2017 Crop Insurance Premiums and 2016 Insurance Use in Illinois

In this article, Revenue Protection (RP) premiums projected for 2017 are compared to 2016 actual premiums. For the same projected prices and volatilities, premiums will be lower in 2017 for both corn and soybeans. In 2016, farmer continued to use crop insurance on a high percentage acres and continued to increase use of high coverage levels. Overall, crop insurance in 2017 likely will be similar to that in 2016.

Revenue Protection Premiums for 2017

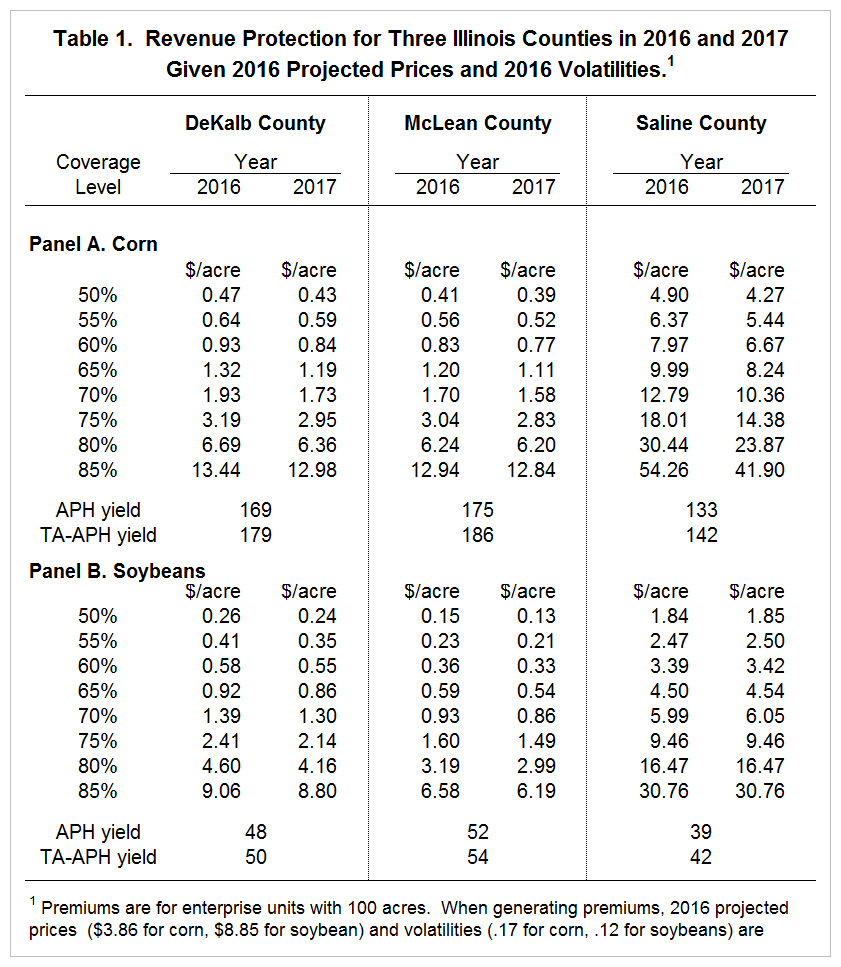

Table 1 shows a comparison of actual 2016 and projected 2017 premiums for Revenue Protection (RP) in three Illinois Counties: DeKalb, McLean, and Saline Counties. DeKalb County is in northern Illinois, McLean County in central Illinois, and Saline County is in southern Illinois. Panel A shows premiums for corn while Panel B shows premiums for soybeans. These per acre premiums are for 100 acres insured using an enterprise unit. The Actual Production History (APH) and Trend-Adjusted APH yields used in premium generation are set near averages for each county and are shown in Table 1. Premiums for 2017 are generated using 2016 projected prices and volatilities. Using the same factors allows comparison of rate impacts on premiums.

For corn, premiums for DeKalb and McLean Counties are slightly lower in 2017 than in 2016. For example, the 85% premium for corn in DeKalb County is $13.44 per acre in 2016 while the 2017 premiums is 3.4 percent lower at $12.98 per acre. Premiums in Saline county are down by a higher percentage than the other counties. The 85% premium is $54.26 in 2016 while the 2017 premium is 22.7% lower at $41.90.

