Reviewing the Debt Limit Deal

Closing out the month of May and rapidly approaching the default deadline, the House of Representatives passed legislation embodying a deal between House Speaker McCarthy and President Biden to suspend the debt limit and institute spending reductions; the vote was 314 to 117 (4 not voting), of which 149 Republicans and 165 Democrats voted for it and 71 Republicans and 46 Democrats voted against it (each caucus had 2 Representatives not voting) (Carney, May 31, 2023; Edmondson, May 31, 2023; Sotomayor, Kane and Siegel, May 31, 2023; Roll Call 243). The Speaker and the President had announced an agreement in principle on Saturday (Carney, Haberkorn, Beavers and Emma, May 27, 2023). Legislative text that incorporated the debt limit deal was introduced on May 29, 2023, titled the “Fiscal Responsibility Act of 2023” (H.R. 3746). The House Rules Committee reported a closed rule for considering the legislation on the floor (House Rules Committee, H. Res. 456; Tully-McManus et al., May 30, 2023). The Congressional Budget Office (CBO) released its estimate of the budgetary effects of the legislation on May 30, 2023 (CBO, May 30, 2023). This article reviews the debt limit legislation.

(1) Suspends the Debt Limit

The topline and most critical provision in the bill is the last: Division D, Sec. 410 of the bill suspends the federal debt limit through January 1, 2025. A notable technical matter is that the debt limit is not increased by a specific amount as has often been done in the past, but rather that the debt limit as a restriction on federal borrowing is suspended until 2025. This means that Treasury can borrow whatever amounts are necessary through that date and when the debt limit suspension ends, the new debt limit is established based on what has been borrowed. (i.e., the total debt on that date). The one exception is that Treasury cannot borrow to create a cash reserve. In other words, this is not an increase in the debt limit but a suspension of its application.

