U.S. Senate Ag Committee version of New Farm Bill

Overview

On April 26, 2012; the U.S. Senate Committee on Agriculture, Nutrition, and Forestry reported the Agriculture Reform, Food, and Jobs Act of 2012 (2012 Farm Bill) to the full Senate for its consideration. This article summarizes provisions that concern the safety net for U.S. crops: The provisions are in Title I, Commodity Programs; Title XI, Crop Insurance; and Title XII, Miscellaneous.

2012 Farm Bill Crop Safety Net for 2013-2017 Crop Years

- Crop Insurance

- adds new Supplemental Coverage Option (SCO) that allows individual insurance to be supplemented with county insurance to cover all or part of the individual insurance deductibl

- Agriculture Risk Coverage (ARC) multiple-year, shallow loss program to complement crop insurance

- farmer makes a 1-time, irrevocable decision to elect a county ARC if the county has sufficient data or an individual farm ARC

- Marketing Loans

- loan rates are the same as for the 2012 crop year, except cotton’s loan rate can be lowered

Brief Description of Selected Crop Insurance Related Provisions

- makes permanent the 2008 Farm Bill pilot program for enterprise crop insurance

- irrigated and non-irrigated enterprise insurance is to be made available in counties

- APH insurance yield will be calculated using 70%, in place of 60%, of the insurance transitional yield

- creates separate county insurance program for cotton, called STAX (Stacked Income Protection Plan)

- premium subsidy is 80%, multiplier capped at 120% (not 150%), minimum deductible is 10%,

- maximum loss covered is 30%, and no cap exists on number of acres

- premium can be charged for catastrophic risk protection

- premium reduced by percentage equal to difference between crop’s average loss ratio and 100 percent, plus a reasonable reserve

- creates additional coverage option under NAP (Noninsured Crop Assistance Program) that does not exceed 65% coverage with a premium fee of 5.25%

- peanut revenue insurance is to be offered beginning with 2013 crop

- premium subsidy and transitional yield is reduced for ground that has never been tilled

- premium subsidy is increased by 10 percentage points for beginning farmers

- allows margin insurance to be developed for crops

- creates pilot program to test providing premium subsidy for an index-based weather insurance for producers of underserved crops and livestock (including specialty crops)

- authorizes studies for whole farm insurance, catastrophic insurance for swine, and margin insurance for catfish

- future Standard Reinsurance Agreements should be budget neutral

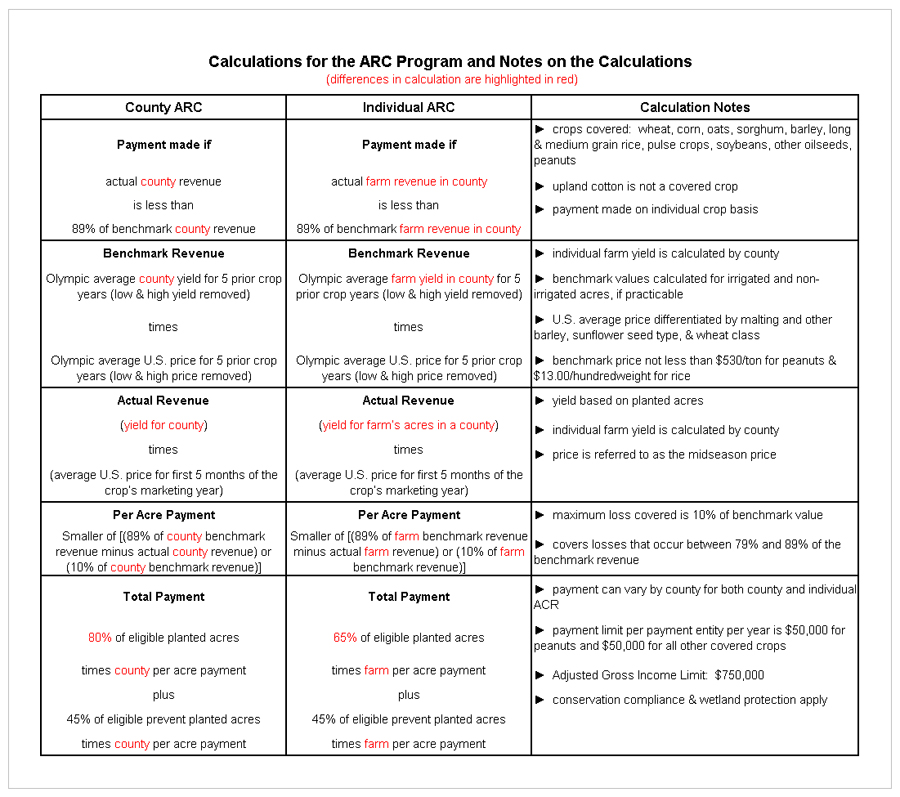

Brief Description of County and Individual Agricultural Risk Coverage Program (ARC)

