Measuring Farm Policy, Part 5: Reviewing Assistance for the Major Program Crops

Etymologically, the month now closing likely got its name from the Latin word for “to open” (aperio) and possibly in reference the opening of flowers in the spring (Boeckman, April 9, 2024; Boeckman, January 17, 2024). Much American history has unfolded in April, from George Washington’s inauguration as America’s first president (April 30, 1789), to General Robert E. Lee’s surrender to General U.S. Grant at Appomattox (April 9, 1865), followed by the tragic assassination of President Abraham Lincoln (April 14, 1865). The month’s history also carries the awful assassination of the Rev. Dr. Martin Luther King, Jr. (April 4, 1968) and the death of President Franklin D. Roosevelt (April 12, 1945). The Library of Congress was established in April (April 24, 1800). Maybe fittingly, William Shakespeare was also born in this at-times tempestuous month (April 23, 1564). All history aside, this April appears unlikely to witness the opening of the Farm Bill’s reauthorization process but it could be just around the corner (Farm Policy News, April 19, 2024; Abbott, April 22, 2024; Yarrow, April 22, 2024). In continued anticipation, this article continues the series measuring farm policy with a review of the assistance to the major program crops from both the farm payment programs and crop insurance (see e.g., farmdoc daily, April 4, 2024).

Background

The Congressional Research Service (CRS) defines the “farm safety net” as a “collection of programs administered by the U.S. Department of Agriculture (USDA) that provide risk protection and income support to farmers” in three categories: (1) crop insurance; (2) permanent disaster assistance programs; and (3) income supporting commodities programs (Rosch, September 22, 2022). This broad definition covers very different program authorizations and policy designs. For example, crop insurance is available for hundreds of crops, livestock, poultry, dairy, rainfall for pasture and rangeland, and even oysters. Farmers can purchase different levels of coverage and a variety of different policies, as well as endorsements on policies (see e.g., Post-Application Coverage Endorsement (PACE)). By comparison, the income supporting commodities programs or farm payment programs are available only to farmers with base acres of a subset of 23 crops, known as “covered commodities” or program crops, as well as dairy farmers (7 U.S.C. §9011; USDA-FSA, ARC/PLC Definitions). The two primary programs are the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs. Finally, Congress has also authorized a suite of permanent or standing disaster programs that includes the Noninsured Crop Disaster Assistance Program (NAP), the Tree Assistance Program (TAP), the Livestock Indemnity Program (LIP), the Livestock Forage Disaster Program (LFP), and the Emergency Assistance for Livestock, Honey Bees, and Farm-Raised Fish Program (ELAP) (7 U.S.C. §7333 and §9081).