(2) Caps Discretionary Spending

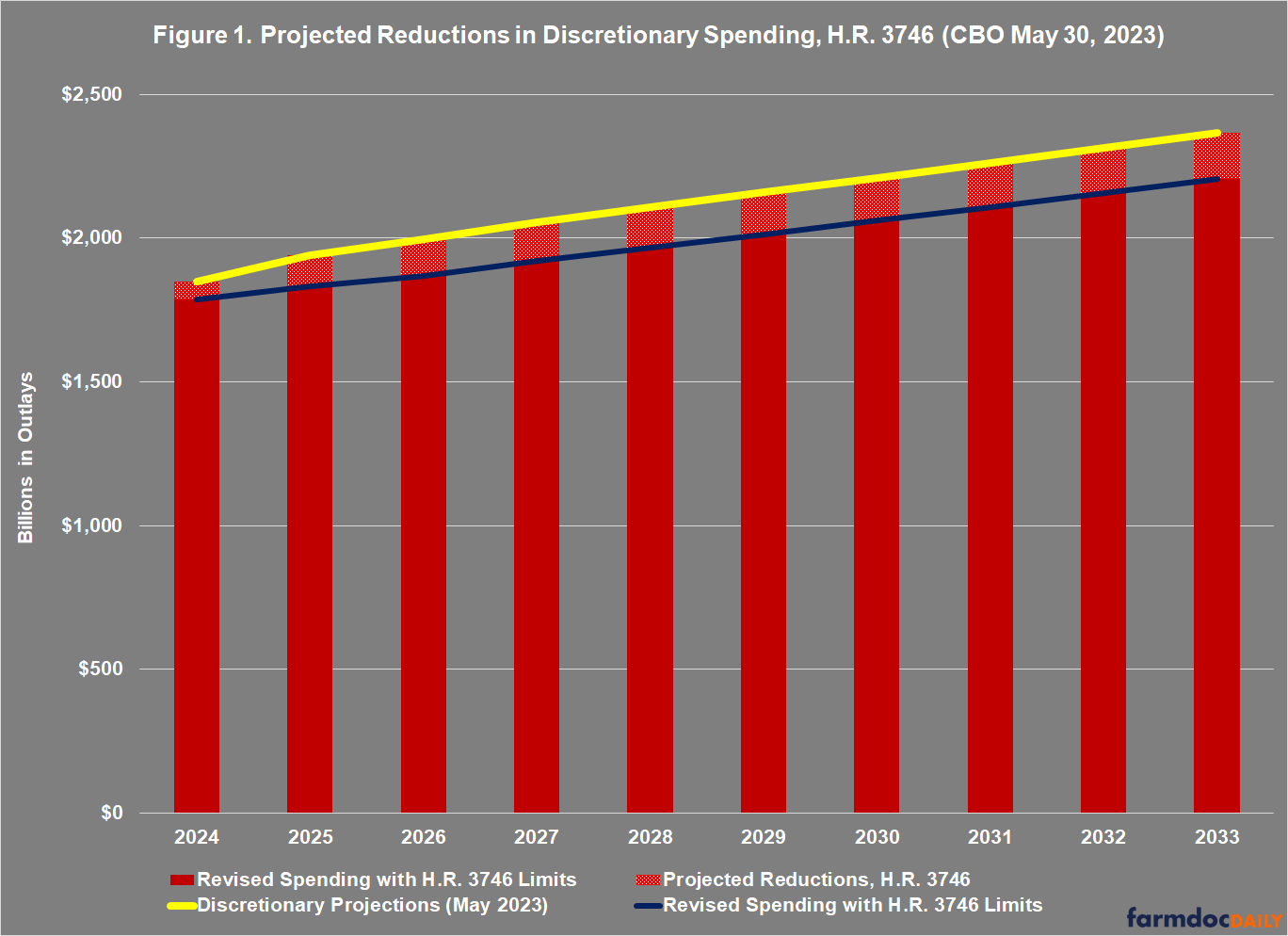

To reduce spending, the bill institutes caps on discretionary spending for fiscal years (FY) 2024 and 2025 in Division A, Title I. Discretionary spending involves the annual appropriations bills that Congress is to enact to fund the federal government as well as programs without mandatory spending. In a farm bill context, discretionary spending funds authorized programs in rural development, agricultural research, farm loans, and similar programs; the programs with mandatory spending, by comparison, include farm payment programs (Title I, commodities), conservation (Title II), and the Supplemental Nutrition Assistance Program (SNAP, Title IV), and are not impacted by these caps (see e.g., Johnson and Monke, CRS IF12047, February 22, 2023). Discretionary spending also includes military and defense appropriations and, in total, it constitutes about a quarter of all federal outlays each FY (see e.g., farmdoc daily, May 25, 2023). According to CBO’s updated projections in May, total defense outlays constitute roughly 45% of total discretionary spending; thus, the spending caps in the debt limit deal address on average 14% of total federal spending (CBO, May 2023).

CBO reported two caps on discretionary spending. First, for FY 2024 and 2025 the legislation would enforce statutory caps through sequestration. For FY 2026 through FY 2029, the legislation would enforce limits on discretionary funding using existing Congressional budget and appropriations procedures. In total, CBO projects these limits to reduce spending by $1.3 trillion from FY 2024-2033. Figure 1 illustrates the expected decreases in discretionary spending.

(3) Suspends Unobligated Balances from Covid Relief

Division B of the legislation rescinds unobligated funds previously appropriated by Congress, much of it in response to the Covid-19 pandemic. CBO estimated that the total rescissions in H.R. 3746 will save $11 billion from FY 2023 to FY 2027. These include some appropriated funds to USDA for Covid relief efforts in the Consolidated Appropriations Act of 2021 (P.L. 116-260) and the American Rescue Plan Act of 2021 (P.L. 117-2). Some of the rescissions apply to the $47 million appropriated to the Secretary’s office for a variety of programs, as well as a total of approximately $10 million appropriated for various other pilot programs or initiatives. Of note, USDA recently announced yet another ad hoc relief program, the Pandemic Assistance Revenue Program (PARP) that uses funds from the Consolidated Appropriations Act of 2021 to pay farmers who suffered an eligible revenue loss in calendar year 2020 due to the pandemic (88 C.F.R. 1862; USDA, farmers.gov: Pandemic Assistance Revenue Program). PARP offers an interesting case study: because the regulation has been published and farmers can sign up for it, the funds would be presumed to have been obligated and the rescission would not impact the payments. USDA estimated the gross estimated outlays for FY 2023 from PARP at $2.7 billion and if there is an impact from the rescission it might be to any spending above this estimate, but USDA needs to clarify if and how rescission would impact the payments.