- Crops covered: wheat, corn, sorghum, barley, oats, long grain and medium grain rice, pulse crops, soybeans, other oilseeds, peanuts

- Upland cotton is not a covered crop

- Popcorn may be designated a covered crop if the Secretary of Agriculture approves after conducting a feasibility study

- Payments made on an individual crop basis

- Farmer makes a 1-time, irrevocable decision to elect a county ARC if county has sufficient data or an individual farm ARC

- Election applies to all acres under operational control of the farmer, including acres added to arm after the ARC election decision

- Acres that change farms are subject to the election decision of the new farmer

- Election decision is not on an individual FSA farm basis

- Eligible acres adjusted for acres in summer fallow and crops to enrich the soil, as well as changes in Conservation Reserve acres

- For a covered crop, eligible acres are all acres planted or prevented from being planted to the crop on a farm during a crop year

- A farm’s total eligible acres cannot exceed its average acres planted to covered crops plus upland cotton for 2009-2012 crop years

- Eligible acres do not include a 2nd crop on the same acre unless Secretary of Agriculture has approved double cropping in an area

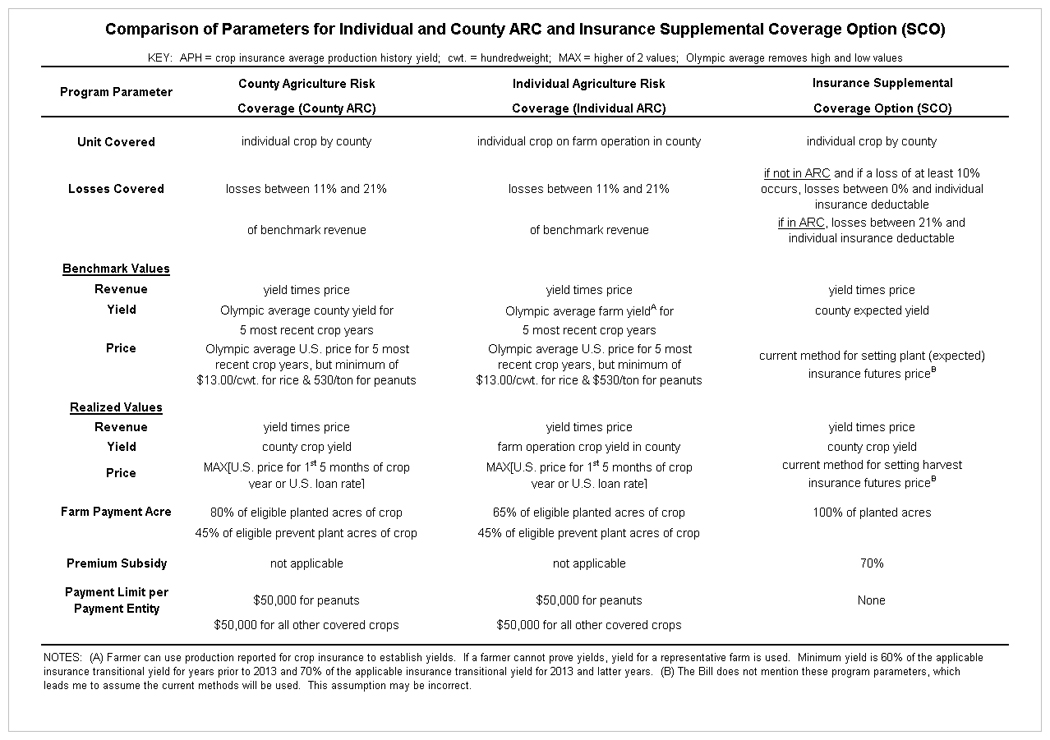

- Coverage is for losses between 11% and 21% of the ARC benchmark value

- Benchmark revenue for the county or individual farm is calculated using an Olympic average (removes low and high values) for the 5 most recent crop years of (1) U.S. price for the crop marketing year and (2) either yield per planted acre for the county or yield per planted acre for the farm in a county