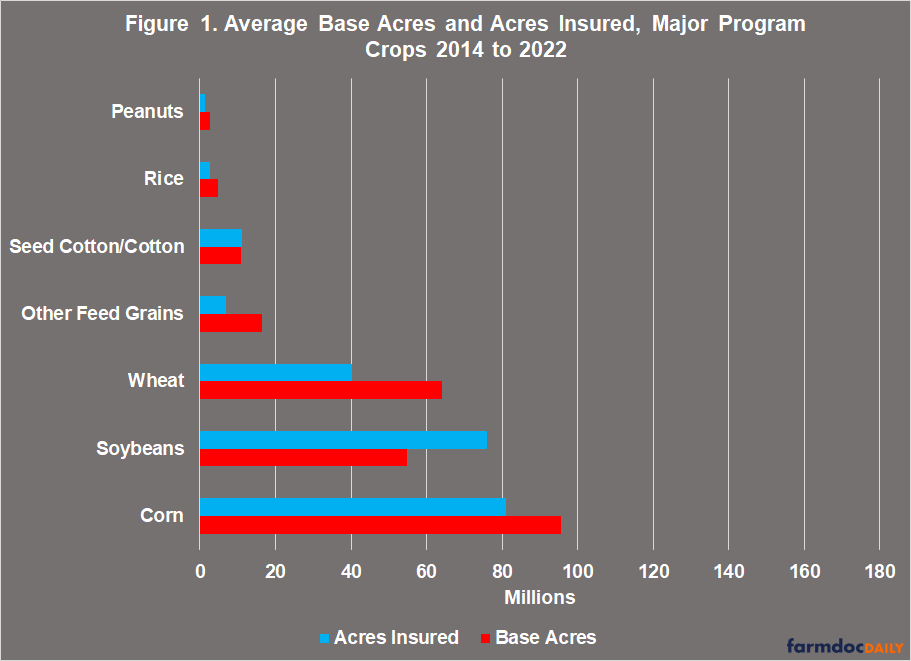

Note that conservation is missing from the definition of the farm safety net. This is not the fault of the CRS messenger, but more a reflection of much political reality. Conservation constitutes roughly one-third of the total direct assistance to farmers from the Farm Bill but is often left out of farm risk deliberations. In keeping with this arguably unfortunate common practice, the discussion below will review the total assistance to farmers from crop insurance indemnities and from ARC and PLC payments; it may shed some light on the reasons. In addition, this review is limited to the major program crops: corn, soybeans, wheat, other feed grains (sorghum, oats, and barley), cotton (seed cotton for ARC/PLC), rice, and peanuts. Figure 1 illustrates the average acres insured and average base acres for these crops from 2014 to 2022 as reported by USDA’s Farm Service Agency (FSA) and Risk Management Agency (RMA) (USDA-FSA, ARC/PLC Program Data; USDA-RMA, Summary of Business).

Discussion

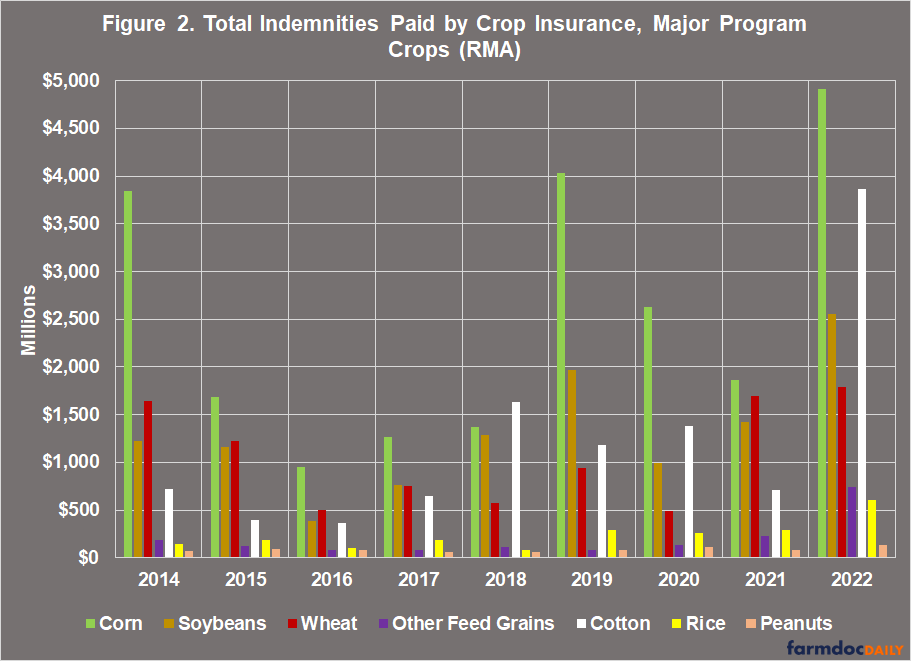

This discussion begins with the total indemnities paid to farmers of the major program crops by the federal crop insurance program. Importantly, crop insurance is most closely connected to the actual risks of farm production and farmers purchase crop insurance policies, although a portion of the premium is subsidized by the federal government. If the insured crop suffers an approved loss (e.g., caused by natural events) in an amount exceeding the deductible range of the policy, the farmer receives an indemnity on the covered loss. Indemnities are used in this discussion to measure the assistance to farmers, but the net farmer benefits provide another method for evaluating crop insurance assistance. Net farmer benefits equal total indemnities minus the portion of the premium paid by the farmer (see, Policy Design Lab; farmdoc daily, September 7, 2023). Figure 2 graphs the total indemnities paid by crop insurance for the major program crops each year from 2014 to 2022. Overall, farmers with insurance policies on these crops received $59.5 billion in total indemnities.