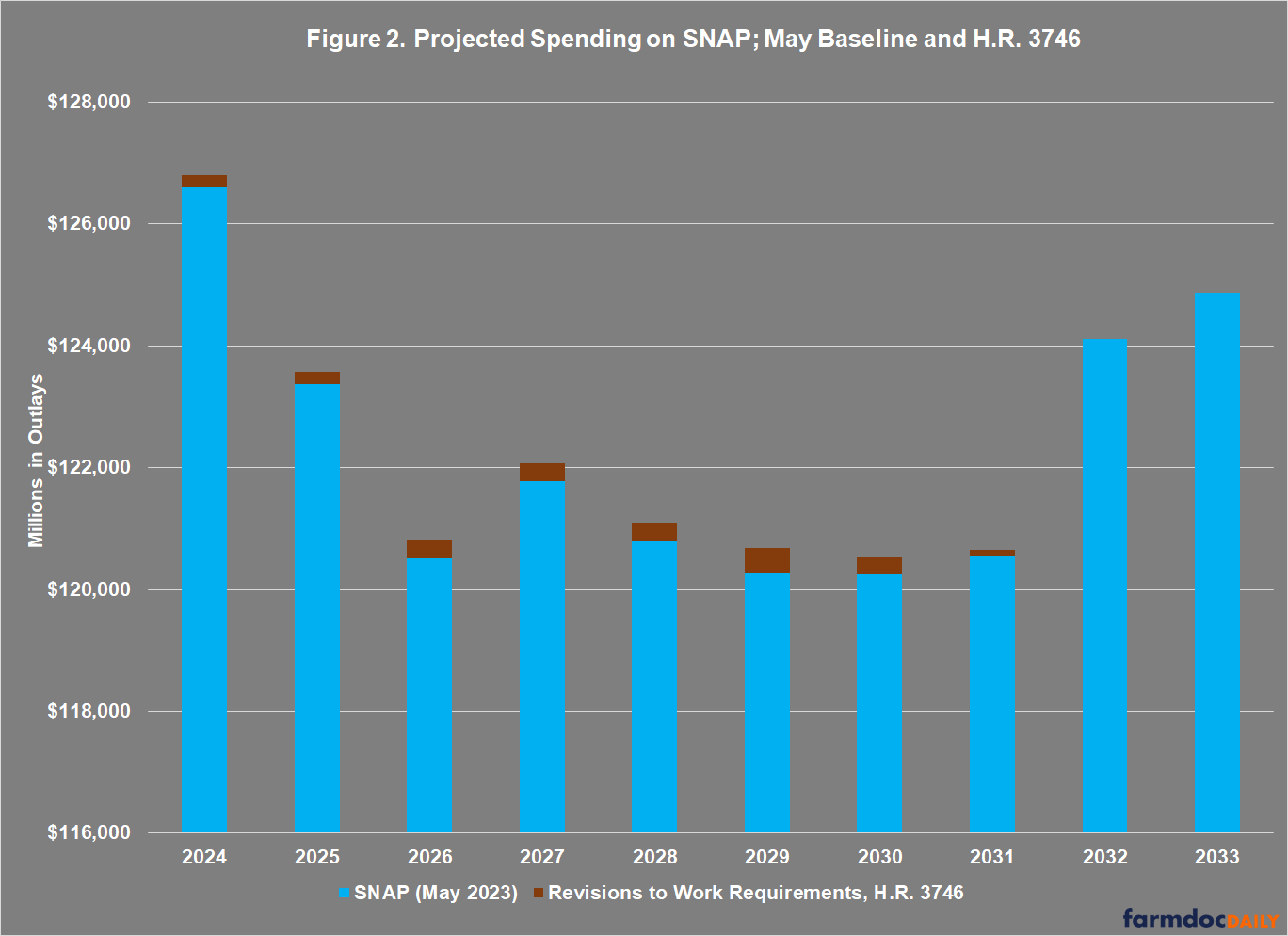

(4) Work Requirements for TANF and SNAP

H.R 3746 also includes revisions to existing work requirements for low-income assistance programs: Temporary Assistance for Needy Families (TANF) and Supplemental Nutrition Assistance Program (SNAP). SNAP is reauthorized in a farm bill and is revised by Division C, Title II. First, the legislation increases the age through which able-bodied adults without dependents must comply with work requirements, moving it to 51 years of age in FY 2023, to 53 years in FY 2024 and 55 years in FY 2025. The legislation, however, revises the work requirements so that they do not apply to homeless individuals, veterans or those under 24 who were in foster care. Notably, CBO estimates that these changes will increase spending on SNAP benefits by $2.1 billion over FY 2023 to FY 2033. Figure 2 illustrates the projected changes in spending for SNAP based on the revisions to work requirements in H.R. 3746.

