Rising Interest Rates and Farmland Prices

Since the U.S. election on November 8th, interest rates on many financial instruments have increased. Interest rate increases since November 8th likely are not large enough to put much downward pressure on farmland prices. However, farmland prices could decline if interest rate increases continue.

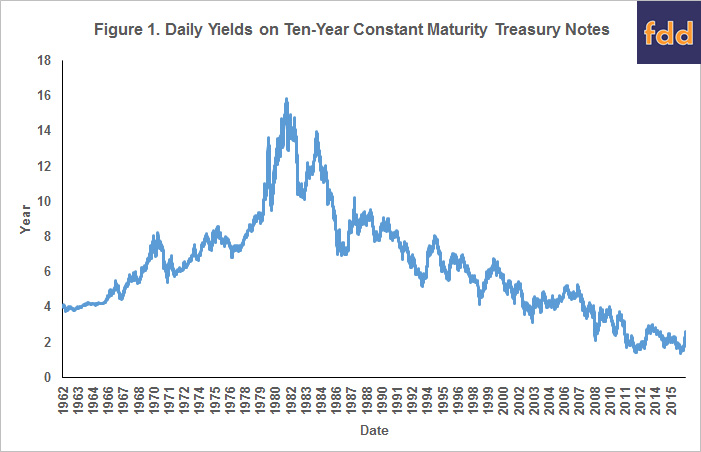

Ten-year Treasury Note Yields

Figure 1 shows yields on ten-year constant maturity Treasury notes. Ten-year Treasury yields reached highs of over 15% in 1981. Since the 1981 highs, Treasury yields have been on a general downward trend, reaching a low of 1.37% on July 5, 2016.

Yields exhibited a notable increase after the U.S. national election on November 8, 2016. On November 7th, the day before the election, the ten-year yield was 1.83%. Yields increased to 2.07% on November 9th, the day after the election. Yields have increased since November 8th, reaching 2.60% on December 15, 2016.

While yields have increased, the 2.60% yield on December 15th is not a high yield. Nor is the increase between November 7th and December 15th the only period of increases in recent times. For example, yields increased from 2.51% on October 23, 2013 to 3.04% on December 31, 2013, after which rates fell (see Figure 1). In and of itself, the late 2016 yield increase does not suggest a significant adjustment down in farmland prices.

However, this increase could be important if it signals continuing rate increases. In the popular press, reasons for the yield increase include anticipated increases in Federal government infrastructure spending and anticipations of increases in economic growth. If these expectations are realized, sustained increases in interest rates could occur.

Interest Rate Increases Impacts on Farmland Prices

Rising interest rates put downward pressures on farmland prices for two reasons. First, higher interest rates increase the financing costs of land purchases, making it more expensive to debt finance farmland. Second, higher rates signal higher returns on alternative investments, thereby making alternative investments more attractive than farmland.

A straight-forward way of evaluating the impacts of both cash rents and interest rates on farmland prices is the following capitalization formula:

Capitalized value = cash rent / ten-year Treasury yield.

We have used this approach in the past to compare Illinois farmland prices to capitalized values (Illinois Farm Economics: Facts and Opinions, October 18, 2010, Choices, 2nd Quarter 2011, farmdoc daily, October 20, 2015). The red line in the following graph shows the capitalized values for Illinois. Also shown are average farmland prices for Illinois.

The relationship between capitalized values and farmland prices is important. When farmland price is above the capitalized value, the fundamental return and rate drivers of farmland prices suggest that either farmland prices are too high or that there are expectations for future increases in returns or lower rates. An extended period with prices well above implied capitalized values occurred in the 1980s, prior to the fall in farmland prices during the agricultural financial crisis. Between 1984 through 2006, farmland prices and capitalized values tracked each other closely. Since 2006 however, the capitalized values have been above actual farmland prices. An interpretation is that capitalized values are not suggesting that farmland prices are overvalued, or that the income experienced in that period was not viewed as totally permanent. Application of the formula resulted in the capitalized value increasing from $9,213 in 2014 to $12,210 in 2016. This occurred because the ten-year rate decreased from 2.54% in 2014 to 1.78% – a greater percentage decline than the percentage decline in cash rents. Importantly, at low interest rate levels, capitalized values are very sensitive to rate changes.

The 2016 capitalized value of $12,210 per acre is based on a $221 per acre cash rent and 1.81% ten-year yield. The $12,210 is $4,760 higher than the 2016 average land price of $7,450. The 2.51% ten-year yield on December 15 results in a $8,805 capitalized value, still above the $7,450 farmland price, but only by $1,335 per acre. A ten-year yield of 2.96% results in the same capitalized value as the farmland price.

The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve Board that determines the direction of U.S. monetary policy. In its December 2016 projections release, most FOMC participants suggest a Federal fund rate near 3.0% would be appropriate in the long-run. Since 1962, the ten-year Treasury yield has average 1.06% higher than the Federal fund rate, suggesting a 4.0% ten-year Treasury yield if a 3.0% Federal fund rate target is obtained. Given the 2016 cash rent of $221 per acre, a 4.0% yield results in a $5,525 per acre capitalize value, $1,925 below the 2016 farmland price. If those rates occur, the above capitalization formula suggests that farmland prices could face significant downward pressures.

Summary

Recent increases in interest rates are not large enough to suggest that decreases in farmland prices need to occur. However, farmland prices could face downward pressure if interest rates continue to increase.

References

Schnitkey, G., B. Sherrick, and T. Kuethe. "2016 Farmland Price Outlook." farmdoc daily (5):194, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 20, 2015.

Schnitkey, G. "Farmland Price Outlook: Are Farmland Prices Too High Relative to Returns and Interest Rates?" FEFO 10-17, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 18, 2010.

Schnitkey, G.D., and B.J. Sherrick. 2011. "Income and Capitalization Rate Risk in Agricultural Real Estate Markets". Choices. Quarter 2. http://www.choicesmagazine.org/choices-magazine/theme-articles/farmland-values/income-and-capitalization-rate-risk-in-agricultural-real-estate-markets

Federal Reserve Advance release. "Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents under Their Individual Assessments of Projected Appropriate Monetary Policy, December 2016." For release at 2:00 p.m., EST, December 14, 2016. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20161214.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.