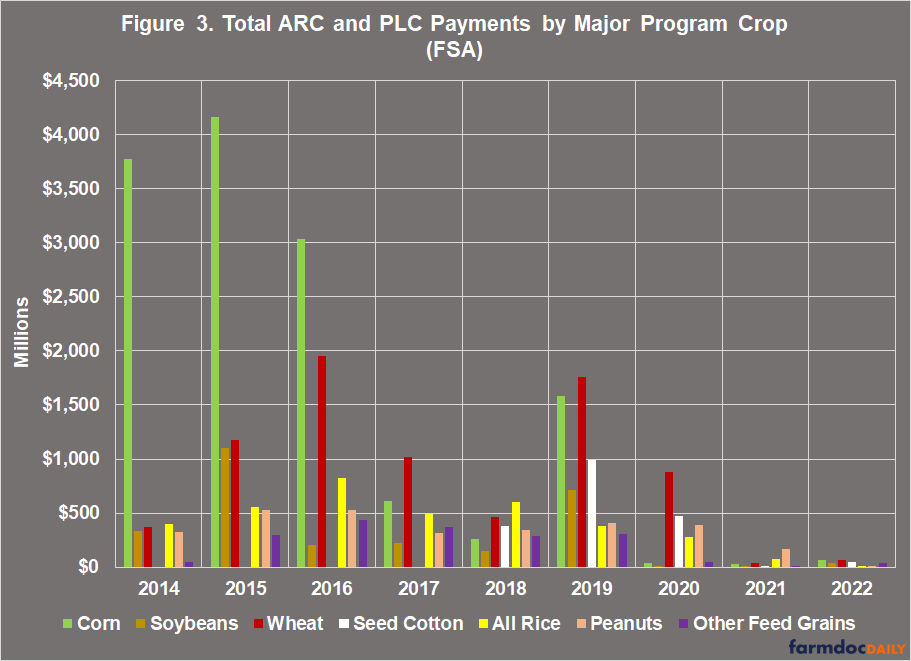

Farmers with base acres of these crops could also have received payments from ARC or PLC if the base acres were enrolled in one of the programs. These programs provide additional income to farmers who enroll base acres but are far less connected to actual production risks for the crops or the farmers. For one, the payments are made on base acres not acres planted and are decoupled from production. For another, payments are made a year after the crop was harvested. While they do not directly overlap with crop insurance indemnities, these payments go to many of the same farmers as the crop insurance indemnities for these crops. In effect, these payments supplement the risk management provided by crop insurance and can further pad the farm safety net. Figure 3 charts the total ARC/PLC payments by major program crop for the years 2014 to 2022. In total, farmers with base acres in these crops received $34.5 billion in payments from ARC and PLC in these years.