Soybeans premiums for DeKalb and McLean County also are slightly low. The 85% RP in DeKalb County is $9.06 in 2016 while the 2017 premium is 2.9% lower at $8.80 per acre. Soybean premiums are about the same in 2017 as in 2016.

Premiums for 2017 will vary from those shown in Table 1 as the projected price and volatility will differ from 2016 levels. The 2016 Crop Insurance Decision Tool, a Microsoft Excel spreadsheet, can be used to generate alternative premium estimates (download available here). Both the projected price and volatility have impacts on premium:

- Increasing the projected price for soybeans from $8.85 to $10.30 (the current level of November futures contract) would increase the 2017 RP 85% premium in DeKalb County from $9.06 per acre to $10.24 per acre.

- Increased the volatility from .12 to .14 would lower the 2016 RP 85% premium in DeKalb County from $8.80 per acre to $9.47 per acre. This change holds the projected price at $8.80.

Obviously, the final projected price and volatility factors will influence whether final 2017 premiums are above or below 2015 premiums.

Crop Insurance Use in 2016

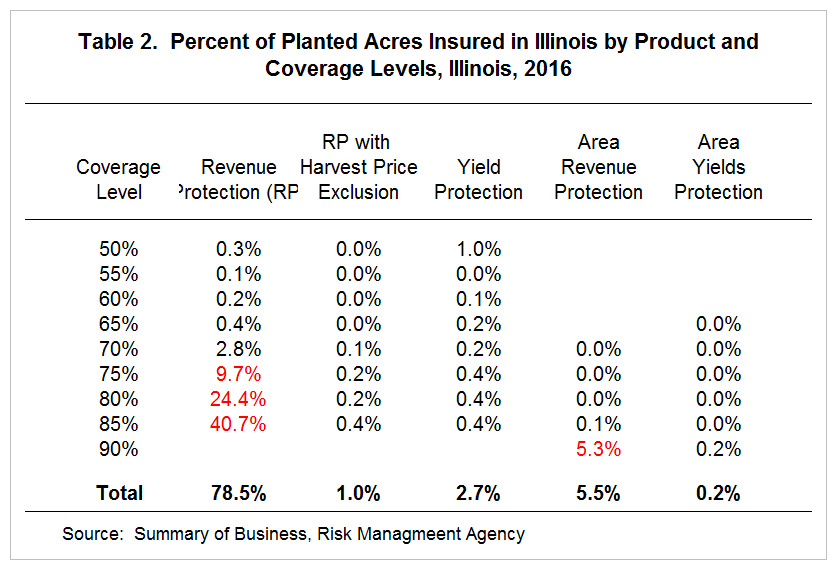

In 2016, RMA reported that 10.1 million acres of corn were insured in Illinois, with insurance being used on 87% of the planted acres, roughly the same percentage insured in 2015. By far, the most used product in 2016 was RP, with 78.5% of planted acres insured with RP (see Table 2). The next largest used product was Area Risk Plan (ARP) accounting 5.5% of use.

Both RP and Area Revenue Protection (ARP) are revenue insurances with guarantee increases, suggesting that farmers prefer these products over revenue insurances without guarantee increase or yield insurances. Moreover, these products are extensively used at high coverage levels. High coverage levels of these two revenue insurance products with guarantee increases were used to insure 80% of planted acres:

- RP at 75% and higher coverage levels account for 74.8% of planted acres, and

- ARP at a 90% coverage level accounts for 5.3% of planted acres.

A significant trend has been the increase in use of these two revenue products at high coverage levels. Revenue insurances were introduced in 1997. Use of high coverage levels policies has climbed from near zero use in 1997 to around 80% in 2016 (see Figure 1). Between 2015 and 2016, use of high coverage levels polices increased form 78% of planted acres to 80% of planted acres.

Summary

Premium changes in 2017 likely will not discourage insurance use as rate changes has decreased premiums slightly. Continued high use of crop insurance is expected. Movement towards higher coverage levels likely will continue.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.