Budget Policy, the Updated CBO Baseline & the Debt Limit

The deadline to avoid a first-ever default on the obligations—the full faith and credit—of the United States is rapidly approaching. President Biden and Congressional leadership are negotiating to avoid this self-inflicted crisis, but with little success thus far (Kanno-Youngs, May 17, 2023; Ngo, May 17, 2023; Edmondson, May 16, 2023; Cancryn and Haberkorn, May 16, 2023; Rappeport, May 15, 2023; Canryn, Haberkorn and Lemire, May 15, 2023; Everett and Beavers, May 15, 2023). As has been obvious for months, any attempt to reauthorize a farm bill in 2023 depends on the outcome of the debt limit showdown (Hill, May 9, 2023). In addition, the Congressional Budget Office released an updated baseline for the farm bill mandatory spending programs, and these budget-centric topics are reviewed in this article.

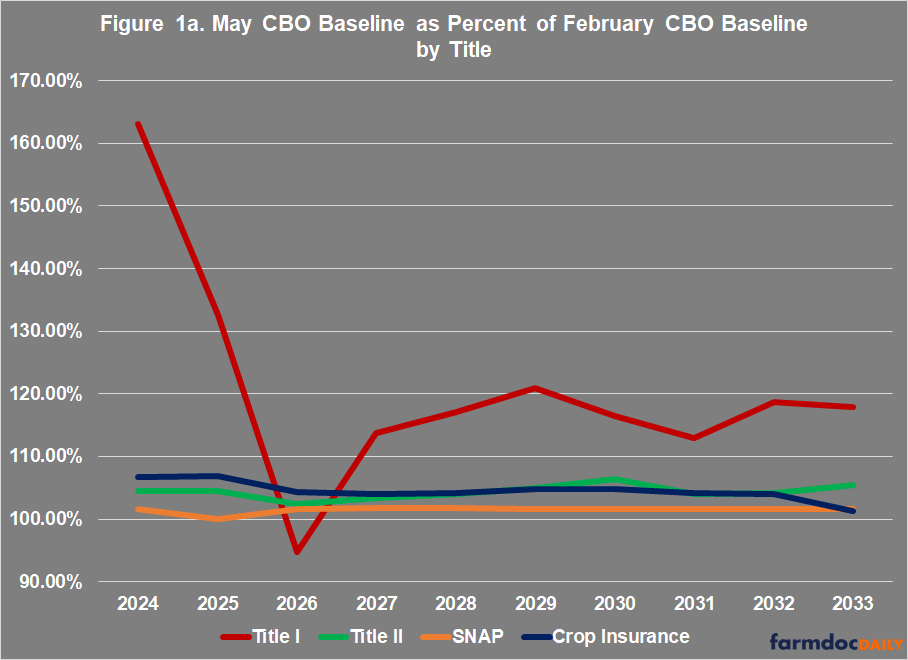

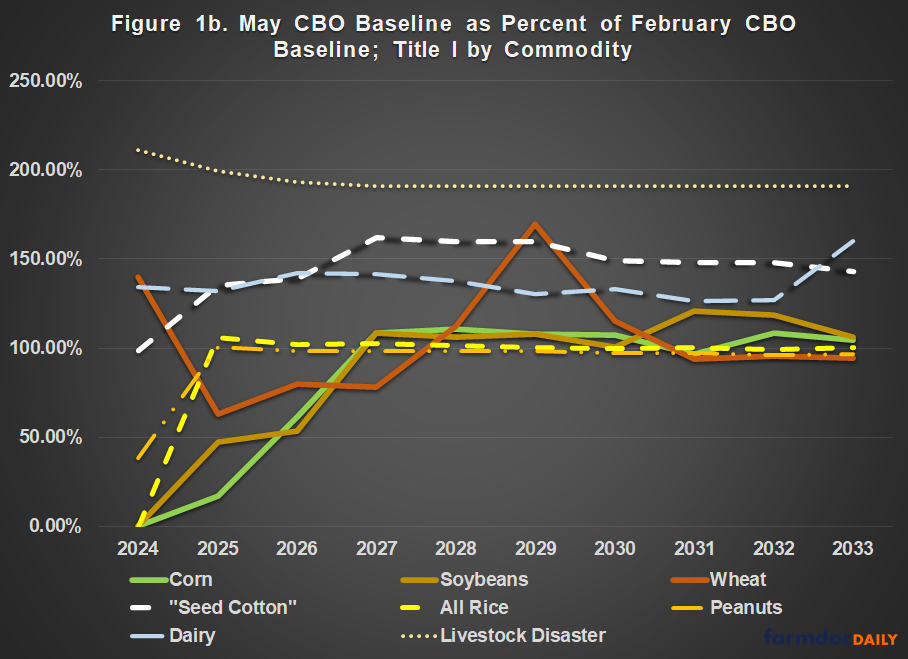

In February, the Congressional Budget Office (CBO) produced its ten-year spending projections known as the Baseline; the projections are a controlling factor on any farm bill reauthorization process because the committees are required by budget rules to remain within the projected spending levels (CBO, February 2023 (Farm Programs and SNAP); farmdoc daily, February 23, 2023). On May 12, 2023, CBO released updates to its baseline projections (CBO, May 12, 2023) including for the mandatory farm bill programs (CBO, May 12, 2023 (Farm Programs and SNAP)). The bottom line for the updated baseline is increased spending across-the-board, but the increase in the Title I commodities (or farm) programs is the most pronounced. Figures 1a and 1b illustrate the May CBO Baseline as a percent of the February CBO Baseline for comparison perspectives: Figure 1a, the change in projected spending by mandatory spending title; Figure 1b the change in projected spending by program commodity.

In total, CBO now projects $33.8 billion in additional spending from these four titles over the ten fiscal years of the baseline (FY2024-2033) compared to what they projected in February. Just over half of the total increase ($17.7 billion) is from SNAP, while the crop insurance program is projected to exceed $100 billion for the first time ($4.4 billion increase). Given the size of these programs, however, the increased projections are relatively minor. In Title I, the spending on livestock disaster programs is projected to increase the most and it accounts for nearly 65% of the increase in that title. Spending on “seed cotton”—which was created in 2018 as a calculation of cotton seed and cotton lint in order to return cotton farmers to the Title I payment programs after having been removed in the 2014 Farm Bill due to the Brazilian WTO dispute (farmdoc daily, February 14, 2018)—accounts for just over 21% of the total increase in Title I expenditures.