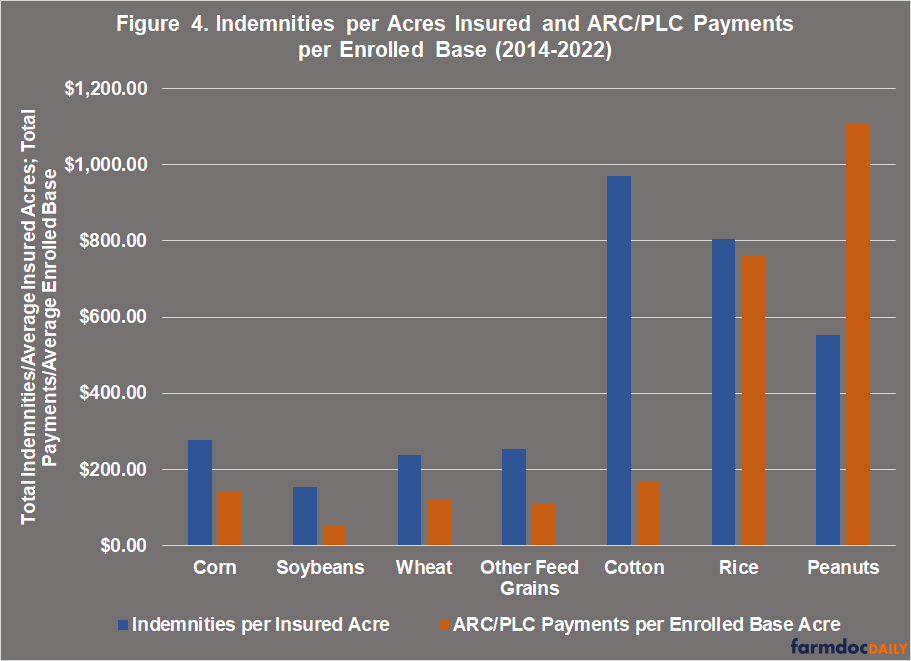

The differences in these two components of the farm safety net are notable. ARC and PLC payments have largely phased out in 2021 and 2022 due to high crop prices and strong farm revenues. Crop insurance indemnities, however, were at the highest levels for each of the major program crops in 2022, and cotton indemnities were nearly three times as much as the next highest year. Importantly, the policy-relevant acres differ significantly—base acres and acres insured—as illustrated in Figure 1. Figure 4 adds a measure of the policies by dividing the total indemnities by the average acres insured for 2014 to 2022 and the total ARC/PLC payments by the average base acres enrolled in those years; because farmers generally insure the same acres each year and enroll the same base acres, Figure 4 offers a perspective on the program or policy value of those acres.

Finally, Figure 5 reports the total assistance by State for the major program crops in a map that includes the total indemnities and the total ARC/PLC payments received from 2014 to 2022. There is no avoiding the obvious: Texas is the outlier with over $14 billion in total assistance (15% of the total), nearly double the next highest state (North Dakota, $7.6 billion). Testing this against crop insurance experience in recent years, over 15% ($6 billion) of all indemnities paid out for these crops since 2020 have been made for cotton in Texas. To the extent this is a harbinger, it is concerning. It may also have significant implications for a program required to be actuarially sound (farmdoc daily, April 11, 2024).

Concluding Thoughts

Measure after measure turns up striking imbalances in American farm policy. While not explored in this discussion, the imbalances arguably begin with underinvesting in conservation and may provide reasons for it (see e.g., farmdoc daily, September 28, 2023; October 12, 2023). The degree to which this underinvestment is the result of narrow, single dimensional concepts of farm risk and conservation is a topic to be explored further. Likely more politically salient are the imbalances in payments among farmers, which favor farmers with historic base acres of the three southern crops but often plant other crops on those base acres (see e.g., farmdoc daily, August 3, 2023; November 30, 2023). Potentially more concerning, however, are those in crop insurance, a program for which imbalances are presumed to be corrected in some form or fashion over time. Reauthorizing a farm bill does offer the potential for course corrections and rebalancing, but often does not. Those who benefit most from existing imbalances would be expected to be the most resistant to opening any process that could lead to better balanced outcomes. As the month of April closes without opening the Farm Bill reauthorization effort, taking the measure of current farm policy sheds light on what may be balanced against it.

References

Abbott, Chuck. “GOP-written farm bill is headed for House defeat, says senior Democrat.” Successful Farming. April 22, 2024. https://www.agriculture.com/gop-written-farm-bill-is-headed-for-house-defeat-says-senior-democrat-8636736.

Coppess, J. "A View of the Farm Bill Through Policy Design, Part 5: Crop Insurance." farmdoc daily (13):162, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 7, 2023.

Coppess, J. "Farm Bill 2023: NRCS Backlogs and the Conservation Bardo." farmdoc daily (13):177, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 28, 2023.

Coppess, J. "Farm Bill 2023: Planted Acres and Additional Pieces of the Base Acres Puzzle." farmdoc daily (13):143, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 3, 2023.

Coppess, J. "The Incredible Shrinking of the Conservation Stewardship Program." farmdoc daily (13):187, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 12, 2023.

Coppess, J. and J. Hutchins. "Farm Policy and the Brief Saga of Soybeans, Part 1." farmdoc daily (13):217, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 30, 2023.

Coppess, J., G. Schnitkey, B. Sherrick, N. Paulson and I. Flores. "The Dilemma of Actuarial Soundness, A Legislative History." farmdoc daily (14):70, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 11, 2024.

Hanrahan, Ryan. “Farm Bill Draft Expected by Memorial Day.” Farm Policy News. April 19, 2024. https://farmpolicynews.illinois.edu/2024/04/farm-bill-draft-expected-by-memorial-day/.

Rosch, Stephanie. “Farm Bill Primer: Farm Safety Net Programs.” Congressional Research Service, In Focus. September 22, 2022. https://crsreports.congress.gov/product/pdf/download/IF/IF12218/IF12218.pdf/.

Yarrow, Grace. “Lawmakers press Mexico to deliver on water treaty.” Politico.com. April 22, 2024. https://www.politico.com/newsletters/weekly-agriculture/2024/04/22/lawmakers-press-mexico-to-deliver-on-water-treaty-00153547.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.