Crop Insurance as a Payment Program

Given Federal premium subsidies, crop insurance will provide payments to farmers that exceed the premiums they pay. Payments to farmers have increased over time as premium subsidies have increased. This article examines crop insurance as a payment program. It uses data for barley, corn, cotton, grain sorghum, oats, peanuts, rice, soybeans, and wheat for the 1989-2023 crop years from USDA, RMA’s (US Department of Agriculture, Risk Management Agency) Summary of Business. Premium subsidies are used to measure long-term expected payments to farmers. Premium subsidies have increased notably in dollars per acre and relative to production cost. The variation across crops has also widened notably, underscoring the role of crop insurance as a payment program.

Premium Subsidy

Given the assumption that crop insurance premiums are rated so that total premiums equal payments, the premium subsidy is a measure of the long-term payments farmers can expect to receive from crop insurance. In short, it is the part of the premium farmers do not pay. Premium subsidies also are a cost to taxpayers of the crop insurance program.

Using premium subsidy instead of net farm indemnity (indemnity paid by insurance minus premium paid by farmers) avoids the confounding factor that indemnity paid may reflect short-term aberrations, including weather, that are not representative of the future. To further smooth out year-to-year variations, 10-year averages are used. We note that loss ratios vary across crops reflecting in part that net indemnity vary from premium subsidy for a crop.

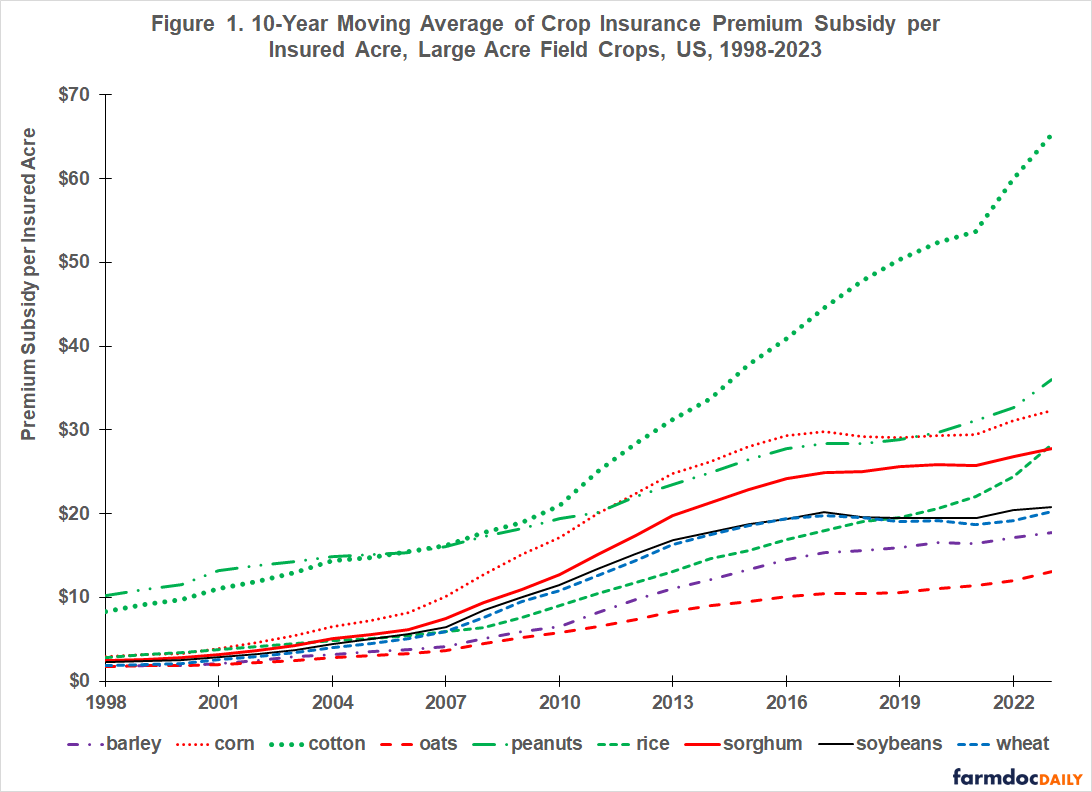

Subsidy per Insured Acre

In 1998, the 10-year average of premium subsidy per primary insured acre ranged from $2 for barley, oats, sorghum, soybeans, and wheat to $10 for peanuts (see Figure 1 and Data Note 1). In 2023, the range was $13 for oats to $65 for cotton. Not only was the premium subsidy per acre notably higher in 2023 for all the crops in Figure 1, but the range from low to high subsidy per acre was also notably wider. The spread between the high and low values was $52 in 2023 ($65 -$13) vs. $8 in 1998 ($10 – $2%). Even excluding cotton, the spread in 2023 was $23 ($36 (peanuts) – $13), almost triple the $8 spread in 1998.

