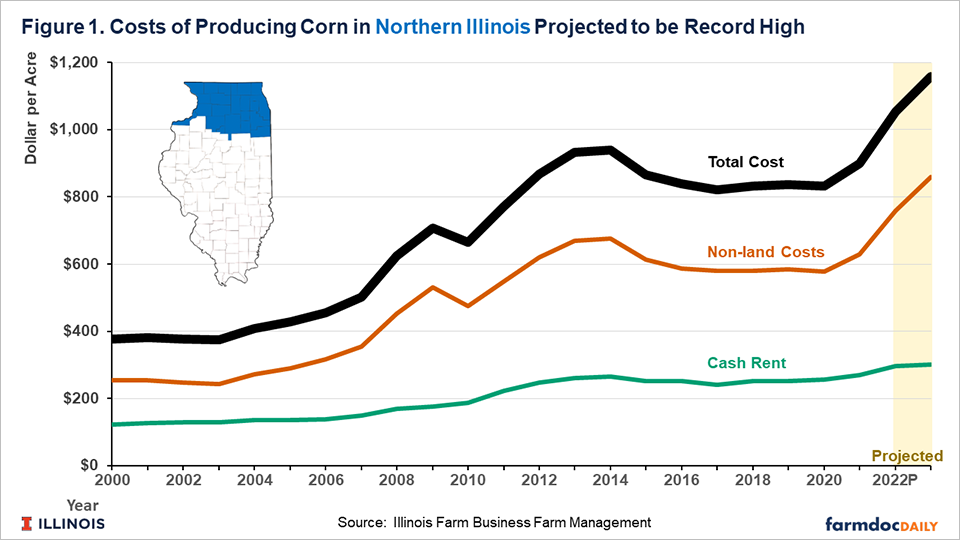

Non-land costs are projected to be higher in 2023 than in 2022, as is illustrated for corn grown in northern Illinois in Figure 1. Non-land costs are projected to be $860 in 2023, up from $758 in 2022. Overall, costs have increased dramatically since 2020, from $577 to $860, an increase of $283 per acre, or a 49% increase.

In northern Illinois, cash rents are projected to increase from $296 per acre up to $301 per acre. While projected returns may not justify an increase in cash rent, relatively high profitability in recent years and continuing high commodity prices likely lead to cash rent increases. Like non-land costs, can rents have increased since 2020, increasing from $256 per acre up to $301 per acre, an increase of $45 per acre, or 18%.

Total costs equal non-land costs and land costs. In 2023, total costs are projected at $1,161 per acre, up from the $1,054 level in 2022. Since 2020, total costs have increased from $833 per acre to $1,161, an increase of $328 per acre, or 39%.

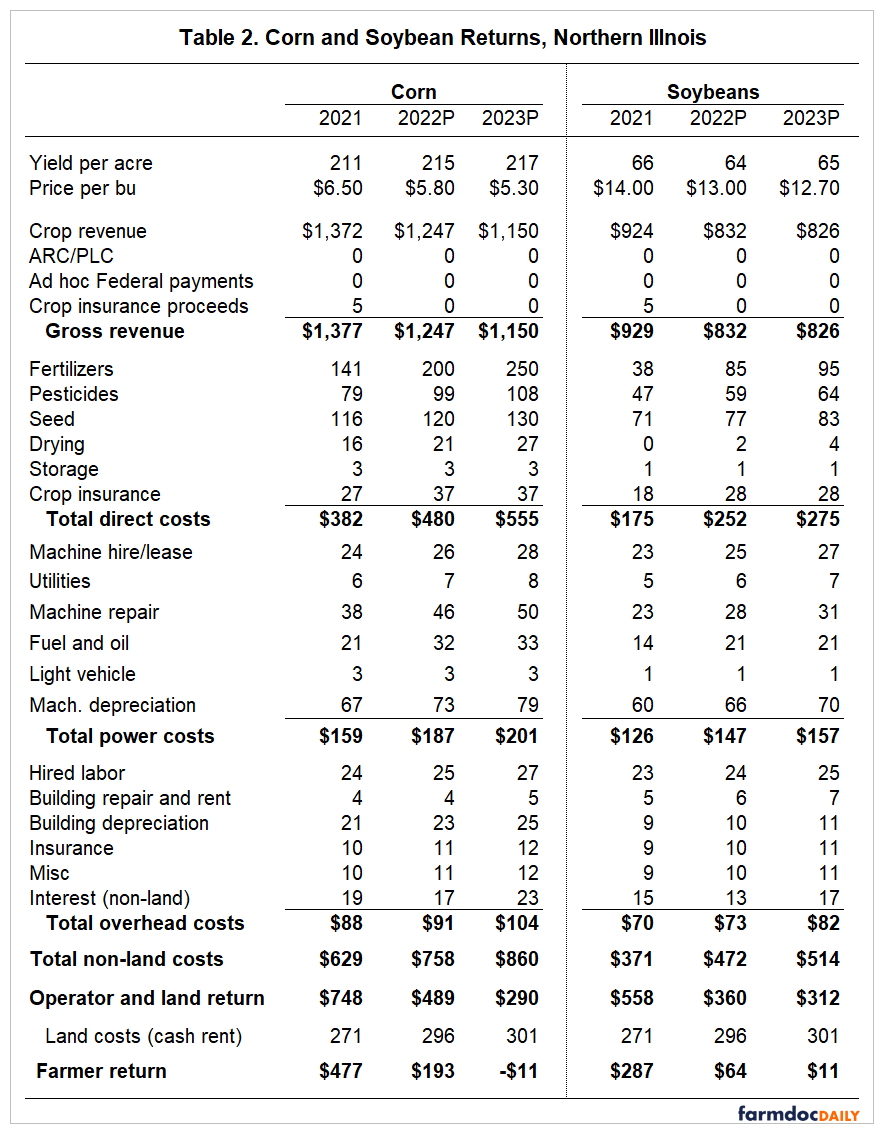

Table 2 shows actual results for northern Illinois for 2021, along with projections for 2022 and 2023. As shown in Table 2, most costs are projected to increase. Inflation is prevalent across the entire U.S. economy. Interest rates, energy prices, and wage rates continue to increase, and supply issues that began in Covid have not been resolved. The Ukraine-Russia war has further clouded the outlook and worsened supply chain issues.