Aside from the livestock disaster programs, the increased outlay projections for the farm program commodities are driven mostly by changes in price projections. Figure 2 illustrates the updated prices in the May 2023 Baseline as a percent of the February 2023 prices. In summary, CBO made relatively minor revisions to their price projections for most of the commodities. For example, corn and soybeans prices were increased by an average of 1.4% and 1.3%, respectively, over the ten years. By comparison, milk prices are projected about 5% lower on average over the ten years. The other notable revision in price projections is for “seed cotton,” which also averages about 5% lower in the May baseline than in February; CBO is not projecting significantly lower prices for cotton lint, however.

The CBO projections are just that, projections based on economic modeling of an unknown and unknowable future. The projections are arguably more instructive about the design of farm programs and the politics of a farm bill. Figure 3 illustrates the total CBO outlay projections for ARC-CO and PLC payments for each of the major program crops (corn, soybeans, wheat, “seed cotton,” all rice and peanuts) per payment acre, which is 85% of program crop base acres. These are little changed from the February 2023 Baseline estimates reviewed previously (farmdoc daily, March 2, 2023).

Figure 3 illustrates vast disparities among these program crops, which translates to disparities amongst farmers. Farmers do not farm only individual crops, but farm policy supports individual crops and not actual farms. According to a simple calculation based on CBO projections, rice base acres will average $142 per payment acre over the 10 years in the baseline, whereas soybean base acres would average roughly $13.50 per payment acre over those years. Farms throughout the country grow soybeans, but the base acres for “seed cotton,” rice and peanuts are almost exclusively limited to farms in the Southern states. These regional disparities amongst a subset of farmers are at the core of farm policy and farm bill politics, in part because there is no real-world justification for so vastly favoring some farmers in this manner with federal taxpayer-funded payments. They also present difficult questions when budget issues are at the forefront and much of the partisan, political dispute is about reducing federal spending. At the least, farm interests risk striking a very politically discordant note when they demand additional payments at a time when many of their representatives in Congress are demanding spending reductions and threatening the full faith and credit of the United States to achieve those reductions. Such policy demands are disconnected from the realities of the political moment, and are unlikely to be sustainable.

