Mulling over Margin, Part 5: An Inherent Problem with Margin Protection Programs

High farm input costs, especially for fertilizer and fuel, have reinvigorated arguments for farm support programs where payments are triggered when the cost of production rises. Historically, cost of production has been a focus of farm policy in periods of elevated price inflation (farmdoc daily September 15, 2022). Current policy discussions have included the concept of margin protection: making farm payments when margin, the difference between revenues and production costs, shrinks. In previous articles in this series (farmdoc daily September 22, 2022 and October 6, 2022), we discussed difficulties involved in quantifying production costs that vary across commodities and regions. These differences make it hard to design a margin protection program that targets program payments to actual farm-level margin declines.

This article discusses an additional problem for the development of a prospective margin protection program for crop commodities. We show margin programs can favor commodities and/or regions with relatively low margins. Specifically, for a given level of variability in the components of revenues and costs, margin program payments are more readily triggered when the reference margin that defines the threshold for receiving a payment is smaller. We illustrate this using historic and projected 2023 margins for Illinois corn farms, but our results apply to any case where farms, commodities, or regions with different reference margins face the prospect of similar declines in revenue or increases in costs.

When a margin protection program favors low margins, it creates an incentive for commodity groups and other interested parties to lobby for program designs that make a given commodity look as unprofitable as possible. Commodity groups would have incentive to include costs that apply to their commodity but not others. For example, we previously described (farmdoc daily September 22, 2022l) how USDA cost of production data includes ginning costs for cotton and drying costs for rice and peanuts while similar processing costs for other commodities are excluded. Defining production costs in this way for a program margin calculation would imply producers of commodities where costs are defined broadly would receive relatively more benefits from the program than producers of commodities where costs are constrained.

While all government programs are subject to lobbying pressures, the large number of parameters involved in defining a margin protection program likely exacerbates the lobbying problem. There are simply more factors affecting the probability of receiving a payment and a more opaque and complex set of trade-offs in the policy design process.

Margin History on Illinois Corn Farms

To make this idea concrete, we review historic margins for corn production on high productivity land in central Illinois since 2005. These data come from the Illinois Farm Management Handbook. Figure 1 shows non-land costs and operator and land returns as a proportion of total revenue measured in nominal dollars. We use operator and land returns to measure margins for the purposes of this article though our main conclusions hold if we change the set of costs included in the margin calculation (for example, if land rent is included or overhead costs excluded).

Figure 1 shows margin is closely related to total revenue. Corn margin in Central Illinois hit record levels in nominal terms in 2021, higher than previous record levels observed in 2011 and 2012. It is projected to be high again in 2022. Margins are expected to fall in 2023 due to a combination of lower prices and increased costs, especially for fertilizer (see farmdoc daily November 9, 2022).

The dashed line in Figure 1 shows the previous 5-year average margin. When current margins fall below this line, it indicates that a margin protection program based on past margin levels would be more likely to provide payments to farmers. Margins in the period 2013-2017 were well below the historic average. In 2018, the previous 5-year average falls below the actual margin; high-margin years like 2011 and 2012 are no longer part of the average, plus total revenues increase due to higher yields and government payments. Projected margin for 2023 is also below the previous 5-year average. This substantial decline in expected margins explains some of the current interest in a margin protection program. Such a program is expected to provide benefits in times like the present.

A Thought Experiment: What Does It Take to Trigger a Margin Protection Program Payment?

Consider a margin protection program based on the difference between total revenue and non-land costs shown in Figure 1. Suppose the program pays farmers when actual margins fall below 70% of the reference margin given by the previous 5-year average (the dashed line in Figure 1). This reference margin level is similar to that used in Canada’s AgriStability program, discussed in a previous article in this series: farmdoc daily November 3, 2022.

