Working Capital: Preserve It or Use It?

Many farms built working capital and other financial reserves during the period of relatively high returns lasting from 2006 to 2012. Increases in average working capital are documented in this article. Now those farmers with positive working capital will face tough decisions. Should this working capital be preserved because of expectations of continued low returns? Or should working capital be used now and decisions to cut cash flows be postponed?

Working Capital on Illinois Grain Farms

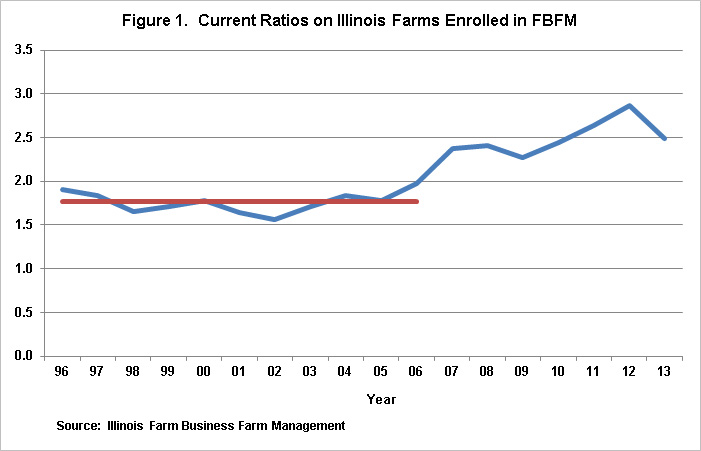

Figure 1 shows yearly, average current ratios for Illinois farms completing usable balance sheets enrolled in Illinois Farm Business Farm Management (FBFM). A current ratio equals current assets divided by current liabilities. Current assets include cash and cash equivalents; crop, feed, and market livestock inventories; and prepaid expenses. Current liabilities include operating loans; current portions of longer-term debt; and accrued items such as income taxes. A current ratio measures the farm’s ability to pay back short-term liabilities with short-term assets. Ratios below 1.00 suggest that a firm will be unable to pay back its obligations without resorting to financial restructuring. Having additional abilities to meet obligations, as indicated by having higher current ratios, is desired. A textbook benchmark for an acceptable current ratio is something above 2.00.

From 1996 to 2006, narrow profit margins existed on most Illinois farms, and the current ratio averaged 1.76 (see Figure 1). Between 2006 through 2012, grain farms had strong returns (farmdoc daily May 12, 2015), and the average current ratio reached a high of 2.87 at the end of 2012 (see Figure 1). Profit margins were lower in 2013, and the average current ratio decreased to 2.49 at the end of 2013. Values for 2014 are not available for public release. Suffice it to say that the average decreased from the 2013 level but is still well above the average for 1996 to 2006.

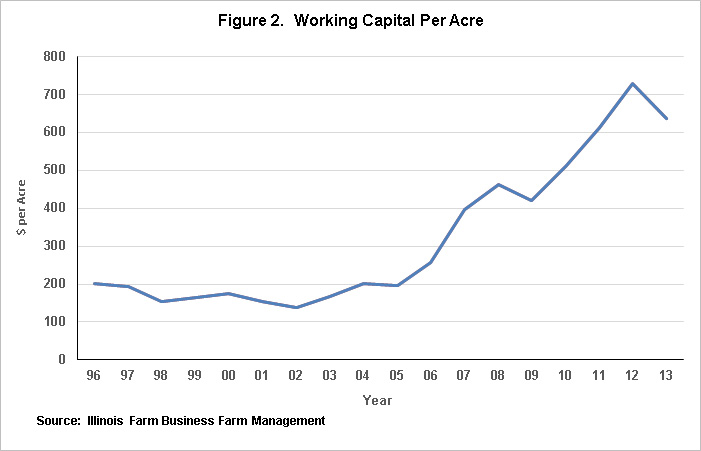

Another way of viewing the current position of farm uses working capital on a per acre basis. Working capital equals current assets minus current liabilities. Positive values indicate that current assets exceed current liabilities, indicating that resources exist to meet current obligations. Positive values are desired.

Working capital averaged $179 per acre from 1996 through 2006 (see Figure 2). Working capital then increased to over $700 per acre at the end of 2012. At the end of 2013, working capital decreased to $637 per acre.

Increasing levels of working capital per acre indicate that many farms built financial reserves. However, the total reserve is not likely to be equal to the current level minus the $179 average from 1996 to 2006. More working capital is needed now because of higher costs. Since costs have roughly doubled, working capital in the $350 to $400 per acre range now would be equivalent to the $179 per acre level from 1996 to 2006.

Implications

Many farms have significant reserves of working capital that were built from 2006 to 2012. Commodity prices have decreased from 2010-12 levels. Lower commodity prices are now projected for the foreseeable future. Lower commodity prices and high costs lead to projections of low or negative cash flows for the next several years. These low return levels will cause negative cash flows on many farms. Farmers then may choose to use working capital in meeting these cash shortfalls, leading to reductions in working capital.

Several points about the current situation:

- Many farms will be able to withstand low and negative cash flows by using working capital and other financial resources built in the past several years.

- Some farmers do not have as much working capital as indicated by the above averages. The above Figures show average levels of many farms. There are some farms that have smaller reserves. Farms with smaller reserves tend to be operated by younger farmers beginning in farming. Also, those farmers who pursued aggressive growth strategies in the past several years using high cash rents to acquire control of farmland may have low levels of working capital.

- For farms with significant amounts of working capital, “easy” decisions will be to continue operations without reducing cash flow. At this point, projections suggest low to negative cash flows for 2015 and the next several years. If commodity prices do not increase, costs and other cash flows will need to be reduced at some point. Reduced cash flows will come from 1) reductions in seed, fertilizer, and chemical costs, 2) reductions in cash rents, 3) reductions in machinery purchases, and 4) reductions in withdrawals from farming operations for family living.

- Preserving working capital now may be a prudent strategy. As working capital is reduced, a farm’s abilities to meet potential future financial difficulties also are reduced. Where this tradeoff likely will be faced most directly is when making cash rent decisions for 2016. Some farms may have farms with high cash rents, leading to projections of negative returns in 2016 if cash rents are not reduced. If landowners are not willing to lower cash rents, some farmers may be in the position where renting the farm is projected to be a financial drain in 2016, leading to an erosion of working capital. Not renting that farm may be the best decision based solely on 2016 returns. However, all possibility of gaining positive returns after 2016 most likely will be foregone if the farm is not rented in 2016. These rental decisions will be very difficult.

Summary

Many farmers built working capital in recent years. Now decisions about the use of that working capital need to be made.

References

Schnitkey, G. "Farmland Returns in 2015." farmdoc daily (5):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 12, 20

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.