We are projecting higher fertilizer costs in 2023. While fertilizer prices have declined recently (see farmdoc daily, July 19, 2022), fertilizer prices are still much higher than last year. Many farmers purchased fertilizer for 2022 before much of the price increase in fall and early winter of 2021. Opportunities to price at those levels do not exist currently.

Given higher costs, break-even levels will be much higher. For northern Illinois, the break-even corn price is $5.34 per bushel on cash rented land. The break-even soybean price is $12.54. Those break-even price are above average prices received from 2014 to 2019: $3.66 per bushel for corn and $9.69 for soybeans.

Farmer Returns

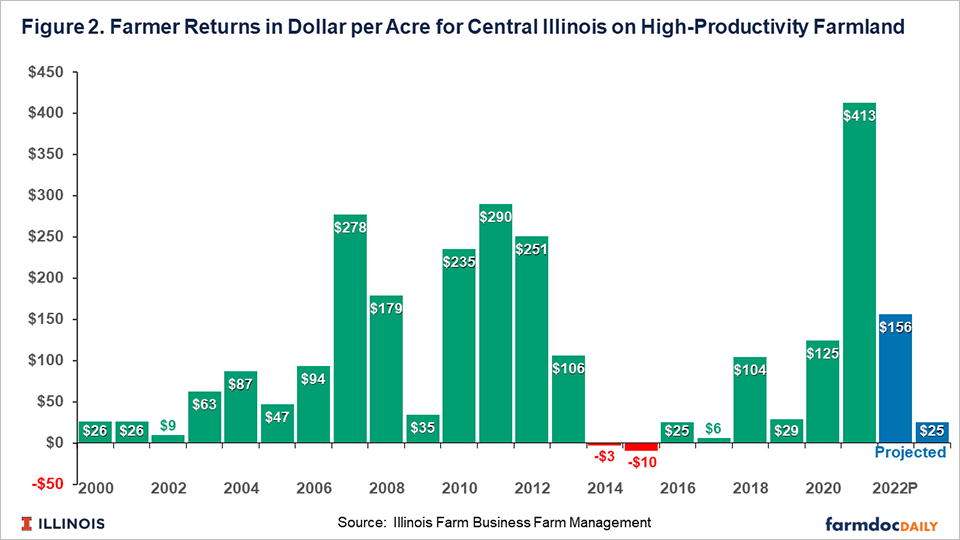

Farmer returns are projected to be lower for 2023, as is illustrated in Figure 2, which shows farmer returns for central Illinois farmland with high productivity farmland. These returns are for a typical 50% corn and 50% soybean rotation in central Illinois. In 2023, farmer returns are projected at $25 per acre, well below levels for 2020 to 2022, when farmer returns averaged $232 per acre. The 2023 farmer return is projected to be close to the average from 2013 to 2019 when the return averaged $29 per acre. The lower projected profits in 2023 result from much higher costs and projected lower commodity prices than 2021 and 2022. While commodity prices are projected lower, those prices still are not low by historical standards. A projected $5.30 corn price for 2023 compares to a $3.66 price from 2014 to 2019. Similarly, a projected 2014 soybean price of $12.70 compares to an average price of $9.69 from 2014 to 2019.

Commentary

Projections are for a return to much lower profits in 2023, continuing a pattern of rising and falling farm incomes. Periods of high net incomes are following by less profitable periods which often persists for several years.

Obviously, risks of lower returns exist. For 2023, much higher prices than average historical prices are needed to maintain some profitability. Lower commodity prices are possible from any number of causes. History suggests that low prices would not lead quickly to lower costs, as costs typically exhibit lags in adjustments. Risks will exist throughout the autumn as many decisions concerning 2023 production are made, and input prices are locked in. A safety net under revenue will be established when projected prices for crop insurance are determined in February 2023. Until that point, the risks of low returns from price declines will be large.

Documents on farmdoc

More details on 2023 budgets are available in the management section of farmdoc through two documents:

- 2023 Crop Budgets give more detail on four crop combinations: 1) Corn-after-corn, 2) corn-after-soybeans, 3) soybeans-after-corn, and 4) soybeans-after-soybeans, and 4) wheat. Double-crop soybeans budgets are given for central and southern Illinois regions.

- Revenue and Costs for Illinois Grain Crops shows historical returns and costs for crops by region. Historical values are given for the years from 2016 to 2021, and projections are given for 2022 and 2023.

References

Schnitkey, G. and K. Swanson. “Illinois Crop Budgets, 2023.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2022.

Schnitkey, G. and K. Swanson. “Revenue and Costs for Illinois Grain Crops, Actual for 2015 through 2021, Projected 2022.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2022.

Schnitkey, G., K. Swanson, N. Paulson, C. Zulauf, J. Coppess and J. Baltz. "Nitrogen Fertilizer Outlook for 2023 Decisions." farmdoc daily (12):106, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 19, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.