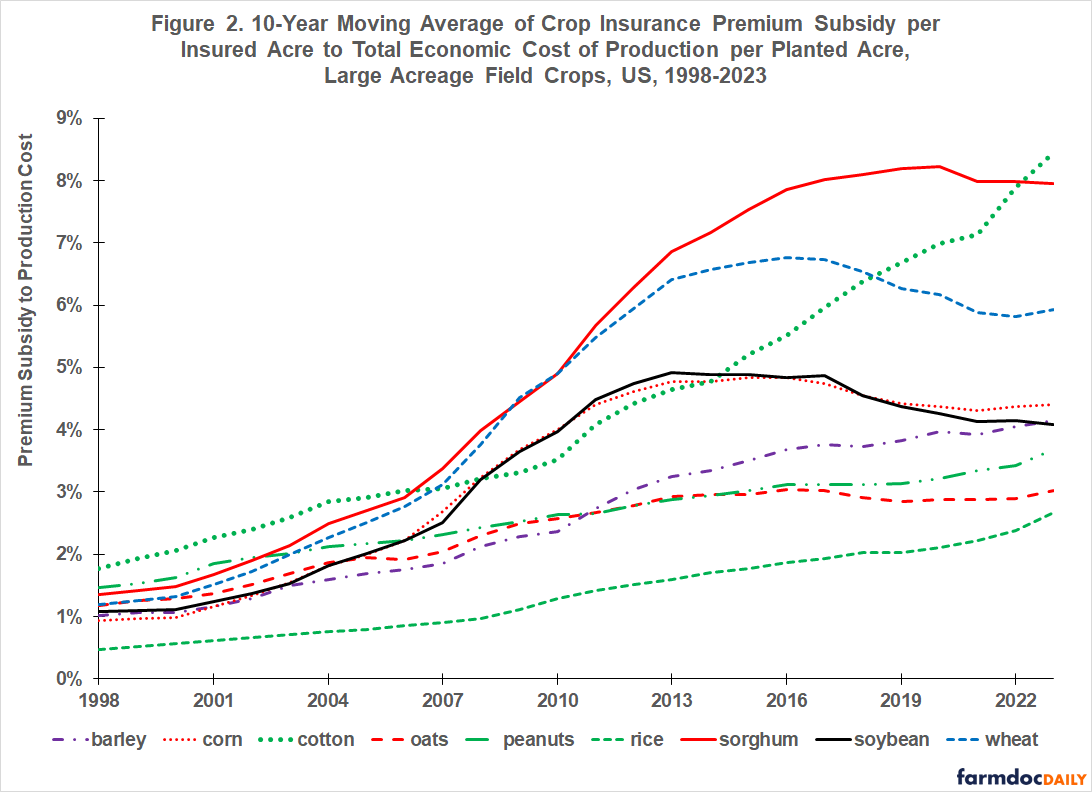

Subsidy vs. Cost of Production

Because cost of production varies notably by crop, it is important to examine subsidy per acre relative to the per acre cost of producing a crop. Cost is measured using total economic cost of production as calculated by USDA, Economic Research Service (ERS). ERS assigns a cost to all inputs except management, including an opportunity cost for owned land and unpaid labor. For an extended discussion of ERS cost estimates, see Zulauf, Langemeier, and Schnitkey (2020).

In 1998, the ratio of the 10-year average of premium subsidy per primary insured acre to the 10-year average of total economic cost of production per planted acre ranged from 0.5% for rice to 1.8% for cotton (see Figure 2). In 2023, the range was 2.7% for rice to 8.5% for cotton. Relative to economic cost, premium subsidy per acre increased on average by 332% for the nine crops between 1998 and 2023. Moreover, the spread from low to high value of the ratio widened by more than four times: from 1.3 (1.8% – 0.5%) to 5.8 (8.5% – 2.7%) percentage points.

Discussion

Since 1989, the role of crop insurance as a payment program has tripled, even after taking into account the increase in economic cost of production per acre. Crop insurance subsidies per acre and thus expected long-term payments by crop insurance have also increasingly favored some crops over others.

The increase in crop insurance’s payment function is enough to prompt an important policy question: “Has the US crop insurance program become a payment program that also provides growing season risk coverage or does it remain an insurance program that makes payments triggered by a covered risk event?”

In addressing this question, it is important to identify the role of specific factors in increasing crop insurance payments. Among the factors are higher crop prices, higher yields, higher subsidy rates; and the policy decision to state subsidy rates as a percent of premium.

The role of subsidy rates includes the increasing availability and use of add-up crop insurance. This consideration has become even more important because the public versions of both the House and Senate farm bills propose notable increases in subsidies for SCO (Supplemental Coverage Option) add-up insurance. Such a change will further shift crop insurance to being a payment program, with attendant issues of equity across crops and regions (see farmdoc daily, August 7, 2024).

Maybe, it is time for a strategic reassessment of crop insurance and its role in the farm safety net before SCO subsidies are increased.

Data Note 1

Primary insured acres do not include acres in insurance products that add insurance coverage on top of individual farm insurance products.

References and Data Sources

House Committee on Agriculture, Chairman Representative Glenn “GT” Thompson. May 27, 2024. Farm Bill: Certainty for All Farmers. https://agriculture.house.gov/uploadedfiles/detailed_summary_final.pdf

US Senate Committee on Agriculture, Nutrition, and Forestry. May 21, 2024. The Rural Prosperity and Food Security Act of 2024 Section-by-Section Summary. https://www.agriculture.senate.gov/imo/media/doc/rural_prosperity_and_food_security_section-by-section.pdf

US Department of Agriculture, Risk Management Agency. August 2024. Summary of Business. https://www.rma.usda.gov/en/Information-Tools/Summary-of-Business

Zulauf, C., M. Langemeier, and G. Schnitkey. 2022. U.S. Crop Profitability and Farm Safety Net Payments since 1975. Journal of the American Society of Farm Managers and Rural Appraisers. Pages 60-69. https://www.asfmra.org/resources/asfmra-journal

Zulauf, C., N. Paulson, J. Coppess and G. Schnitkey. “Use of Supplemental Coverage Option by Crop.” farmdoc daily (14):146, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 7, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.