(5) Other Provisions of the Legislation

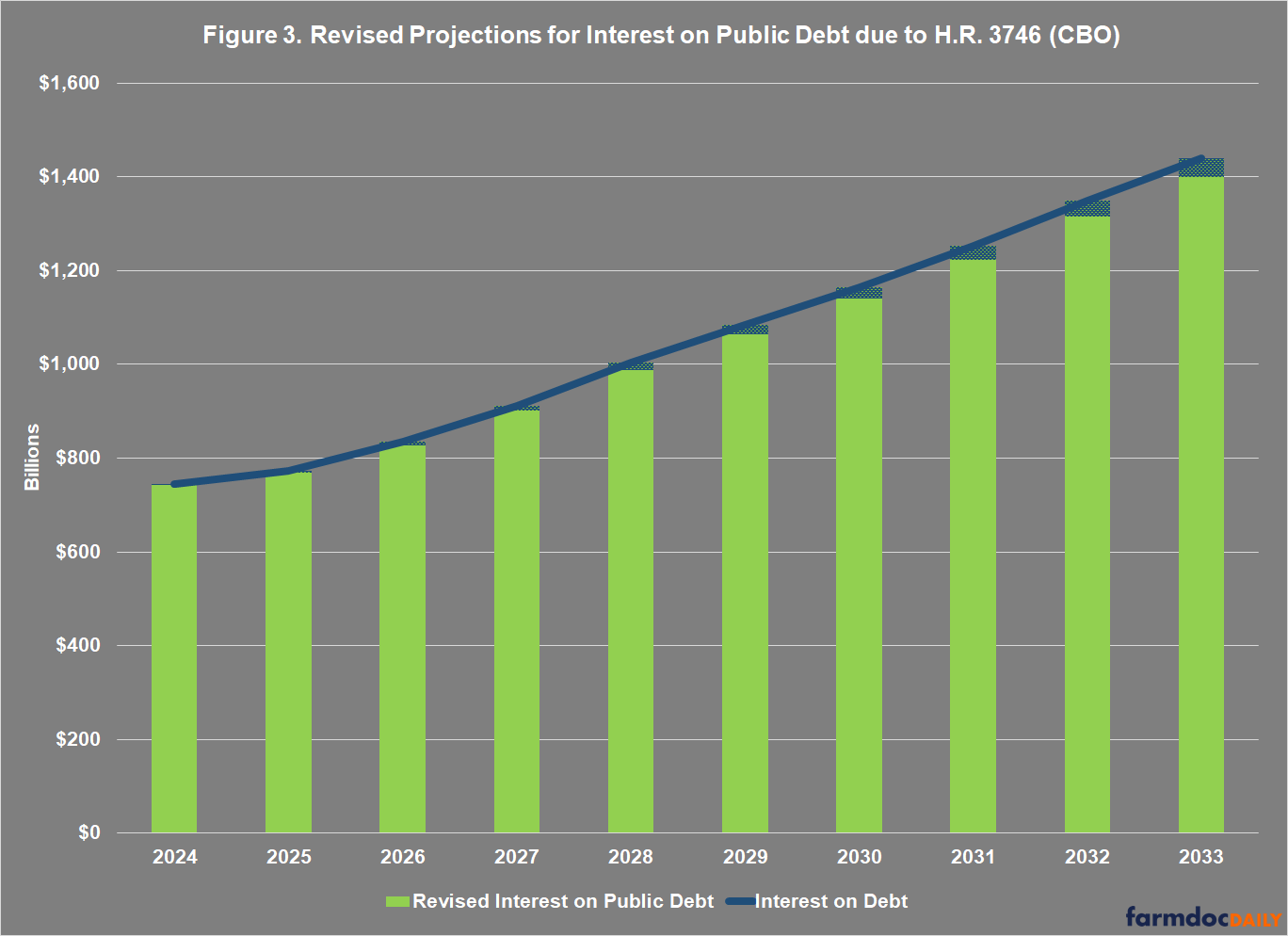

Division B, Title II, rescinds $1.4 billion in funds appropriated to the Internal Revenue Service by the Inflation Reduction Act of 2022 (P.L. 117-169) and Title IV terminates the suspension of payments for federal student loans, while also requiring resumption of the accrual of interest and collections. CBO projects that the reduction in funding for IRS will reduce revenues by $2.3 billion over 10 years, at a net cost of $900 million. Division C, Title III includes permitting reforms under the National Environmental Policy Act of 1969 (NEPA) for energy projects. Finally, CBO projects that the changes will reduce spending on interest on the public debt by a total of $188 billion in FY 2023 to FY 2033. Figure 3 illustrates the proposed changes to the costs of interest for the debt due to the changes by H.R. 3746.