The lessons from the disparities in farm program payments are also instructive about the complete failure of budget policy. The U.S. has experimented with various iterations of the current budget policy since 1974, when Congress enacted the Congressional Budget and Impoundment Control Act (farmdoc daily, November 29, 2018; April 18, 2019; July 18, 2019). For nearly 50 years, budget policy has failed to discipline federal budgets or Congress, it has failed to prevent or reduce deficits, and the national debt has exploded. While it has failed in its core purposes, budget policy has managed to facilitate factional capture of federal benefits and exacerbated partisan, ideological polarization; the disparities in farm program payments among the major commodities provide an example. The program crops with the fewest base acres—rice and peanuts—receive the largest payments ($142 per payment acre and $127 per payment acre on average for FY2024 to 2033, respectively). They achieve this through the statutory reference prices fixed by Congress in a farm bill. Reference prices for rice and peanuts are established at levels that far exceed market prices or market price projections, triggering large payments on those base acres almost every year (farmdoc daily, May 16, 2023; March 2, 2023). Under existing budget policy, with its emphasis on bottom line outlay projections, large payments on a per acre basis—which is the payment rate to the actual farmer—are miniscule in the baseline: total ten-year outlays for rice are approximately $4 billion, while total ten-year outlays for peanuts are just over $2.7 billion in the May 2023 CBO Baseline. By comparison, the relatively small payments per payment acre for soybeans (averaging $13.50 per payment acre over the ten years) are projected to cost more than $6 billion over 10 years. There are 53.5 million base acres of soybeans compared to 4.6 million base acres for all of rice and 2.5 million base acres for peanuts.

Under current budget policy, the smallest factional interests—in the case of farm program payments those farmers with rice and peanut base acres—easily capture outsized benefits because the total costs are relatively small. This also means that demands for increasing reference prices will be unacceptably expensive for the large acreage crops (corn, soybeans, and wheat), but relatively inexpensive for the small acreage crops (“seed cotton,” rice and peanuts). It is likely that budget discipline as it is currently designed could result in farm policy that increases already outsized payments to those farmers with base acres in the small acreage crops. In other words, the debt limit fight could help contribute to further disparities and inequities in farm program payments.

This lesson from farm program payments applies to the entire farm bill: farm programs make payments on less than 2 million farms each fiscal year that payments are triggered; by comparison, the Supplemental Nutrition Assistance Program (SNAP) makes payments to more than 40 million participants on average each month. As a result, farm programs are projected to spend $66 billion over 10 years in the May 2023 CBO Baseline while SNAP is projected to spend a total of $1.2 trillion. In the partisan budget disputes, it is SNAP that receives most of the political attention while farm program payments are effectively ignored, placing assistance to low-income Americans for purchasing food at the center of the dispute while obscuring and protecting assistance to farmers because of the bigger bottom-line projections in the baseline. Maybe these disparities and factional dynamics would be worth it if budget policy was effective, but budget policy has failed.

The failure of federal budget policy is magnified and compounded by this most recent episode in which the Nation faces the threat of a catastrophic default. The self-inflicted crisis presents few good options for resolution, which is why there are strong arguments for considering the Constitutional implications of the debt limit threat. The Constitutional arguments and implications are too substantial to be addressed completely in this article, and will be introduced in summary. The 14th Amendment to the Constitution provides in Section 4: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned” (U.S. Constitution, Amendment 14). On its face, the words of the Constitution read as preventing a default on the public debt of the United States, but there remains significant disagreement about its application to the debt limit. It may be that the debt limit does not violate the Constitution but that actions leading to a default would be.

There are other Constitutional considerations to this as well. Congress has the power to tax and spend, while the President is required to faithfully execute the laws enacted by Congress. Here a conflict presents itself because Congress last raised—or temporarily extended—the debt limit on December 16, 2021 (P.L. 117-73), by $2.5 trillion. That was not the last word, or last instructions from Congress on matters of spending, however. Consider that Congress has enacted multiple spending measures, including appropriations, that were not subject to the debt limit or otherwise limited by it and that each of these has been enacted into law since the debt limit was last increased (see e.g., P.L. 117-84; P.L. 117-180; P.L. 117-103; P.L. 117-128; P.L. 117-229; P.L. 117-86). Arguably most notable, Congress enacted the Consolidated Appropriations Act of 2023 on December 29, 2022 (P.L. 117-328) and the Inflation Reduction Act of 2022 on August 16, 2022 (P.L. 117-169). In general, the later-enacted legislation controls. More importantly, in none of these bills did Congress subject its spending obligations to the debt limit. Arguably, Congress chose to negate the debt limit in each. It also raises a serious Constitutional question as to which laws the President is to faithfully execute, as well as whether the President can effectively ignore or suspend the Congressional instructions in the later-enacted appropriations and spending bills. While these are complicated matters, they present very clear additional proof that the current set of budget policies are ineffective for their purposes and need to be seriously reconsidered; all of which is nearly impossible, however, under the threat of default.