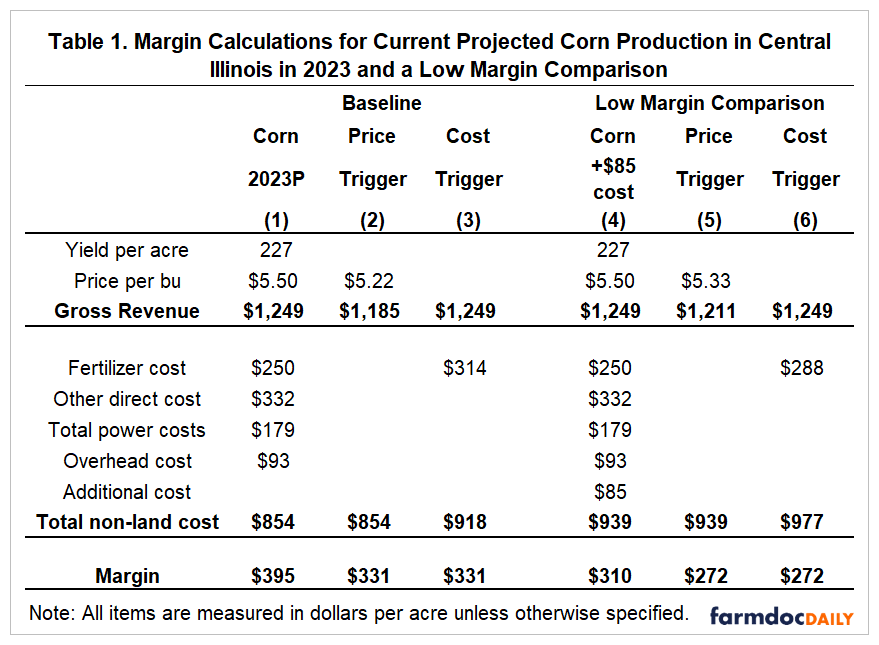

This margin program would not be expected to make payments to Central Illinois corn farms in 2023. For 2023, the projected margin is $395 per acre. Table 1 shows margin calculations based on current 2023 projections from the Illinois Farm Management Handbook in column (1). The previous 5-year average margin is $473 per acre, so the margin level necessary to trigger a payment is $473 x 0.70 = $331 per acre. While projected margin for 2023 of $395 per acre is well below levels observed in 2021 and 2022, it would not be low enough to generate a payment.

How much would the corn price have to fall or fertilizer costs rise relative to current expectations to trigger margin payments under this program? The necessary decrease in corn price is shown in column 2 of Table 1. The fertilizer cost increase needed to trigger a payment is shown in column 3. These changes generate the payment trigger margin of exactly $331 per acre. In these scenarios, all other components of the margin calculation remain the same as in column (1). Table 1 shows payments under this program are triggered when corn price decreases to $5.22 or when fertilizer cost increases to $314 per acre. In percentage terms, corn prices would need to fall by 5% or fertilizer cost increase by 25% to trigger payments.

Now contrast these calculations for corn in columns (1)-(3) with a lower margin case. To facilitate comparison to the base case, we do these margin calculations for a commodity that is identical to Illinois corn except that it includes an additional cost item of $85 per acre. As such, the projected 2023 margin for the low margin comparison commodity is $310 per acre, or $85 per acre lower. Not shown are margin calculations for previous years which assume this additional cost item is $85 per acre in all previous years. Based on these calculations, this farm has a 5-year average reference margin of $388 per acre, so the payment trigger level is $272 per acre ($388 times 70%).

Table 1 shows how much prices or costs would have to change for the low margin corn comparison to trigger a margin protection payment under the hypothetical program. For the low margin corn, the price would have to fall just $0.17 per bushel to $5.33 to trigger a payment. Similarly, fertilizer costs would have to increase just $28 per acre to $288 per acre. Recall that for the baseline case, price declines of 5% or fertilizer cost increases of 25% were necessary to trigger a payment. For the low margin corn, price needs only fall about 3% or fertilizer cost increase by 15% to trigger program payments. While not illustrated here, this result (that lower margin commodities more easily trigger margin program payments) holds regardless of the revenue or cost component difference that causes lower margins. A commodity with low margins due to lower yields or higher direct or indirect costs will more quickly trigger payments.

Conclusions

A prospective margin protection program is intended to provide a safety net for farmers in times of low prices and high costs. We compare outcomes for a hypothetical but representative margin protection program for two scenarios with different margins for corn using historical revenue and cost data for central Illinois. These example calculations show how a relatively small change in the program margin calculation – adding an additional cost item that increases costs by about 10% – affects the conditions required and thus the probability of triggering a payment. A prospective margin program must specify the set of costs that are included, but also the method for measuring prices, yields, and each cost item. Changes in any of these factors affects the probability of payments.

The thought experiment above points to an inherent flaw in these programs: they favor low margin commodities and regions. Assuming high and low margin commodities face price declines or input cost increases that are proportionally similar in magnitude, low margin commodities will trigger larger payments and derive greater benefits from the program. This would be true when there are differences in margin due to commodity and regional price, yield, and cost of production differences discussed earlier in this series of articles.

Under a prospective margin protection program, commodity groups and other interested parties will lobby for program designs that make a given commodity look as unprofitable as possible. While all government programs present incentives to lobby for program parameters favorable to a given sector, a margin protection program is particularly prone to such behavior because the calculation of production costs becomes one more program parameter that policy actors can potentially manipulate. More levers to pull means a more complicated, counterproductive contest to capture the largest share of Farm Bill dollars.

References

Coppess, J., J. Janzen, C. Zulauf, G. Schnitkey, K. Swanson, N. Paulson and J. Baltz. "Mulling Over Margin, Part 1: Introduction and Historical Background." farmdoc daily (12):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 15, 2022.

Coppess, J., J. Janzen, K. Swanson, N. Paulson, C. Zulauf and G. Schnitkey. "Mulling Over Margin, Part 2: the “Elusive” Cost of Production." farmdoc daily (12):146, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 22, 2022.

Janzen, J. "Mulling over Margin, Part 4: Lessons from Canada’s Whole-farm Margin Protection Program." farmdoc daily (12):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 3, 2022.

Janzen, J. and J. Coppess. "Mulling Over Margin, Part 3: Chasing the Cost of Production Across Regions." farmdoc daily (12):152, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 6, 2022.

Schnitkey, G. and K. Swanson. “Revenue and Costs for Illinois Grain Crops, Actual for 2016 through 2021, Projected 2021 and 2022.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 2022.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Outlook for Nitrogen Prices in Spring 2023." farmdoc daily (12):168, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 9, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.