Previously, CBO projected that the federal debt held by the public will approach $26 billion in fiscal year 2023, with annual deficits each fiscal year that climb from $1.5 trillion in FY 2024 to $2.7 trillion in FY 2033. CBO estimated that the changes contained in H.R. 3746, if enacted into law and not changed during those ten fiscal years, will reduce federal deficits by $1.5 trillion. In FY 2033, CBO previously projected that the federal debt will be $46.7 trillion; the debt limit bill is projected to reduce that total debt to $45.2 trillion. Figure 4 illustrates CBO’s projected changes in annual budget deficits through FY 2033.

Concluding Thoughts

The political stand-off over the debt limit that threatened a catastrophic federal default appears to be ending as the House has passed legislation to suspend the debt limit and reduce some spending; as of this writing, the legislation awaits action by the Senate but the large bipartisan vote in the House provides some degree of confidence that it will pass the upper chamber as well. CBO estimated that the final deal could reduce federal deficits by $1.5 trillion over ten fiscal years. It is difficult to assess this outcome. If the glass is half full, the U.S. has avoided a self-inflicted catastrophe with relatively little pain. If nothing changes for the next 10 years (and five Congresses), moreover, then the deal will modestly reduce deficits and the federal debt. If the glass is half empty, the threat to the full faith and credit of the United States achieved very little other than political theatre. If annual deficits and the federal debt are of real concern and need to be addressed, the entire episode demonstrated the extent to which federal budget policy has completely failed and is ineffective at best. As a Nation and a system of self-government, we are approaching 50 years operating under this particular experiment but continue achieving very little. This latest episode raises more (and increasingly difficult) questions than it answers and should catalyze serious examination of these challenging matters (see e.g., Klein, May 31, 2023). It is exceedingly difficult, however, to extract positive lessons from the murk of cynicism the entire effort has generated.

References

Carney, Jordain. “House passes bipartisan debt deal, sending it to Senate.” Politico.com, May 31, 2023, https://www.politico.com/news/2023/05/31/house-debt-ceiling-vote-00099573.

Carney, Jordain, Jennifer Haberkorn, Olivia Beavers, and Caitlin Emma. “McCarthy and Biden reach agreement in principle on debt limit.” Politico.com, May 27, 2023, https://www.politico.com/news/2023/05/27/mccarthy-and-biden-reach-agreement-in-principle-on-debt-limit-00099107.

Congressional Budget Office. “An Update to the Budget Outlook: May 2023 to 20233.” Report, May 12, 2023, https://www.cbo.gov/publication/59096.

Congressional Budget Office. “CBO’s Estimate of the Budgetary Effects of H.R. 3746, the Fiscal Responsibility Act of 2023,” May 30, 2023, https://www.cbo.gov/publication/59225.

Edmondson, Catie. “House Passes Debt Limit Bill in Bipartisan Vote to Avert Default.” The New York Times, May 31, 2023, https://www.nytimes.com/2023/05/31/us/politics/debt-ceiling-house-vote.html.

Johnson, Renée and Jim Monke. “Farm Bill Primer: What Is the Farm Bill?” Congressional Research Service, CRS In Focus IF12047, updated February 22, 2023, https://crsreports.congress.gov/product/pdf/download/IF/IF12047/IF12047.pdf/.

Klein, Ezra. “We May Be About to Find Out How This Republican Party Really Works.” The New York Times, Opinion, May 31, 2023, https://www.nytimes.com/2023/05/31/opinion/biden-mccarthy-debt-ceiling-deal.html.

Sotomayor, Marianna, Paul Kane, and Rachel Siegel. “Debt ceiling bill passes House, moves to Senate as deadline nears.” The Washington Post, May 31, 2023, https://www.washingtonpost.com/business/2023/05/31/debt-ceiling-deal-house-vote-bill/.

Tully-McManus, Katherine, Sarah Ferris, Jordain Carney and Nicholas Wu. “McCarthy overcomes Rules rebellion over debt deal.” Politico.com, May 30, 2023, https://www.politico.com/news/2023/05/30/debt-ceiling-deal-house-rules-committee-republicans-00099245.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.