The 2013 ACRE Decision

Farmers and landowners have until June 3rd to enroll their Farm Service Agency (FSA) farms into the Average Crop Revenue Election (ACRE) program, an alternative within the 2008 Farm Bill to the Direct and Counter-Cyclical program (DCP). While ACRE likely will pay less than DCP, enrollment in ACRE may still be advisable as ACRE will make large payments if revenue is low. Hence, ACRE provides significant risk protection.

The Tradeoff

As detailed here and here, farmers who choose to enroll in ACRE will give up 20% of direct payments, have loan rates reduced by 30%, and not be in the counter-cyclical program. The loan and counter-cyclical program are not likely to make payments in 2013. Therefore, the cost of enrolling in ACRE is giving up 20% of direct payments.

In 2013, most Midwest farmers will have direct payments in the $18 to $25 per acre range if they remain in DCP. Enrolling in ACRE will reduce direct payments by $3.60 per acre ($18 x .2 reduction) to $5.00 per acre ($25 x .2 reduction).

For the $3.60 to $5.00 per acre reduction in direct payments, farmers will have the chance of ACRE payments. ACRE is a state revenue program that makes payments when:

- State benchmark: State revenue is below state benchmark revenue, and

- Farm benchmark: Farm revenue is below a farm benchmark.

The farm benchmark usually is met when the state benchmark is met, particularly if low prices are causing low revenues. Given that a farm purchases insurance, the chance of meeting the farm benchmark is over 90% when the state benchmark is met (see here).

Price and Yields Resulting in ACRE payments

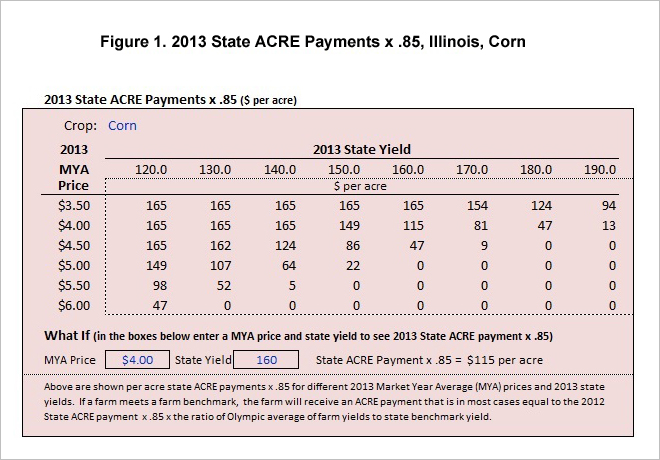

State revenue is calculated using state yields and national, market year average (MYA) prices. Figure 1 shows state yields and MYA prices and resulting ACRE payments for corn in Illinois. These payments are stated as state ACRE payment times .85. Payments that farmers receive will be:

- State ACRE payment x .85 x 5-year Olympic average farm yields / benchmark state yield

Multiplying the state ACRE payment by .85 gives that average ACRE payment for a corn acre in Illinois. Higher yielding farms will have higher payments and vice versa.

The table in Figure 1 comes from the 2013 State ACRE Payment Estimator, a FAST spreadsheet that is available for download from the farmdoc website (download here). Tables such as that shown in Figure 1 are available for corn, soybeans, and wheat in most states.

As can be seen in Figure 1, ACRE payments for corn in Illinois will occur under either low yields or low prices. Illinois corn yields typically are in the 160 to 170 bushel range. At these yield levels, prices below $4.50 per bushel will result in ACRE payments. Concerns with low prices this year cause ACRE to be an attractive alternative, as ACRE will provide payments in low price scenarios.

Chance and Average Payment

The 2013 ACRE Payment Estimator provides estimates of the chance ACRE will pay and the average payment from ACRE. For corn in Illinois, the chance ACRE will pay in 2013 is 27%, meaning that 27% of the time ACRE will pay and 73% of the time ACRE will not pay. The average state ACRE payment times .85 is expected to be $13 per acre. For soybeans in Illinois, the chance ACRE will pay in 2013 is 22% of the time and the average ACRE payment times .85 is expected to be $6 per acre.

Summary

The chance that ACRE will pay in Illinois is less than 50% for 2013. ACRE still will be advisable to consider as it will provide payments when low revenues occur. In essence, the 20% reduction of direct payments can be viewed as an insurance payment against chance of low revenues.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.