Concluding Thoughts

Budget policy has largely produced lose-lose-lose outcomes for nearly 50 years, and the farm bill provides a case study. The lessons of this case study can be gleaned from the updated CBO Baseline. First, the focus on spending and large baseline numbers tends to concentrate cuts on the safety net for those most in need, as exemplified by the continued push for reducing spending on food assistance for low-income households in SNAP. Second, the budget and spending debate facilitates an ability for the smallest factional interests to capture outsized benefits that are hidden by the large baseline numbers, as exemplified in the extremely large payments for farmers with rice and peanut base acres. Third, and most damning of all, these budget policies have completely failed to discipline the budget, reduce deficits, or control the national debt. The debt limit impasse stands in the way of Congress reauthorizing a farm bill in 2023, but it presents far more complicated and concerning questions for our Constitutional system of government. It may be that the farm bill offers lessons for consideration for budget policy, while it remains to be seen how any resolution of the budget impasse will impact a potential farm bill.

References

Canryn, A., J. Haberkorn and J. Lemire. “Biden Dives into Debt Ceiling Talks, Causing Mini Panics Among His Base.” Politico, May 15, 2023. https://www.politico.com/news/2023/05/15/biden-debt-ceiling-talks-00097055

Congressional Budget Office. “An Update to the Budget Outlook: 2023 to 2033.” May 12, 2023. https://www.cbo.gov/publication/59096

Congressional Budget Office. CBO’s February 2023 Baseline for Farm Programs. February 2023. https://www.cbo.gov/system/files?file=2023-02/51317-2023-02-usda.pdf

Congressional Budget Office. Supplemental Nutrition Assistance Program (SNAP). February 2023. https://www.cbo.gov/system/files?file=2023-02/51312-2023-02-snap.pdf

Congressional Budget Office. Supplemental Nutrition Assistance Program (SNAP). May 2023. https://www.cbo.gov/system/files?file=2023-05/51312-2023-05-snap.pdf

Congressional Budget Office. USDA Farm Programs. May 2023. https://www.cbo.gov/system/files?file=2023-05/51317-2023-05-usda_0.pdf

Coppess, J. "A Deeper Dive into the February 2023 CBO Baseline: Title I Commodities Programs." farmdoc daily (13):38, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 2, 2023.

Coppess, J. "A View of the 2023 Farm Bill from the CBO Baseline." farmdoc daily (13):33, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 23, 2023.

Coppess, J. "Federal Budget Discipline and Reform: A Review and Discussion, Part 1." farmdoc daily (8):218, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 29, 2018.

Coppess, J. "Federal Budget Discussion, Part 2: Revenues and Spending." farmdoc daily (9):70, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 18, 2019.

Coppess, J. "The Debt Limit: A Saga of Self-Inflicted Trouble." farmdoc daily (9):131, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 18, 2019.

Coppess, J., N. Paulson, G. Schnitkey and C. Zulauf. "Farm Bill Round 1: Dairy, Cotton and the President’s Budget." farmdoc daily (8):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 14, 2018.

Edmondson, C. “Congress Is Running Out of Days to Act on the Debt Ceiling.” The New York Times, May 16, 2023. https://www.nytimes.com/2023/05/16/us/politics/congress-days-in-session-debt-ceiling.html

Everett, B. and O. Beavers. “Intensifying Debt Talks Threaten Rare GOP Unity.” Politico, May 15, 2023. https://www.politico.com/news/2023/05/15/debt-talks-gop-bill-00097052

Haberkorn, J. and A. Cancryn. “Biden Appoints 2 Additional Top Aides to Try and Get to the Finish Line on Debt Ceiling Talks.” Politico, May 16, 2023. https://www.politico.com/news/2023/05/16/biden-and-mccarthy-remain-at-odds-as-debt-ceiling-deadline-looms-00097240

Hill, M. E. “Senate GOP Leaders Watch Debt Limit Collide with Their Coveted Farm Bill.” Politico, May 9, 2023. https://www.politico.com/news/2023/05/09/debt-limit-farm-bill-00095844

Kanno-Youngs, Z. “Biden Says He Is Confident America Will Not Default on Its Debts.” The New York Times, May 17, 2023. https://www.nytimes.com/2023/05/17/us/politics/biden-debt-limit-default.html

Ngo, M. “Biden Taps Two Negotiators to Reach Debt Ceiling Deal With Republicans.” The New York Times, May 17, 2023. https://www.nytimes.com/2023/05/17/us/politics/biden-debt-ceiling-shalanda-young-steve-ricchetti.html

Rappeport, A. “Yellen Reiterates That the U.S. Could Run Out of Cash by June 1.” The New York Times, May 15, 2023. https://www.nytimes.com/2023/05/15/business/debt-limit-yellen-treasury.html

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Commodity Title Choices and Payment Expectations." farmdoc daily (13):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 16, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.