- -Benchmark values for yield are calculated, if practicable, for irrigated and non-irrigated acres

- -Establishes minimum benchmark price of not less than $530/ton for peanuts and $13.00/hundredweight for rice

- -National average price is differentiated by type of sunflower seed, malting and other barley, and class of wheat

- Actual county or individual farm revenue is calculated using (1) the U.S. average price for the first 5 months of the crop marketing year and (2) yield per planted acre in the county or yield per planted acre on all the farm’s acres planted to the crop in the county

- Payment can vary by county for both the county and individual ARC programs (since individual farm yields are calculated by county)

- Farmer can use production reported for crop insurance purposes to establish yields

- If a farmer cannot prove yields, the yield for a representative farm is used

- Minimum yield is 60% of the applicable insurance transitional yield for years prior to 2013 and 70% of the applicable insurance transitional yield for the year 2013 and latter years

- Limit on payment per payment entity per year is $50,000 for peanuts and $50,000 for all other covered crops

- Spouses can be a payment entity

- No payments can be received if a payment entity’s average adjusted gross income over the 3 preceding taxable years exceeds $750,000 (Adjusted Gross Income Limitation)

- Conservation compliance and wetland protection must be met to be eligible for ARC payments

Thoughts on the Farm Safety Net

This farm bill draft clearly moves the U.S. farm safety net in the direction of risk management. The elimination of direct payments, creation of ARC, and enhancements to crop insurance all support this observation.

Individual farm crop insurance emerges as the foundation for the farm safety net. However, the search for a complement program remains on-going. This bill proposes 3 alternatives: (1) a county multiple-year shallow loss program (i.e., county ARC), (2) a farm multiple-year, shallow loss program (i.e., farm ARC), and (3) a supplemental county insurance coverage option (SCO). While many desire a single complement program, it is important to remember that risk varies notably across the U.S. and by crop. This variation makes creation of a single program to complement insurance difficult. Thus, the optimal policy might be multiple programs to complement insurance.

Thoughts on Farm Safety Net Decisions

Should the proposed safety net come into existence, farmers will have to decide their preferred safety net combination. The possible combinations include:

- individual insurance plus marketing loans

- individual insurance plus SCO and marketing loans

- individual insurance plus county ARC and marketing loans

- individual insurance plus individual ARC and marketing loans

- individual insurance plus county ARC, SCO, and marketing loans

- individual insurance plus individual ARC, SCO, and marketing loans

Because the decision involves the management of risk and because risk varies by crop, region, farm, and farmer; the discussion needs to begin with a recognition that no universal recommendation exists. The appropriate combination will vary. However, consideration of the following factors will nudge the decision toward one of the options. A recent farmdoc daily article looked at this decision in more detail, as well as how expected payments will vary by crop and region.

The first factor is what value the farmer places on multiple-year risk protection. Crop insurance guarantees are reset each year based on the futures prices during the discovery period for the expected planting price. In contrast, the ARC guarantee is set using an Olympic average of prices and yields over the 5 previous crop years. If prices decline substantially, the ARC guarantee will decline more slowly than the crop insurance guarantee. In fact, it likely will not decline in the first year of a substantial price decline because the Olympic average removes the low value. The marketing loan also provides multiple year protection, but loan rates will be well below the ARC price for the 2013 and 2014 crop years. Thus, the more a farmer is concerned about multiple year risk, the more likely ARC will be chosen.

A second factor is whether the farm’s greatest risk is (1) low yield on their farm or (2) low market price. The individual ARC is more attractive the more variable is the yield of the farm, especially relative to the county yields. In contrast, if low prices are the more important risk, the county ARC is more attractive due to its greater payment rate for planted acres (80% vs. 65% for the individual farm ARC).

A third factor is the farm’s yield relative to the yield of the county in which the farm is located. The individual ARC is more attractive the higher a farm’s yield is relative to the county yield while the county ARC is more attractive if a farm’s yield is less than the county yield. A simple calculation suggests that the individual ARC is especially more attractive if a farm’s average yield is more than 25% above the average county yield.

A fourth factor is that SCO covers all losses, once the 10% loss target is met. This factor interacts with the 150% multiplier in the county product. The interaction is illustrated for 2012 crop wheat grown in Crawford County, Ohio and assuming that the farm exactly follows the county and that the premium paid by the farmer is the same as the current GRIP premium at 90% coverage. While a highly simplified illustration, SCO combined with the 150% multiplier substantially alters a farm’s loss profile where loss is defined relative to the county guarantee. For example, a farm’s gross revenue is nearly the same at a price of $5 as at a price of $9. The change in the loss profile raises policy questions about SCO changing farmers’ response to price and encouraging production in more risky production areas.

A fifth factor is the $50,000 limit on ARC payments. Risk management programs will make large payments when a sizable loss occurs. However, occurrence of such a loss is not known until after the crop is planted. To limit payments when they are most needed undermines the program and makes the management of farm risk much more difficult. The ARC payment limit will nudge farmers toward individual insurance and SCO because they have no payment limit.

In summary, when taken as a group, these 5 factors suggest the following decision matrix:

- If multiple year risk protection is a priority, elect ARC

- Choice of county or individual ARC will depend upon the farmer’s priority regarding individual farm yield risk or price risk, whether the farm’s yield is higher or lower than the county yield, and other factors.

- For farmers in areas with low yield variability and who elect to participate in ARC, consider a lower individual insurance coverage and SCO for losses greater than those covered by ARC. This decision will rest in part upon the premium charged for the SCO associated with ARC.

- If multiple year risk protection is not a priority, take SCO.

- Choice of high or low individual insurance coverage will in part rest on the farm’s yield variability, especially relative to the county.

Please note that these are initial thoughts and will change as more information becomes available, especially from farm level analyses and discussion with farmers and colleagues.

Thoughts on Other Farm Safety Net Features

The Bill allows the Risk Management Agency and private crop insurance companies to develop margin insurance for crops. Margin insurance refers to the difference between gross revenue and cost of production. Margin insurance will raise difficult public policy issues. An important explanation for the different margins observed across farms, both within a production year and across time, is management performance. A farm’s margin also is related notably to farm size, being lower for larger farms. A significant reason for the lower cost on larger farms is the ability of larger farms to buy inputs at a lower cost than smaller farms due to the number of inputs they buy. Hence, setting margin insurance at an average margin for the crop will provide more protection to larger farms than to smaller farms, thus encouraging the growth of larger farms. And, the advantage provided the larger farm may have nothing to do with management performance, but simply with. While it is reasonable to allow private insurance to offer margin insurance to farmers, it is also reasonable to ask whether the public should subsidize margin insurance when key determinants of the difference in margin across farms is not due to risk.

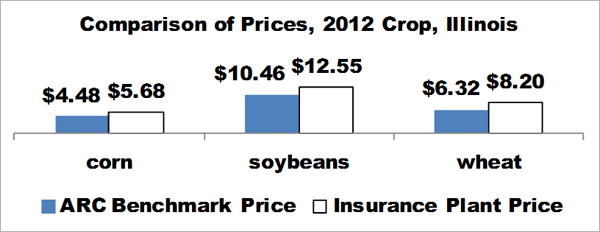

A commonly-expressed desire for the 2008 Farm Bill was to reduce overlap in farm programs. This objective is clearly advanced by limiting the ARC program to losses between 11% and 21% compared with the larger range of losses covered by both ACRE and SURE. However, because different prices and yields are used to determine the ARC benchmark values and the insurance plant guarantee values, overlap continues to exist. For the 2012 crop year, the estimated benchmark price for ACR for Illinois corn, soybeans, and wheat is less than the insurance plant (expected) price. Thus, despite reductions in farm program overlap, ARC and crop insurance can still cover some of the same losses. The only ways to eliminate all overlap is to integrate insurance and commodity programs or to make ARC effective only if its benchmark revenue exceeds the crop insurance revenue guarantee. At present, neither of these options is likely to be politically acceptable.

The fixed minimum price in ARC for peanuts and rice is a potentially important policy parameter, especially if prices decline. Fixing support if prices decline substantially and permanently will shift resources to the crops with fixed support, leading to potential resource misallocations. For a discussion of the issues related to fixed support rates, please see this earlier farmdoc daily article.

Caveat

This is a draft farm bill. The bill must be passed by both the House and Senate and signed by the President. In addition, as part of the agreement to address the Brazilian cotton case with the World Trade Organization (WTO), Brazil will have to decide if it finds the proposed cotton program acceptable and what actions it will take if it finds the cotton program unacceptable. In short, there are lots of steps remaining before the farm bill is finalized. Much discussion will occur and changes will be made.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.